Mitigating the Delay Risk in Power Plant Projects

By Jacob C. Jørgensen·

Contents |

[edit] Introduction

The international power plant industry is a risky place – especially, if you are an EPC contractor. The financial risks associated with project delays are significant due to the elevated level of liquidated damages in the EPC contract.

The EPC contract, which is typically based on the FIDIC Silver Book conditions, offers only very limited extension of time possibilities and places most of the project risks on the EPC contractor, including notably the risk of delays resulting from unforeseeable, adverse site conditions.

An EPC contractor will usually have to furnish the owner with a 10% on demand guarantee from a top-rated bank and in some cases also with a parent company guarantee. Accordingly, the chances of escaping liability for delays are very limited in practice.

The risk of delays is amplified by the fact that the EPC contractor only has limited direct control of the multitude of design, procurement and construction activities since the majority of the activities are carried out by third party sub-contractors and suppliers.

Thankfully, a large portion of the "hardware" that is needed to build a power plant comprises short lead items, but a certain portion of the power plant’s key components are complex and tailored, and can therefore not be procured on short notice. In the following, I will refer to these components, which for example include the boiler in a biomass power plant, as “key components” and to the suppliers of such components as “sub-contractors” or “suppliers”.

It is generally not possible to push the full economic risk of delays associated with key components downstream onto the responsible suppliers at commercially viable terms. Nor is it possible to effectively insure the EPC contractor against the risk of defaulting key component suppliers. Accordingly, the EPC contractor is largely stuck with the risk of project delays, and the problems and expenses resulting from this risk, which may for example include exposure to commercial duress from less honest suppliers seeking to exploit the EPC contractor’s vulnerable position.

This article explores how the risk of project delays related to key component suppliers may be mitigated in practice by implementing clauses in the key sub-contracts aimed at leveraging the EPC contractor's chances of achieving specific performance, or quickly replacing a defaulting supplier where specific performance is not a viable option.

[edit] The traditional approach to risk mitigation

First of all, the EPC contractor should attempt to mitigate the above described risk by subjecting its key component suppliers to a due diligence investigation prior to entering into any type of contracts with them.

In most cases, the EPC contractor will demand a performance bond at an amount, which typically corresponds to 10-15% of the value of the sub-contract.

If the due diligence reveals financial problems that could prevent the sub-contractor from fulfilling its contractual obligations and/or if the sub-contractor cannot provide a performance bond, the EPC contractor should probably consider an alternative sub-contractor candidate.

Assuming that the sub-contractor is not facing detrimental financial problems and is able to provide a performance bond from a bank with a reasonable ranking, the EPC contractor can engage the sub-contractor in two basic contractual ways:

[edit] Joint venture

In some situations, the EPC contractor may be interested in and able to engage the sub-contractor as a partner in a joint venture to thereby incentivise timely performance on the basis of the joint and severable liability, which a joint venture contract imposes on the venturing partners [1].

In its purest form, a joint venture agreement will presumably mitigate the EPC contractor’s risk exposure to delays caused by a joint venture partner who is financially strong because the exposure to claims for liquidated damages by the owner under the EPC contract will be equally threatening to all of the partners in the joint venture.

However, in practice the joint venture agreement will usually contain caps limiting the partners’ liability to a certain percentage of the value of their respective shares of the scope of work. Moreover, the joint venture agreement will rarely obligate the partners to furnish each other with performance bonds, since the partners will use their respective credit lines to furnish the owner with a joint performance bond or with separate bonds under the EPC contract.

In practice, the formation of a joint venture between an EPC contractor and a key component supplier may therefore not effectively mitigate the EPC contractor’s exposure to the risk of project delays caused by the supplier. This is particular so, in situations where the supplier is financially weak.

[edit] Sub-contract

Where the formation of a joint venture is not commercially possible or desirable, for example because the key component supplier is unwilling to share technical know-how and design information with the EPC contractor or any other third party for that matter, the EPC contractor will usually choose to enter into a sub-contract with the supplier.

The sub-contract will usually contain conditions that are largely back to back with the EPC contract, and place an obligation on the supplier to furnish the EPC contractor with a performance bond at an amount matching the overall liability cap in the sub-contract.

[edit] Payments

Furthermore, if the key component supplier’s financial strength is questionable, the EPC contractor may seek to mitigate the risk of its prepayments “going astray” by paying the supplier’s sub-suppliers and sub-contractors directly. Where this is not possible, the EPC contractor could propose to pay the sub-contractor via an earmarked account owned by the EPC contractor. In such an arrangement, the sub-contractor will often be given a revocable power of attorney to operate the account up to certain transactional thresholds per day, week and/or month, whereas the EPC contractor will reserve the right to approve transactions above such thresholds. A simple clause to this effect could be drafted as follows:

“All payments made in accordance with this contract shall be in € as set out and specified in Schedule x (The Milestone Events and Payment Schedule) and shall be paid into an earmarked account owned by the EPC contractor. The EPC contractor shall grant the sub-contractor with a revocable power of attorney to make payments from the account up to an amount of € per transaction and a total aggregate amount of € per month. Payments from the account in excess of these thresholds shall require prior written approval from the EPC contractor. The Parties agree to sign an online banking agreement with the EPC contractor’s bank so that payment instructions and approvals may be given via online access.”

[edit] Delays

Regardless of whether the key component supplier is engaged on the basis of a joint venture agreement or a sub-contract, the EPC contractor’s remedies in case of delays or non-performance are usually restricted to claiming liquidated damages up to the agreed liability cap. Once the cap is reached, the contract will usually allow the EPC contractor to terminate and replace the supplier.

In power plant projects, the sub-contract (or joint venture agreement) will normally identify a number of sections in the sub-contractor’s scope, which must be completed according to a milestone program. The contract will allow the EPC contractor to claim liquidated damages in case the sections are not completed on time.

A clause allowing the EPC contractor to claim liquidated damages for interim delays motivates the sub-contractor to perform the sub-contract in a timely manner throughout the project. Most importantly, such a clause gives the EPC contractor a chance to react before a delay materialises into a failure to meet the final handover date [2].

[edit] Termination

To strengthen the EPC contractor’s strategic position and ability to counter a key component supplier’s anticipatory breach of contract, the contract should ideally stipulate that the cap on liquidated damages cannot be relied upon in case the contract is terminated.

Furthermore, the sub-contract should contain a clause exemplifying what constitutes gross negligence [3] as this may improve the EPC contractor’s chances of defeating the supplier’s liability cap, for example in situations where the supplier seeks to exploit the EPC contractor’s exposure to liquidated damages by suspending or slowing down its construction activities (or threatening to do so) if the EPC contractor refuses to accept the supplier’s (contested) claims for extra payment and/or time extensions. In this author’s experience, these tactics are unfortunately not at all uncommon in large scale, international construction projects.

The sub-contract should also provide for termination in case the sub-contractor goes bankrupt, is wound up, liquidated or otherwise loses control of its business. Sometimes the sub-contract will also allow the EPC contractor to terminate in case the sub-contractor suspends performance or refuses to accelerate its activities to comply with the time schedule.

[edit] Replacing the supplier?

The existence of a performance bond and the threat of liquidated damages and ultimately termination will of course incentivise the supplier to comply with the contract, but a fundamental weakness of the above described remedies is that they do not increase the EPC contractor’s chances of quickly and successfully replacing for example a defaulting boiler builder. This is unfortunate since a quick replacement may often be the only relevant remedy from the EPC contractor’s point of view in case the boiler builder lacks the ability or will to perform the contract on time. This shortcoming in the traditional approach to mitigating the EPC contractor’s exposure to the risk of project delay is especially problematic in situations where the default (or threatening default) of the boiler builder is rooted in financial problems.

Replacing a boiler builder is fundamentally problematic because the boiler is a highly complex and tailored component that cannot easily be finalised by a new sub-contractor. The EPC contractor can, however, as explained in the following, seek to contractually alleviate this basic challenge by facilitating access to or control of the three main elements, which the construction or manufacturing of most key components entails, namely:

- (a) The “hardware”, i.e., the bolts, valves, steel, etc. which the component is made of;

- (b) The “design”, i.e., the software, blue prints, calculations, technical descriptions, and other intellectual property that is required to build, hand over, test and use the component; and

- (c) The manpower, i.e., the engineers, project managers, software experts, and one or more ”workshops” where the key component is assembled.

In the following, I will describe and comment on some different contractual concepts that may be adopted by EPC contractors seeking to increase their control of these three main elements.

[edit] An alternative risk mitigation approach

[edit] The hardware

On the basis of collateral warranty agreements (sometimes also called “step in rights clauses”) with the key component supplier’s sub-suppliers and sub-contractors, the EPC contractor will usually have a fairly good legal chance of securing access to the physical elements of the key component in case the supplier defaults.

Clauses allowing the EPC contractor to step into the supplier’s sub-contracts will usually be accepted by the sub-suppliers in that such clauses increase their chances of receiving payment for the materials sold to the key component supplier. A simple step in rights clause could be drafted as follows:

“The supplier undertakes to implement the following step in rights clause in its main sub-contracts and sub-supply agreements that are listed in schedule x: ‘The Parties agree that the EPC contractor, after having given written notice to both of the Parties to this present Contract, shall have the right to immediately replace [name of key component supplier] and take over all of [name of key component supplier’s] rights and obligations under this present Contract.’”

The sub-contract between the key component supplier and the EPC contractor should then regulate under which circumstances the EPC contractor may exercise the step in right, for example as follows:

“The EPC contractor shall have the right to step into the supplier’s main sub-contracts and sub-supply agreements that are listed in schedule x in any of the following situations: (a) if the supplier becomes insolvent, files for bankruptcy, goes into liquidation, has a receiving or administration order made against it, compounds with its creditors, carries on business under a receiver, trustee or manager for the benefit of its creditors, or if any act is done or event occurs with under applicable laws has a similar effect to any of these acts of events; or (b) if there is a Change in Control of the supplier or its parent entity as defined in clause xx, or (c) if the EPC contractor has the right to suspend or terminate the this present Sub-Contract.

Finally, the EPC contractor should seek to contractually ensure that ownership to the hardware passes to the EPC contractor (or if required to the owner) as soon as possible. Ownership should preferably pass as soon as the key component supplier has entered into its sub-supply agreement, where this is possible under the applicable law. To this end, it will often be necessary to ensure and document that the hardware is kept duly labelled and individualised. In some situations, depending on the lex rei situs, it may alternatively be possible (or preferable) to establish a floating charge covering the hardware during the assembling of the key component in a workshop.

[edit] The design

Providing the EPC contractor with fast and smooth access to the blueprints, technical descriptions, software components and any other intellectual property relating to the design of the supplier’s scope of work, in case the supplier defaults, is both commercially and legally problematic.

First of all, the design is typically the supplier’s main asset, and an EPC contractor wishing to obtain any extended legal rights to the design, beyond a standard single user license, will inevitably be met with resistance in the contract negotiations.

Relying solely on the typical non-exclusive, single user IP license, which most standard contracts grant the EPC contractor, is not always sufficient in case the supplier defaults as a result of bankruptcy, in that the administrator of the bankruptcy will often, under the lex concursus, have a right to repudiate the license agreement as an executory contract, i.e., a contract on which performance remains due on both sides.

This appears to be the case under German law, where sec. 103 and sec. 112 of the German Bankruptcy Act (“Insolvenzordning”) grant insolvency administrators with broad discretion to assume or reject executory contracts such as IP license agreements [4].

A similar result seems to flow from sec. 61 of the Danish Bankruptcy Act, which allows the administrator to terminate executory contracts for an extended duration with a “usual notice” in spite of the fact that such contracts may stipulate that they cannot be terminated, or that they may only be terminated with a very long notice. [5]

On the other hand, §365(n) of the US Bankruptcy Code specifically exempts a wide range of IP license agreements from repudiation by a bankruptcy administrator [6].

In the absence of clear statutory rules in the jurisdiction of the company where the design rights of the supplier have been placed, protecting the rights of the EPC contractor to continue to use the IP license in a situation where the supplier becomes insolvent, the EPC contractor will in most cases have an interest in obtaining an IP pledge, which embraces the design and other IP related to the key component. Such a pledge should be established and duly registered as a supplement to the usual IP license to use the supplier’s design. This will in most jurisdictions, increase the EPC contractor’s chances of successfully completing the component on the basis of the supplier’s design in case the supplier goes bankrupt before the sub-contract is performed.

Establishing a first priority IP pledge will, however, sometimes prove to be difficult because the IP portfolio of the supplier has already been securitized in favour of the supplier’s bank or other major creditor under a floating charge or a similar multi-asset-embracing securitization arrangement [7].

However, as the bank may sometimes have an economic interest in a successful performance of the sub-contract by the supplier, the EPC contractor may be able to strike a deal with the bank aimed at ensuring a continued and unhindered access to use the design rights, which will fall into the hands of the bank following the supplier’s bankruptcy. It may in particular be possible to reach such an agreement in situations where the bank has issued a performance bond for the supplier in favour of the EPC contractor and/or in situations where the supplier has assigned its right to receive payments under the sub-contract to the bank.

Under any circumstances, the EPC contractor should always consider pursuing an agreement according to which the supplier undertakes to copy all design data related to the key component from its own server onto an escrow server owned and operated by a third party. The main purpose of such a “design escrow agreement”, which is a common feature in contracts related to solar and wind power projects, is to give the EPC contractor a right to access and take over the updated design data (blueprints, software components, calculations, technical descriptions, etc.) if the supplier defaults so that the sub-contract can be handed over to a new supplier and performed with as little delay as possible.

The core clauses of a “design escrow agreement” could be drafted as follows:

“The EPC contractor shall have a full and unrestricted right to access and freely use the Data in any of the following situations: (a) if the supplier becomes insolvent, files for bankruptcy, goes into liquidation, has a receiving or administration order made against it, compounds with its creditors, carries on business under a receiver, trustee or manager for the benefit of its creditors, or if any act is done or event occurs with under applicable laws has a similar effect to any of these acts of events, or (b) if there is a Change in Control of Supplier or its parent entity as defined in clause xx, or (c) if the EPC contractor has the right to suspend or terminate the Sub-Contract.

The EPC contractor or an IT consultant appointed by the EPC contractor shall have the right to access the Escrow Server and the Supplier’s own Server to verify that the Data has been duly backed-up in the agreed format and is up to date.

In case the EPC contractor exercises its right to access the Data pursuant to clause xx, the supplier shall as of the date of the notice given by the EPC contractor be deemed to have given a time-unlimited, royalty-free, irrevocable and unrestricted license to the EPC contractor to use all of the Data for the purposes of successfully constructing, testing, handing over and where applicable later operating and maintaining the Works“.

If the escrow server is operated from and located in a jurisdiction [8] that does not readily recognise and enforce rulings of the bankruptcy courts of the supplier’s jurisdiction, a “design escrow agreement” may in practice largely alleviate the above described problems facing an EPC contractor in case the administrator of a key component supplier’s bankruptcy decides to repudiate the EPC contractor’s license to use the design of the key component.

[edit] The manpower

Even if the EPC contractor manages to quickly gain access to a defaulting key component supplier’s updated design data and to the hardware, the EPC contractor will often face serious project delays due to the absence the supplier’s key employees.

Without the specific project know-how of the supplier’s project managers, lead engineers, software developers, and others who have been involved in project, the EPC contractor will rarely be able to finalise the defaulting supplier’s key component on time.

It is therefore of paramount importance for the EPC contractor to take measures to increase the chances of having the supplier’s key employees continue their work on finalising the key component even in a situation where the supplier becomes insolvent.

For example, the EPC contractor may be able to incentivise the supplier’s key employees to finalise the key component by offering a cash bonus upon successful completion. Such a bonus should be paid by the EPC contractor directly to the key employees in accordance with the terms of the sub-contract.

The sub-contract will often contain a standard non-solicitation clause. In some cases, it may be relevant to add wording to such a clause, allowing the EPC contractor to actively engage the sub-contractor’s key employees in case the supplier becomes insolvent or seriously breaches the sub-contract.

Depending on the nature of the key component, the supplier will sometimes have entered into an agreement with a workshop where the component is assembled. The EPC contractor should ensure that step-in rights clauses are implemented into agreements with the supplier’s workshop. The type of clause set out above under section 3.1 may be used in this regard.

[edit] Conclusions

In general, standard construction contract forms do not effectively support the EPC contractor’s chances of quickly and successfully replacing a key component supplier, which is often the only relevant remedy worth pursuing for an EPC contractor in case the supplier lacks the ability or will to perform the sub-contract on time.

Replacing for example a boiler builder in a power plant project is fundamentally problematic because the boiler is a highly complex and often tailored component. The EPC contractor can, however, seek to contractually alleviate the challenges of replacing a defaulting boiler builder by facilitating quick and unhindered access to the three main elements, which the construction of any key component entails, namely: The hardware, the design, and the manpower.

Whereas step in rights clauses, designed to secure access to the hardware in case of a defaulting supplier, have become more or less standard due to demands from the lenders involved in the non-recourse financing of thermal power plant projects, it is somewhat surprising that the need for contractual leverage in relation to securing a continuous exploitation of an insolvent key component supplier’s design rights has apparently only attracted attention in relation to solar and wind power projects. In the opinion of this author, there is a need for design escrow arrangements in most types of contracts with key component suppliers in light of the fact that the laws of most European jurisdictions apparently allow bankruptcy administrators to freely repudiate IP licenses granted by suppliers with dire consequences for the EPC contractors.

Where a design escrow arrangement is not practical or possible, the problems arising in relation to the EPC contractor’s continued use of a bankrupt key component supplier’s design may in some situations be avoided if the design rights and related IP can be placed in an SPV incorporated in the United States or in another “IP license rights friendly” jurisdiction. An alternative solution could be for the supplier to transfer the design rights to a trustee to thereby safeguard the IP if the supplier becomes insolvent.

· Advokat (H), LL.M. (Cantab), FCIArb, TEP.

[1] For more details on construction project joint ventures, see Jacob C. Jørgensen, “International Construction Project Joint Ventures under Swiss Law”, The International Construction Law Review, 2006/10, p. 394 ff.

[2] For more details on the topic of interim delays and other issues related to project delays under various legal systems see Jacob C. Jørgensen et al. in “Delay Clauses in International Construction Contracts”, 1st edition, 2010.

[3] For example it could be considered stipulating that the following acts and omissions will be deemed to constitute gross negligence: (a) Suspending the works or threatening to suspend the works in connection with claims for an extension of time and/or additional payment; (b) Failing to pay sub-suppliers and sub-contractors in a timely manner; (c) Refusing to accelerate activities in case of delays or threatening delays; etc.

[4] See “Intellectual property rights under German insolvency law”, by Peter Jark and Tom H. Braegelmann, available here: https://www.dlapiper.com/en/us/insights/publications/2015/04/global-insight-issue-13/intellectual-property-rights-under-german/

[5] The commented Danish Bankruptcy Act specifically mentions license agreements in relation to s. 61, cf. “Konkursloven med Kommentarer”, by Anders Ørgaard et al., 12th edition, 2013, at §61.

[6] See “Intellectual Property Licenses and Bankruptcy: The Latest Word” by Geoffrey Groshong, Kathleen Petrich and Drew Voth, available here: http://www.americanbar.org/publications/blt/2014/08/03_groshong.html.

- A brief outline of inter alia Japanese, Finnish and Australian law on this topic is available here: http://aippi.org/wp-content/uploads/committees/241/WG241English.pdf

- A relatively recent description of English law, which appears to be similar to German and Danish law on this issue, is available here: http://united-kingdom.taylorwessing.com/synapse/march13.html

- Dutch law seems to allow the administrator to “passively” repudiate executory contracts, whereas an “active” repudiation of for example an IP license agreement is not allowed, cf. http://www.lexology.com/library/detail.aspx?g=ae272fac-bb17-4fb0-bde2-d2c7ab929bd5

[7] An overview of the rules concerning the registration of rights to intellectual property and other assets in 19 different jurisdictions can be found in “Finding, Freezing and Attaching Assets – a Multi-Jurisdictional Handbook”, by Jacob C. Jørgensen et al, 1st edition, 2016.

[8] As an example one could mention that Denmark does not recognise foreign insolvency proceedings apart from proceedings in the other Nordic countries, cf. Henrik Sjørslev and Dennis Højslet in “The International Insolvency Review”, 2nd Edition, 2014, p. 114 ff.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings for people to come home to... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

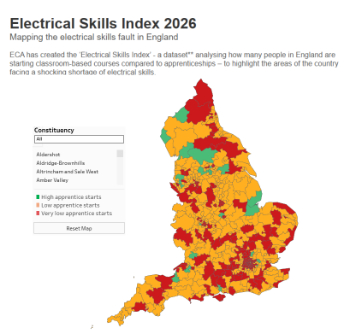

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

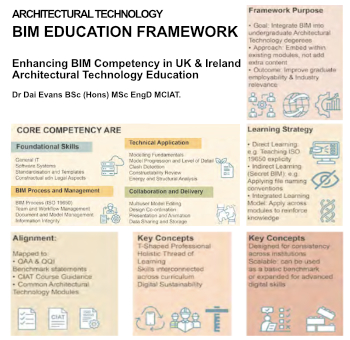

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”