Capital

Contents |

[edit] Introduction

In classic economics, a country’s resources are called the ‘factors of production’ and are generally necessary to create goods and services (they do not form part of the final product).

The factors of production (FOP) are:

So, in this respect, strictly speaking, ‘capital’ amounts to those items that further the production process, such as tools, machinery, plant and equipment. (Some economists cite a fourth FOP: the entrepreneur, who takes the risks to organise the three factors and direct them to create new goods and services.)

However, a more contemporary definition might be the wealth (money or assets) that reveals the financial viability of an individual, organisation, or nation, and which is assumed to be available for development or investment. This may be further broken down into:

- Capital investment

- Capital employed and

- Working capital.

[edit] Capital investment

This is the amount of money (funds) that has been invested in a business (or project) to help achieve its objectives. The investment may come from the owner, shareholders, bondholders, equity investors, banks, venture capital, angel investors and lenders.

Capital investment may also refer to a firm’s acquisition of capital assets or fixed assets, such as plant and machinery.

The amount of invested capital is not usually listed as a separate line item on a firm’s balance sheet; it has to be inferred from other information in the firm’s accounting records.

[edit] Capital employed (or funds employed)

This is the total amount of capital being used in a firm to allow it to continue as a revenue-generating business. It is the total value of all the assets employed in the business and can be calculated by taking total assets and subtracting current liabilities (or fixed assets plus current assets minus current liabilities).

[edit] Working capital

This is the excess of the total current assets over the total liabilities of the firm (or current assets minus current liabilities). The formula measures a firm’s short-term liquid assets that remain after short-term liabilities have been paid off. An example would be as follows:

[edit] Current assets:

Cash £30,000

Inventories £10,000

Accounts receivable £30,000

Total £70,000

[edit] Current liabilities

Accounts payable £15,000

Short-term borrowings £10,000

Liabilities accrued £5,000

Total £30,000

So, the working capital is £70,000 - £30,000 = £40,000

[edit] Capital expenditure

Capital expenditure (sometimes abbreviated as Capex, CAPEX or CapEx) is one-off expenditure that results in the acquisition, construction or enhancement of significant fixed assets including land, buildings and equipment that will be of use or benefit for more than one financial year.

For more information see: Capical expenditure.

[edit] Capital Gains Tax

Capital Gains Tax (CGT) is levied on the profit that is made when something is sold, gifted, swapped or otherwise disposed of.

For more information see: Capital Gains Tax.

[edit] Related articles on Designing Buildings Wiki

- Budget.

- Capex.

- Capital allowances.

- Capital costs.

- Capital gains tax.

- Capital value.

- Cost plans.

- Depreciation.

- Human capital.

- Enhanced Capital Allowance scheme.

- Natural capital.

- Net Present Value.

- Produced capital.

- Social capital.

- Working capital

[edit] External references

Featured articles and news

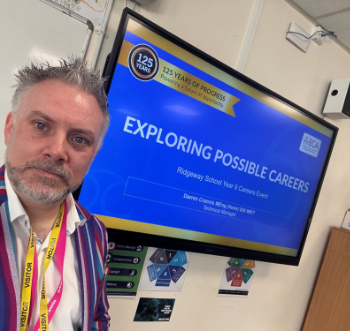

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this.