VAT Policy for historic buildings part 2

Due to its length, this article is in two parts. You can see part 1 here.

This article was created by The Institute of Historic Building Conservation (IHBC). It was written by Bob Kindred MBE BA IHBC MRTPI and published in May 2014. You can see the original on the IHBC website.

It was originally published with an annex: Tax Relief for Heritage: Lessons from abroad.

Contents |

Loss of specialist construction capacity

At the time of the change to VAT in 2012 HMRC stated that businesses and charities owning protected buildings would be affected if they could not reclaim the additional VAT incurred. It estimated that 35,000 to 50,000 listed buildings were owned by businesses or charities and used for residential or charitable purposes and that around 1,000 businesses and charities might be affected each year. All businesses undertaking alterations to listed buildings would be affected, including specialist tradesmen, but HMRC expected that one-off compliance costs would be negligible. No further evidence was provided to substantiate this. [29]

HMRC thought that around 5,000 to 6,000 businesses routinely working on listed buildings might incur small costs from familiarisation with the new guidance and additional bookkeeping and a further 100,000 businesses providing construction services might incur 'very minimal' familiarisation costs. HMRC did not expect there to be ongoing business costs because there would be familiarity with making standard-rated supplies of repair and maintenance and simplifying the VAT rules could be expected to reduce the ongoing costs of compliance.

Heritage contractors are usually small firms to which the government pays particular attention where legislative and taxation impacts are concerned. In applying the so-called 'Small firms impact test' it was HMRC's view that while the 20% VAT rate might affected businesses of all sizes undertaking listed building work there would be an impact on small firms (including tradesmen specialising in protected buildings), but HMRC did not specify or did not know what this would be. Consequently any VAT concession in the treatment for supplies of construction work by small firms was ruled out.

Notwithstanding Government assurances, the impact of the 2012 changes to VAT on jobs in the heritage sector was quickly identified as a serious concern by the IHBC and wider heritage sector and construction industry bodies.

A number of contractors with the particular expertise necessary for the appropriate repair of historic buildings - and an excellent reputation for craftsmanship - have recently closed or been placed in administration, over the past year. These include Killby & Gayford Group (255 staff); Linford-Bridgeman Limited (240 staff, including those of subsidiaries Dorothea Restorations and Trumpers); and Holloway White Allom (170 staff). Removal of the zero rate increased the costs on specialist conservation businesses that they were unable to pass on to their private sector customers, many of whom were themselves struggling to ensure they were maintaining and enhancing their building appropriately. [30]

In addition to contractors, companies involved with the production and manufacture of specialist building components needed for historic building repair have needed to downsize significantly. These have included for example across a wide range of specialisms: Bricknell Conservation Limited; C J Building Ltd; Period Property Preservation Ltd; J Oldham & Co (Stonemasons) Ltd; Cumbria Stone Quarries; Caradale Traditional Brick; Copsale Oak Ltd; Crane Forge Blacksmiths; G Burditt & Co Ltd; Cy-Pres (lime products); and Devereux Decorators Ltd. All have shed staff and the associated, essential, specialist skills and these people may be lost to the industry in future by having to seek other forms of employment. Many other specialist conservation companies are now a fraction of their former size.

Concerns of the private sector

Within the private sector, the Country Land and Business Association (CLA) claims its members manage and/or own between a quarter and a third of all heritage in England and Wales and has strongly opposed the imposition of the change in VAT and has made it explicit that it is the zero rating of VAT on alterations to listed buildings that provides an incentive for owners to adapt them to make them fit for modern use. [31] [32]

CLA argues that historic buildings are disproportionately expensive to maintain given the specialist materials and skills required – and sometimes because of the scale and inaccessibility of the works - and this relief was virtually the only concession available to help alleviate the increased costs of ownership, particularly as 20% VAT is already levied on all repairs, with the HHA adding that removing this concession is likely to discourage owners from embarking on projects which will give historic buildings a viable future and dissuade potential buyers of listed buildings in need of rescue.

The HHA also reiterated the concerns of other sector bodies - not only about the impact on larger historic houses - but also about a likely downturn in the conservation building industry, with skilled contractors losing their jobs; the loss of opportunities for employment in traditional craft skills; and that all the effort and investment in recent years injected into combating the perceived skills shortages will have been for nothing. In rural communities this is stimulus is particularly important as historic houses and their associated repair and alteration are often a major source, sometimes the only source, of economic activity and employment in the local area.

Listed Places of Worship & VAT

The Listed Places of Worship Scheme (LPWS) was introduced in December 2001 as a temporary arrangement for eligible claims relating to repair and maintenance works. One significant impact stemming from the 2012 Budget about the withdrawal of the zero rate for approved alterations, was it's the effect on the LPWS. [33] [34]

To mitigate for the impact of this change, HMRC extended the LPWS in October 2012 to effectively preserve the zero rate for works to the fabric of the listed place of worship by a refund mechanism although this was not without difficulties for the cash-flow of the claimants as the cost of VAT needed to be paid before the reclaim could be made.

The key feature of the revision was that the Government made an additional £30M available for the scheme for the duration of the current Parliament; that is until 31 March 2015. The intention was that this would cover all the anticipated eligible claims, and provide greater certainty than the previous arrangements of pro-rata payments where it had transpired that claims had exceeded the available budget.

The Government than changed the scope and operation of the LPWS with effect from 1 October 2013; increased the annual budget to £42M; and simplified the scheme's administration.

- Additional works became eligible as did professional services directly related to eligible building work, such as architect fees could be included. For the first time the LPWS was also able to accept applications from religious or charitable groups whose principal or primary purpose is 'to conserve, repair and maintain redundant listed places of worship not in private ownership'. Overall about 4,000 LPWS applications are made annually. [36]

- Given that European Union rules have recently changed to permit the UK Government to vary the rates of VAT that it charges if it chooses; there does not appear to be any reasonable impediment to the extension of the principle of the LPWS to a targeted scheme for other listed buildings. This is believed not to be a concern to the EU.

Lack of a government policy evidence base

At the time of the introduction of the 20% VAT increase, HMRC stated that the effects of this tax increase 'might lead to a small increase in the price of alterations to listed buildings which would lead to a fall in demand (but...) the overall macroeconomic impacts are expected to be negligible;' but the Government were unwilling or unable to provide any statistical evidence for this. Individual examples of the increased burden identified by the sector were dismissed as merely anecdotal.

In its defence of the increase, the HMRC claimed that one aim of was to tackle an 'anomaly' through which millionaire owners of listed buildings could install swimming pools without paying VAT, and MPs were briefed to this effect by the government. An analysis of more than 12,000 applications for alterations and concluded however that only 34 of these related to swimming pools and this anecdotal evidence as the basis for government heritage taxation policy was widely ridiculed in the national press. [38]

Half of those who live in listed buildings are in the lower socio-economic groups C1, C2, D and E, but the Treasury has claimed that the majority of work being carried out to listed buildings is 'not necessary for heritage purposes'. Information obtained through the Freedom of Information Act confirming that this evidence was based on 105 cases out of 30,000 was clearly not defensible. No more robust evidence has been released by the Treasury.

This is one of a series of occasional IHBC Research Notes published by The Institute of Historic Building Conservation (IHBC). The Notes necessarily reflect knowledge and practice at the time they were developed, while the IHBC always welcomes new case examples, feedback and comment to ihbc.org.uk research@ihbc.org.uk for future revisions and updates.

--Institute of Historic Building Conservation 08:17, 14 Jun 2016 (BST)

Find out more

Related articles on Designing Buildings Wiki

- Building Preservation Notice.

- Cautions or formal warnings in relation to potential listed building offences in England and Wales.

- Certificate of immunity.

- Charging for Listed Building Consent pre-application advice.

- Conservation area.

- Conservation officer.

- Ecclesiastical exemption.

- Forced entry to listed buildings.

- Heritage partnership agreement.

- Institute of Historic Building Conservation.

- Listed Building Heritage Partnership Agreements.

- Scheduled monuments.

- Sites of Special Scientific Interest.

- Tax Relief for Heritage: Lessons from abroad.

- Use of direct action in heritage enforcement cases in England.

- VAT.

- VAT Policy for historic buildings.

- VAT - protected buildings.

Endnotes

- [1] See also the key reference documents below.

- [2] From 1 April 1973 two rates: a standard rate of 10%, & zero rate on selected goods & services (e.g. food, books, children's clothing). The main changes to the VAT since are: standard rate cut to 8% (29/07/74); higher rate on selected goods & services introduced (18/11/74) at 25% (initially just to petrol) & extended to a list of other supplies (01/05/75). Higher rate cut to 12.5% (12/04/76).

- [3] See also the key reference documents below.

- [4] Although the intention was to reduce 'anomalies' there were successful campaigns to reverse the proposals on hot food (the 'Pastie Tax') and in relation to caravans. See http://ihbconline.co.uk/newsachive/?p=4269

- [5] Anthony Seeley, 'VAT: Budget 2012 changes to loopholes and anomalies' House of Commons Library Standard Note SN6298 3 September 2013.

- [6] Although not a Listed building, in the case of 3 Trafalgar Road, Twickenham an unlisted semi-detached early 19th Century two-storeyhouse in a Conservation Area, identified as of special local interest and covered by an Article 4 Direction was demolished without consent because the owner was intent on rebuilding the front façade in facsimile and redeveloping behind to save the VAT. The owner was fined £80,000 on 26 July 2011. Details are given under Listed Buildings Prosecutions Commentary on the IHBC Resources web-page at http://ihbconline.co.uk/prosecutions/

- [7] HMRC, 'VAT: Approved Alterations to Listed Buildings' (Advisory note produced as part of the 2012 Budget proposals.

- [8] Seely, 2013 at footnote 4 above.

- [9] The Ancient Monuments Society; The Council for British Archaeology, The Garden History Society, The Georgian Group; The Society for the Protection of Ancient Buildings, The Twentieth Century Society and The Victorian Society but also including te Architectural Heritage Fund; the Association of Preservation Trusts; The Churches Main Committee; The Historic Chapels Trust; The Historic Houses Association; IHBC; ICOMOS UK, The National Trust; SAVE; The National Trust for Scotland; The Theatres Trust and The Ulster Architectural Heritage Society.

- [11] John Sell, 'VAT and listed buildings: findings of the recent study', Context 64, December, 1999: www.ihbc.org.uk/context_archive/64/vat2/study.html)

- [12] English Heritage, Power of place: the future of the historic environment, December 2000 p.11.

- [13] Experian, 'Value Added: the economic, social and environmental benefits from creating incentives for the repair, maintenance and use of historic buildings', New Economics Foundation for the Prince's Regeneration Trust, 2007.

- [14] Rob Pickard and Tracy Pickerill, 'A Review of fiscal measures to benefit heritage conservation', RICS, FiBRE: Findings in Built and Rural Environments, July 2007.

- [15] Anthony Seeley, 'VAT on historic building repairs' House of Commons Library Standard Note SN01450 2 July 2012. http://www.parliament.uk/briefing-papers/SN01450/vat-on-historic-building-repairs

- [16] Referring to key government policy publications in a cover letter to the European Commission 'Review of existing legislation on VAT reduced rates', dated 7 May 2008, Scotland's Deputy First Minister & Cabinet Secretary for Health and Wellbeing Nicola Sturgeon MSP writes 'I see alterations to VAT legislation on reduced rates as one method of helping us achieve the goals we have set out…'. (http://www.scotland.gov.uk/Resource/Doc/1071/0063941.pdf). Her primary reference is to 'The Government Economic Strategy' (Scottish Government, November 2007, http://www.scotland.gov.uk/Resource/Doc/202993/0054092.pdf).

- [17] In the private sector in Scotland, around 33% of all houses and 48% of houses built before 1919 required urgent repairs, while 36% of houses in tenements of all ages were in critical disrepair.

- [18] Scotland's Future, Your guide to an independent Scotland, 2013, http://www.scotland.gov.uk/Publications/2013/11/9348/0

- [19] ibid, p315.

- [20] ibid, (Q480, p534).

- [21] ibid, (Q483, p.535).

- [22] See: http://www.fmb.org.uk/search/?q=VAT+Campaign&x=11&y=13

- [23] See: https://www.cla.org.uk/search/node/VAT

- [24] For a list and profiles of the sixty-three major heritage sector, professional and building industry supporters of this campaign see http://www.fmb.org.uk/news-publications/newsroom/campaigns/cut-the-vat/whos-behind-us/organisations/

- [25] Although it can be argued there is no 'duty of care' on owners, a local authority can take statutory action to ensure repairs and maintenance of listed buildings are undertaken.

- [26] See www.resources.fmb.org.uk/docs/VATResearchFinal.pdf.

- [27] See Section 6.

- [28] Including up to 2,417 new construction jobs in Scotland, 1,119 in Wales & 315 in Northern Ireland.

- [29] See note 5. This note is also the source for the figures that follow.

- [30] For select sources see IHBC's NewsBlog archive at http://ihbconline.co.uk/newsachive/?p=4155

- [31] https://www.cla.org.uk/rural-policy-advice/legal-and-professional/heritage

- [32] Country Land and Business Owners Association, 'Averting Crisis in heritage, CLA report on reforming a crumbling system', CLA, 2007.

- [33] http://www.lpwscheme.org.uk

- [34] http://ihbconline.co.uk/newsachive/?p=3377

- [35] Such as works to pipe organs, turret clocks, bells and bell ropes. See http://ihbconline.co.uk/newsachive/?p=6477

- [36] Two cases were cited in the House of Commons Note SN01450 VAT on historic building repairs See Note 15 above.

- [37] http://www.heritagecanada.org/en/issues-campaigns/financial-incentives/municipal/tax-relief

- [38] United States National Park Service 'A Guide to the Federal Historic Preservation Tax Incentives Program for Income-Producing Properties'.

- [39] For ease of reference, UK nomenclatures are used, and so for example 'listed buildings' rather than as in North America and Australasia: 'designated heritage structures'.

Key Reference Documents

- Royal Institution of Chartered Surveyors: 'A Review of fiscal measures to benefit heritage conservation', RICS July 2007.

- Antony Seely, 'VAT on historic building repairs', House of Commons Library Standard Note SN01459, 2 July 2012. www.parliament.uk/briefing-papers/SN01450.pdf

- Antony Seely, 'VAT and churches, House of Commons Library Standard Note SN 01051, 5 November 2013 http://www.parliament.uk/briefing-papers/SN01051/vat-and-churches

- HMRC VAT: Approved Alterations to Historic Buildings (2012).

- HMRC Reference: 'VAT: approved alterations to listed buildings' Information Sheet 10, 12 August 2012. http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=pageLibrary_PublicNoticesAndInfoSheets&propertyType=document&columns=1&id=HMCE_PROD1_032282

- English Heritage Consultation response to the removal of the zero rate of VAT on alterations to listed buildings, May 2102. Four page expression of concerns and the impact of transitional arrangements accessible via: http://www.english-heritage.org.uk/about/news/vat-hmrc/

- New Economics Foundation for the Prince's Regeneration Trust 'Value Added: the economic, social and environmental benefits from creating incentives for the repair, maintenance and use of historic buildings', NEF 2007.

- European Commission: 'VAT Rates Applied to Member States of the European Union – Situation at 1st July 2011' Ref: txud.c.1(2011)759291 – EN 27pp. (2011).

- Experian Report, March 2014 for Cut the VAT Campaign Coalition 'An estimate of the effects of a reduction in the rate of VAT on housing renovation and repair work: 2015 to 20120' Experian, March 2014.

IHBC NewsBlog

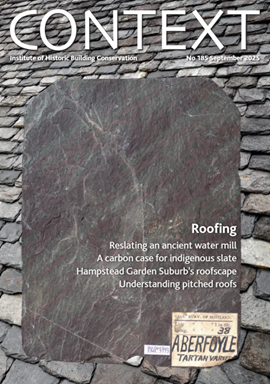

Latest IHBC Issue of Context features Roofing

Articles range from slate to pitched roofs, and carbon impact to solar generation to roofscapes.

Three reasons not to demolish Edinburgh’s Argyle House

Should 'Edinburgh's ugliest building' be saved?

IHBC’s 2025 Parliamentary Briefing...from Crafts in Crisis to Rubbish Retrofit

IHBC launches research-led ‘5 Commitments to Help Heritage Skills in Conservation’

How RDSAP 10.2 impacts EPC assessments in traditional buildings

Energy performance certificates (EPCs) tell us how energy efficient our buildings are, but the way these certificates are generated has changed.

700-year-old church tower suspended 45ft

The London church is part of a 'never seen before feat of engineering'.

The historic Old War Office (OWO) has undergone a remarkable transformation

The Grade II* listed neo-Baroque landmark in central London is an example of adaptive reuse in architecture, where heritage meets modern sophistication.

West Midlands Heritage Careers Fair 2025

Join the West Midlands Historic Buildings Trust on 13 October 2025, from 10.00am.

Former carpark and shopping centre to be transformed into new homes

Transformation to be a UK first.

Canada is losing its churches…

Can communities afford to let that happen?

131 derelict buildings recorded in Dublin city

It has increased 80% in the past four years.