Appeals against urgent works notices

This article was created by The Institute of Historic Building Conservation (IHBC). It was written by Bob Kindred MBE BA IHBC MRTPI and originally published in April 2015.The original article can be seen on the IHBC website.

Contents |

Executive summary

This Note aims to draw some further lessons from the procedure where recipients of an Urgent Works Notice can appeal to the Secretary of State against the notice under the provisions of S.55 of the 1990 Act. [1]

IHBC first published data on S.55 Appeals in 2003. [2] Appeals are uncommon and the recovery of costs of works undertaken by local authorities under the notice is optional not mandatory.

This Research Note is based on recent data helpfully provided by the Heritage Protection Branch of the Department for Culture Media and Sport. The Institute gratefully acknowledges the Department’s assistance in enabling a near definitive position to be established for the period up to mid-2014. Additional data and insights from readers would be invaluable in future.

The outcomes of S.55 appeals spanning more than a decade have been overwhelmingly in favour of local planning authorities thus providing reasonable confidence that serving an Urgent Works Notices will be successful provide the necessary procedural steps are carefully followed.

Introduction

Use of Urgent Works Notices by local planning authorities remains an uncommon practice, notwithstanding the estimated 37,000 listed buildings at risk in England.[3] Recovery of costs by a local authority doing the works in default is an even greater rarity and is not a statutory requirement.[4][5]

One of the first considerations of the authority when using these powers should be the financial circumstance of the owner, as an appeal may be made on grounds of hardship.

Legislation and guidance

The legislation and the advice regarding procedures is perfunctory, and quantification of outcomes is equally so. The wording of the 1990 Act Section 55 is as follows:

|

S.55 Recovery of expenses of works under s.54. (1) This section has effect for enabling the expenses of works executed under section 54 to be recovered by the authority who carried out the works, that is to say the local authority, the Commission [6] or the Secretary of State or, in the case of works carried out by the Commission on behalf of the Secretary of State, the Secretary of State. (2) That authority may give notice to the owner of the building requiring him to pay the expenses of the works. (3) Where the works consist of or include works for affording temporary support or shelter for the building - (a) the expenses which may be recovered include any continuing expenses involved in making available the apparatus or materials used; and (b) notices under subsection (2) in respect of any such continuing expenses may be given from time to time. (4) The owner may within 28 days of the service of the notice represent to the Secretary of State - (a) that some or all of the works were unnecessary for the preservation of the building; or (b) in the case of works for affording temporary support or shelter, that the temporary arrangements have continued for an unreasonable length of time; or (c) that the amount specified in the notice is unreasonable; or (d) that the recovery of that amount would cause him hardship, and the Secretary of State shall determine to what extent the representations are justified. [7] (5) The Secretary of State shall give notice of his determination, the reasons for it and the amount recoverable - (a) to the owner of the building; and (b) if the authority who gave notice under subsection (2) is a local authority or the Commission, to them. |

Corresponding provisions for the recovery of costs in Scotland can be found at S.50 of the Scottish Listed Buildings Act and under article 80 (5)-(10) of the Northern Ireland Order.

Past government guidance in PPPG 15 [8] was not particularly informative and confined to a single paragraph as follows:

‘Local authorities (or English Heritage in London, or the Secretary of State) may recover from owners the cost of urgent works carried out under these provisions, subject to the owner's right to make representations to the Secretary of State. Representations may be made on the grounds that some or all of the works were unnecessary; that temporary arrangements have continued for an unreasonable length of time; or that amounts are unreasonable or their recovery would cause hardship. The Secretary of State will take all such representations into account before determining the amount to be recovered, and will be particularly concerned to establish whether the works carried out were the minimum required to secure the building's preservation and prevent further deterioration. If an authority intends to attempt to recover the cost of the works, the financial circumstances of the owner should be taken into account at the outset and any sums the authority wishes to recover from an owner should not be unreasonable in relation to his or her means.’

It is regrettable in policy terms and to assist the conduct of best practice, that no similar guidance was included in the National Planning Policy Framework in 2012 or the associated guidance. Although the PPG 15 paragraph quoted above has been withdrawn and is no longer official government policy; the statement limited though it is, remains a valid expression of the Secretary of State’s administration of this part of the Act.

If the local authority [9] resolves to recover the expenditure of carrying out urgent works for the preservation of the building, it must first serve notice on the same owner that received the Urgent Works Notice together with a calculation of the cost, and make a request for payment. That notice for recovery should state that it has been issued under S.55 and explain the mechanisms by which the owner can make representations to the Secretary of State under S.55(4).

If the building changes hands in the interim, there is no legal provision for the authority to recover the cost from any new owner and the cost cannot be recovered as a local land charge. [10]

To prevent possible difficulties arising from a property changing ownership, the authority should aim to recover the cost as soon as possible after urgent works have been undertaken.[11]

An inference may be drawn from the wording in the 1990 Act that the sums due do not attach to the property nor bind successive owners and that a fresh S.55 notice would need to be served in respect of continuing expenses against subsequent owners.

Within 28 days of receiving a demand for payment the owner may make representations to the Secretary of State as set out above. [12]

Precautionary documentation

Local planning authorities should note the Secretary of State’s advice to appellants with regard to coordinating its own documentary evidence in support of the S.55 Notice.

Photographs of the condition of the building prior to urgent works being carried out and of the temporary arrangements should be taken as a matter of course. The authority may also wish to consider if any quantity surveying or structural engineering reports are required.

With regard to the costs of works undertaken, the Secretary of State’s advice refers to builders of comparable experience and it would be advisable for the authority to be explicit regarding comparative rates of work, prices, expenses and profit margins etc.

Given that the Secretary of State requires financial information from the owner, the authority may wish to consider commissioning an independent recent valuation of the building upon completion of the works, and if the building is in company ownership, determining the status of the company accounts and the assets of its directors (who will have personal liability under S.89(1) of the 1990 Act.

Outcomes

There appear to be no national statistics on the overall number of Urgent Works Notices served annually by local planning authorities, against which the number of appeals to DCMS can be measured but the twenty-two received by the Secretary of State over a ten year period 2004-14 suggests the numbers to be low.

A limited review of the outcomes of eight S.55 appeals to the Secretary of State prior to 2003 was kindly provided by DCMS to IHBC in that year but the Department helpfully brought this up to date in October 2014 as set out in the Appendix, bringing the total available for analysis to thirty. [13]

In only one case out of thirty were all the grounds under S.55 (4) appealed against - and all grounds were rejected.

Appeals against the undertaking of unnecessary works S.55 (4)(a) featured in twelve cases of which ten went fully in favour of the local planning authority. In the remaining cases costs were apportioned 67% to 33%, and 47% to 53% between the appellant and the local authority.

Fewest appeals (three) were submitted involving arguments under S.55 (4)(b) that temporary support or shelter had continued for an unreasonable length of time.

Appeals concerning the unreasonableness of the amount being specified in the notice (cost) under S.55 (4)(c) arose in fourteen cases all of which were determined in the local planning authority’s favour but in one case to of the owners were required to reimburse the council while a third was excused on grounds of hardship.[13]

Where hardship was concerned under S.55 (4)(d), six cases were determined in the local planning authority’s favour and two to the owner (including the case referred to immediately above).

A number of appeals were classified as invalid. For example, on the one hand a notice had not been correctly served by local planning authority; or on the other, because the appellant did not submit any grounds of appeal to the Secretary of State.

It should be noted that where works involve include temporary support or shelter for the building, continuing expenses can be recovered from the owner and can be billed on an interim basis, but the owner may claim against the recovery of the Council’s cost (as one of the grounds of appeal under S.55) that the temporary works had continued for an unreasonable length of time. There is no evidence that this has happened in practice.

On the basis of the cases set out in the Appendix identifying the outcomes of S.55 appeals over more than a decade, and overwhelmingly in favour of the local planning authority should give those authorities reasonable confidence to proceed provide the necessary procedural steps are carefully followed. Further evidence on the outcomes of the grounds of appeal in future would be welcome from local planning authorities to inform a future edition of this Note.

Secretary of State’s Procedures

In the initial procedure where a Notice under S.55 is served by the local planning authority, this should state clearly to the owner that an appeal may be made to the Secretary of State within 28 days. The four ground on which the owner may appeal should be set out together with the address to which representation should be made:

Culture Team, Heritage Protection Branch, 4th Floor, Department of Culture Media & Sport, 100 Parliament Street, London SW1A 2BQ.

As there has been some uncertainty in the past about how DCMS processes S.55 appeals, the following ten main steps below are intended as helpful guide. The appeal procedure was revised by DCMS in April 2013.

Note that while there is no prescribed format for the Notice, an example is provided in the English Heritage publication ‘Stopping the Rot’ (2011) Appendix 2, Sample 10. [14]

While it is open to the parties in S.55 appeals to have legal representation the Department’s procedures have been designed to allow parties to represent themselves. It is important to note that the Secretary of State can only consider the representations, which fall within the four grounds of appeal under S.54 (4) (a) to (d). [15]

The Department’s Guidance Note emphasises that ‘The Secretary of State expects that the use of section 54 should be restricted to emergency repairs, for example works to keep a building wind and weather-proof and safe from collapse, or action to prevent vandalism or theft. The steps taken should be the minimum consistent with achieving this objective, and should not involve the owner in great expense’:

|

5.5.1 When an owner appeals to the Secretary of State, the Department will respond by letter setting out the representation process. The owner will again be told the grounds of appeal and the timescale in which all the correspondence will be copied between the parties. [16] The local planning authority will be informed that the owner has appealed via a letter from the Secretary of State. This is important because there is no requirement for the appellant to notify the local authority of the appeal against costs (although it would be sensible to do so). [17] 5.5.2 In making the appeal, the owner should confirm by letter that he was the owner of the building at the date of the Section 55 notice; whether any other person had an interest; and whether or not the building or a part of it was occupied at the time the urgent works were undertaken and include a copy of the relevant Section 54 and Section 55 notices served by the authority. 5.5.3 Appropriate evidence in support of the representations might include for example: a) copy report(s) from a quantity surveyor or structural engineer; photographs of the condition of the building prior to the works being carried out and of the temporary arrangements; b) copy quote(s) from builders’ firms of comparable experience to the contractor that undertook the works, which indicate lower rates, prices, expenses or profit margin; c) copies of the owner’s recent bank statements for all bank and savings accounts; details of the value of other assets owned by the owner and of any charges on those assets; a copy of a recent valuation of the building to which the works were carried out; details of any loan agreements; details of any debts and outstanding credit card payments; details of any recent County Court judgments against the owner; copies of company accounts. This evidence is particularly important where the owner is appealing on grounds of hardship. Copies of previous correspondence between the owner and the authority may also be helpful, but only if relevant to the grounds of appeal. 5.5.4 As gathering such evidence can take some time it is acceptable to the Secretary of State for the owner simply to notify the Department of the representations the owner wishes to make within the 28 day time limit; and to provide full details of those representations together with supporting evidence within 28 days of the notification. A request for an extension of time will be considered if good reasons are advanced. 5.5.5 Onus is on the owner to supply as much information as possible in support the representations. Once the documentation has been received, DCMC copies all these to the local planning authority – as this forms the only basis on which the Secretary of State will determine the appeal. This principle applies throughout the Section 55 procedure. 5.5.6 Two rounds of representations then follow. The owner’s first appeal documents are copied to the local planning authority – which has 28 days to respond and these are then copied by DCMS to the owner. In the second stage, the owner can make further representations within 14 days and again DCMS copies these to the local planning authority. It then has 14 days to reply and again the response is copied by DCMS to the owner but for information only. 5.5.7 Once these two rounds of representations have been concluded, no further representations can be made unless exceptionally new information comes to light that was not previously known to one of the parties involved. DCMS does not screen representations to determine what is or is not relevant as the Secretary of State only considers these once representations have been closed. Either party can highlight evidence not considered to be relevant. 5.5.8 The Secretary of State will then examine the evidence and proceed to a determination and will be particularly concerned to establish that the works completed were the minimum required to secure the building’s preservation and prevent further deterioration. [18] 5.5.9 Further clarification may be requested from either or both parties (and copied by DCMS to the other party as necessary) but if representations are incomplete and clarification is needed the Secretary of State’s decision will be delayed. If necessary, the Secretary of State may instruct experts to assist in reaching a determination. If an expert is instructed to inspect the building, both parties will be informed and they (or their representatives) may attend if they wish. 5.5.10 The Secretary of State will then issue a decision letter to the owner and the local planning authority explaining the extent to which the appeal is justified, the reasons for it and the amount (if any), which is recoverable. |

The Department also makes clear that while the Secretary of State has power to hold a public inquiry, these should only be held in exceptional circumstances in order to determine to what extent the representations of the owner are justified.

Other options

It should be borne in mid that S.36 of the Local Government Act 1974 also enables local authorities to recover such sums as appear to them to be reasonable in respect of their establishment charges regarding any land or building in their area which sometimes might include the incurring of professional fees such as conservation engineering advice.

An appendix to this article provides a: Summary of appeals at October 2014 under S.55 of the Planning (Listed Buildings and Conservation Areas) Act 1990. It provides a table which combines the data from cases 1-8 provided by DCMS in 2003 and published in Context, September 2003 with cases 9-30 helpfully provided by Heritage Protection Branch in October 2014.

--Institute of Historic Building Conservation 11:33, 13 Jun 2016 (BST)

Find out more

Related articles on Designing Buildings Wiki

- Building Preservation Notice.

- Cautions or formal warnings in relation to potential listed building offences in England and Wales.

- Certificate of immunity.

- Charging for Listed Building Consent pre-application advice.

- Conservation area.

- Enterprise and Regulatory Reform Act 2013 and listed buildings.

- Forced entry to listed buildings.

- Heritage partnership agreement.

- Institute of Historic Building Conservation.

- Listed Building Heritage Partnership Agreements.

- Local Listed Building Consent Orders.

- Listed buildings.

- Listed Building Consent Order.

- Summary of appeals at October 2014 under S.55 of the Planning (Listed Buildings and Conservation Areas) Act 1990.

- Urgent works in advance of a listed building consent.

- Use of injunctions in heritage cases in England and Wales.

Endnotes

[1] Planning (Listed Buildings & Conservation Areas Act, Section 55. Section 55(6) was repealed (02.01.1992) by Planning and Compensation Act 1991 (c. 34, SIF 123:1), ss. 25, 84(6), Schedules: 3 Part II paragraph. 23, 19 Part I; Statutory Instrument 1991/2905, Article 3 Schedule 2.

See also: http://www.legislation.gov.uk/ukpga/1990/9/section/55

[2] Context 81, September 2003.

[3] The precise figure is unknown, but is commonly based on 8% of the total of known listed buildings and structures entries on the National Heritage List.

[4] The authority is not obliged to recover anything, but there is no reason in law why it should not seek to recover only some of the cost, or none – subject to any concerns about the way in which decisions are made about why recovery might be declined. The owner may for example be an individual of limited means or a charity, or the owner may be bankrupt, based overseas or unknown.

[5] There will be circumstances in which it will not be possible to reclaim the costs under S.55 and an alternative is to carry out an enforced sale procedure to place the building on the open market

[6] i.e. The Historic Buildings & Monuments Commission for England (English Heritage)

[7] In Wales there is no specific advice concerning hardship in Welsh Office Circular 61/96 dated 05/12/10996, paragraph 133.

[8] Planning Policy Guidance Note 15; Planning and the Historic Environment, withdrawn March 2012.

[9] or English heritage

[10] In any event, as a proposal in the Queen’s Speech on 4 June 2014 (as part of the proposed Infrastructure Bill) Local Land Charges will become the sole responsibility of the Land Registry in England and Wales. This removes the ability of the authority to include an Informal Notice from the Land Charges Search. The Infrastructure Bill is expected to complete its passage through Parliament by March 2015.

[11] On the question of urgency, it should be noted that in the case of Henbury Cottage, Southgate Road, Southgate (R v. Secretary of State for Wales, ex parte the City & County of Swansea)[1999]; it was held that the local authority had power to execute urgently necessary works; that this was a matter for judgment; and that it was not a precondition that the works were actually urgently necessary provided they believed it to be so. Provided that the action is not irrational or invalid, the authority is protected from having to pay the cost of the repair if it turns out that the situation is not as urgent as they supposed when needing to act quickly. It is enough (given that the powers anticipate urgency) for the local authority to believe that the building needs urgent action, not that it must prove conclusively that urgent works are required.

[12] If English Heritage undertakes the works (as agent of the Secretary of State) it is the latter that is entitled to recover the cost.

[13] The Department received about 25 appeals subsequent to the availability of the 2003 figures but the information regarding the earliest of those cases is now lost. DCMS did not keep full electronic records until 2009.

[14] In the Court of Appeal case of Bolton MBC v. Jolley (1989) where the forms were commended as “models of their kind” it was held that the presentation of a bare account was insufficient and that the notice should have contained sufficient detail to enable representations to be made to the Secretary of State, who in turn could form some conclusion as to its validity or otherwise. Furthermore the local authority should have made it explicit that it was exercising its power under the 1990 Act to seek reimbursement.

[15] It is not unknown for appellants to list numerous irrelevant representations, which cannot be taken into account.

[16] Owner, local planning authority & Secretary of State.

[17] Not least of the reasons is that the local authority is made aware why the Council’s costs have not been reimbursed.

[18] R v Secretary of State for the Environment, ex parte Hampshire County Council [1981]

IHBC NewsBlog

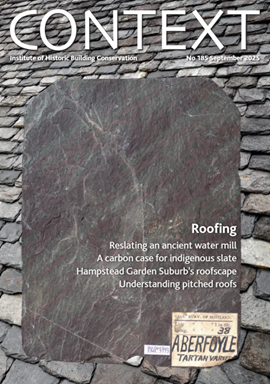

Latest IHBC Issue of Context features Roofing

Articles range from slate to pitched roofs, and carbon impact to solar generation to roofscapes.

Three reasons not to demolish Edinburgh’s Argyle House

Should 'Edinburgh's ugliest building' be saved?

IHBC’s 2025 Parliamentary Briefing...from Crafts in Crisis to Rubbish Retrofit

IHBC launches research-led ‘5 Commitments to Help Heritage Skills in Conservation’

How RDSAP 10.2 impacts EPC assessments in traditional buildings

Energy performance certificates (EPCs) tell us how energy efficient our buildings are, but the way these certificates are generated has changed.

700-year-old church tower suspended 45ft

The London church is part of a 'never seen before feat of engineering'.

The historic Old War Office (OWO) has undergone a remarkable transformation

The Grade II* listed neo-Baroque landmark in central London is an example of adaptive reuse in architecture, where heritage meets modern sophistication.

West Midlands Heritage Careers Fair 2025

Join the West Midlands Historic Buildings Trust on 13 October 2025, from 10.00am.

Former carpark and shopping centre to be transformed into new homes

Transformation to be a UK first.

Canada is losing its churches…

Can communities afford to let that happen?

131 derelict buildings recorded in Dublin city

It has increased 80% in the past four years.