Scottish government intervention in market-led regeneration

|

| Inverness High Street and Town Hall (Photo: Enric, Wikimedia). |

Oscar Wilde’s definition of a cynic (‘a man who knows the price of everything and the value of nothing’) is often used in property circles. Cost consultants are well qualified to advise on how much things will cost but how rigorously do we investigate the long-term investment value? People often say to me that there is more to value than money, but asset value does provide a good indication of wider worth which is much more than cash. Not thinking about investment value represents a potential blockage in getting more complicated things delivered.

The refurbishment of older property is a challenge which many would say is best left to the experts or the insane. Unless one likes to gamble, the majority of people make financial decisions based on obtaining the best evidence and taking the safest possible route. When it comes to regeneration projects, particularly those that have a heritage element, assessing risk will be high on the agenda.

The economics of land and property are determined by a range of factors. Markets can rise and fall, finance is available one day but not the next, politics change and behaviours change leaving a cloud of mystery which even algorithmic robotics will fail to predict. Changing circumstances often lead to market unease, making investors nervous of potential negative outcomes. So how do we smooth the negativity and generate greater confidence?

Within Scotland the level of vacant and derelict land and buildings has shown little sign of improvement in recent years. Public servants and academics debate what needs to happen to enable greater levels of activity.

The fundamental question is one of confidence. Developers are unlikely to participate where there are easier opportunities and market demand is better understood. Funders get extremely nervous if demand is unproven and constraints are unquantified. Risk has to be managed, but if you do not know what you are managing, financial people will be reluctant participants. It is not just about locational aspects but regenerating existing property carries greater risks than its new build counterpart and it is certainly not helped by an inequitable taxation policy.

When markets perform well, confidence will be sufficiently high to offset or at least lower other risk elements. Prior to the recession, banks were quite liberal with their lending on property projects as escalating property values would overcome most cost overruns. This approach had a habit of breeding hubristic behaviour but this does not work when values are static and costs continue to rise. A flat market will ensure that proposals are examined in forensic minutiae. The problem is that projects are unlikely to proceed where the minutia is unknown and no one wants to speculate.

Other than prime locations, such circumstances have essentially been the operating ground for the last 10 years. The finance market has become very wary of property lending and if it does participate, the level of diligence will be substantial. All this leads to a lowering of confidence and, therefore, activity. In locations where confidence is low, market failure can prevail over a lengthy period, increasing the likelihood of stigmatisation. This makes it all the more difficult to see how market-led regeneration can work without some form of state intervention. In previous market downturns, we have seen governments providing a stimulus to the sector through development grant subsidy as part of a regeneration/renewal programme but such support is now rare to find. If the state is not a willing participant in bridging the value/cost gap, projects struggle to operate.

Unfortunately, since the recession there has been no long-term national regeneration policy or significant private development subsidy in Scotland. Scottish local authorities are left to decide their investment priorities at a time of limited resources and austerity budgeting, which inevitably means addressing immediate problems rather than adopting a long-term investment approach. Clyde Gateway Urban Regeneration Company has demonstrated that places can be turned around with public-backed investment with social benefits but such an approach is all too rare.

While significant commitment has been given to funding affordable housing, little stimulus is provided to the remaining three quarters of the housing system. Property regeneration is much more than building houses. Successful long-term solutions have to come from a ‘whole-place’ investment approach, which provides confidence to local people and persuades other people to come into such areas. This can only be done by civic champions who have vision, leadership and commitment to generate wide-ranging confidence. A good illustration of public commitment and place-promoting leadership comes from Dundee City Council at its Waterfront Dundee project. This high-profile project has the benefit of a city centre and riverside location, but the challenge is for the state to play such a facilitation and investment role in smaller projects in more tertiary locations.

It is encouraging to hear principal public officials pronounce that ‘we are open for business’ but their words have to be backed by investment deeds. To this end one hopes that City Region funds, including a municipal equity commitment, will help liberate many of the projects that have been sitting dormant for the last 10 or more years. For years, public officials had a standard phrase of ‘risk transfer’. However, in areas of market failure the private sector has effectively reversed that risk transfer to the state calling on it to get more involved directly proactively. Without state participation, fund managers are likely to look to place their investments elsewhere. Short termism will not correct market failure, nor will it transform our rundown places and property. To get ‘inclusive growth’, Scottish Government, with its public partners, has to step up and bridge the gaps. They need to act as municipal entrepreneurs leading and promoting a commitment to a patient-capital approach that is based on a long-term vision and direct participation that will restore our heritage, our buildings and, most important, give confidence to people in the renewal of our places.

|

| The new V&A Museum under construction on Dundee Waterfront in 2017. In the foreground is the Discovery, which took Scott and Shackleton to the Antarctic in 1901, its masts removed for repair (Photo: Laerol, Wikimedia). |

This article was originally published as ‘The cost and the value of heritage’ in IHBC's Context 158 (Page 41) in March 2019. It was written by Steven Tolson, a chartered surveyor and property economist.

--Institute of Historic Building Conservation

Related articles on Designing Buildings Wiki

- Caithness Broch Project.

- Conservation.

- Conservation in the Highlands and Islands.

- Development of sustainable rural housing in the Scottish Highlands and Islands.

- Engaging communities in our Highlands and Islands.

- IHBC articles.

- Lord Leverhulme on Lewis and Harris.

- Macallan Distillery.

- Matthew Davidson stonemason and civil engineer.

- New architecture of Scotland's west coast.

- Orkney gables.

- Re-thatching a Hebridean blackhouse.

- United Free Church of Scotland: Design for Manses in the Highland Districts.

- The challenges and opportunities of conservation in the Highlands and Islands.

- The Engine Shed.

- The Institute of Historic Building Conservation.

- Vernacular architecture.

IHBC NewsBlog

RICHeS Research Infrastructure offers ‘Full Access Fund Call’

RICHesS offers a ‘Help’ webinar on 11 March

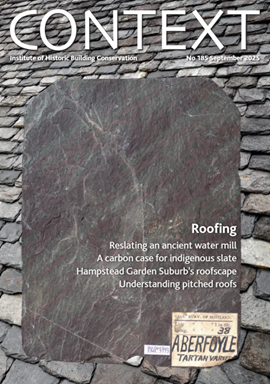

Latest IHBC Issue of Context features Roofing

Articles range from slate to pitched roofs, and carbon impact to solar generation to roofscapes.

Three reasons not to demolish Edinburgh’s Argyle House

Should 'Edinburgh's ugliest building' be saved?

IHBC’s 2025 Parliamentary Briefing...from Crafts in Crisis to Rubbish Retrofit

IHBC launches research-led ‘5 Commitments to Help Heritage Skills in Conservation’

How RDSAP 10.2 impacts EPC assessments in traditional buildings

Energy performance certificates (EPCs) tell us how energy efficient our buildings are, but the way these certificates are generated has changed.

700-year-old church tower suspended 45ft

The London church is part of a 'never seen before feat of engineering'.

The historic Old War Office (OWO) has undergone a remarkable transformation

The Grade II* listed neo-Baroque landmark in central London is an example of adaptive reuse in architecture, where heritage meets modern sophistication.

West Midlands Heritage Careers Fair 2025

Join the West Midlands Historic Buildings Trust on 13 October 2025, from 10.00am.

Former carpark and shopping centre to be transformed into new homes

Transformation to be a UK first.

Canada is losing its churches…

Can communities afford to let that happen?