VAT - Protected Buildings

Note: From 1 October 2012, zero rating has been withdrawn for work undertaken to protected buildings.

To mitigate the impact of this change, a transitional relief will apply until 30 September 2015. Zero-rating will continue to apply where a 'relevant consent' was applied for before 21 March 2012 or a contract was entered into before 21 March 2012. This included contracts already underway on 21 March 2012. For more information see HMRC, Buildings and construction.

Contents |

[edit] Introduction

Work on certain types of building may be zero-rated. This means that that no VAT is payable on such work.

For these rules to apply the building in question must be a 'protected building', a 'listed building' or a 'scheduled monument'. And for such works on these types of building, the works themselves are subjected to a variety of tests as to whether they are considered 'approved alterations'.

There are clear definitions which apply to each of these categories of building.

Consultants’ fees associated with such works are not, however, zero-rated although some consultants services which are supplied via, for example, a design and build contract may be zero-rated depending upon the nature of such services and the contractual arrangement under which they are supplied.

Your services can be zero-rated when all of the following conditions are met:

| Condition | Description |

| 1 | Work is carried out to a ‘protected’ building. |

| 2 | The work is an ‘alteration’ of a protected building and is not work of ‘repair or maintenance’. |

| 3 | The alteration is ‘approved’. |

| 4 | Your services are made ‘in the course of the approved alteration’ of that building. |

| 5 | Where necessary, you hold a valid certificate. |

| 6 | Your services are not specifically excluded from zero-rating. |

[edit] What is a ‘protected’ building?

A building is a ‘protected’ building when the following conditions are met:

| A protected building is a building that is | and is |

|

Designed to remain as or become a dwelling or number of dwellings. Intended for use solely for a relevant residential purpose. Intended for use solely for a relevant charitable purpose. |

Either a listed building or a scheduled monument |

[edit] What is a listed building?

A listed building is one included in a statutory list of buildings of special architectural or historic interest compiled by the Secretary of State for National Heritage in England and by the Secretaries of State for Scotland, Wales and Northern Ireland.

In England and Wales there are three categories of listed building, Grade I, Grade II*, and Grade II. In Scotland the equivalent categories are Grade A, Grade B and Grade C(s). In Northern Ireland the equivalent categories are Grade A, Grade B+ and Grade B.

Buildings within the curtilage of a listed building such as outhouses or garages which, although not fixed to the building, form part of the land and have done so since before 1 July 1948 (for example, an outhouse) are treated for planning purposes as part of the listed building.

Unlisted buildings in conservation areas, or buildings included in a local authority's non-statutory list of buildings of local interest, which used to be known as Grade III buildings, are not ‘protected’ buildings for VAT purposes.

See Listed buildings for more information.

[edit] What is a scheduled monument

A scheduled monument is one included in a statutory schedule of monuments of national importance as defined in the Ancient Monuments and Archaeological Areas Act 1979 or the Historic Monuments and Archaeological Object (Northern Ireland) Order 1995.

You can only zero-rate an approved alteration to a scheduled monument if it is a building that meets the certain tests set out by HM Revenue and Customs.

The underlying purpose of these provisions is to facilitate the repair and protection of nationally important buildings as well as to make the provision of certain types of dwelling easier and less financially demanding than would otherwise be the case.

However, at the time of writing, these zero-rating rules are being reviewed by HM Government and it may be the case that this favourable treatment is removed for approved alterations to approved buildings.

[edit] Related articles on Designing Buildings Wiki

- Business rates.

- Conservation areas.

- Listed buildings.

- PAYE.

- Stamp duty.

- Tax Relief for Heritage: Lessons from abroad.

- VAT.

- VAT - Option to tax.

- VAT Policy for historic buildings.

- VAT reverse charge.

[edit] External references

- HMRC: VAT.

- HMRC, VAT, Buildings and construction.

IHBC NewsBlog

RICHeS Research Infrastructure offers ‘Full Access Fund Call’

RICHesS offers a ‘Help’ webinar on 11 March

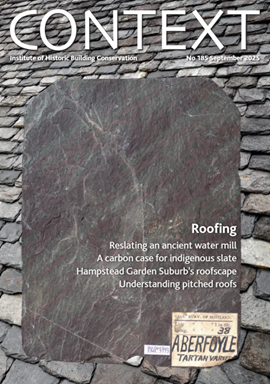

Latest IHBC Issue of Context features Roofing

Articles range from slate to pitched roofs, and carbon impact to solar generation to roofscapes.

Three reasons not to demolish Edinburgh’s Argyle House

Should 'Edinburgh's ugliest building' be saved?

IHBC’s 2025 Parliamentary Briefing...from Crafts in Crisis to Rubbish Retrofit

IHBC launches research-led ‘5 Commitments to Help Heritage Skills in Conservation’

How RDSAP 10.2 impacts EPC assessments in traditional buildings

Energy performance certificates (EPCs) tell us how energy efficient our buildings are, but the way these certificates are generated has changed.

700-year-old church tower suspended 45ft

The London church is part of a 'never seen before feat of engineering'.

The historic Old War Office (OWO) has undergone a remarkable transformation

The Grade II* listed neo-Baroque landmark in central London is an example of adaptive reuse in architecture, where heritage meets modern sophistication.

West Midlands Heritage Careers Fair 2025

Join the West Midlands Historic Buildings Trust on 13 October 2025, from 10.00am.

Former carpark and shopping centre to be transformed into new homes

Transformation to be a UK first.

Canada is losing its churches…

Can communities afford to let that happen?

Comments

Its worth noting that this consession was removed as of 1st Oct 2012 and so any schemes that wernt considard 'live' before this date dont qualify for any ZR