The National Housing Bank; a publicly owned and backed subsidiary of Homes England

In June 2025 the government announced "Over 500,000 homes to be built through new National Housing Bank". The creation of the new National Housing Bank, aims to significantly boost housebuilding across the country. It will be backed by £16 billion in financial capacity and managed as a subsidiary of Homes England. The initiative is expected to unlock £53 billion in private sector investment. Combined with an existing £6 billion already allocated, the project will facilitate the construction of over 500,000 new homes, while also creating jobs and stimulating economic growth.

This new housing bank will grant Homes England increased autonomy and the power to issue government guarantees directly, allowing it to make long-term, flexible investments. Its goal is to bring greater stability and certainty to the housing market, especially for private developers and investors. Additionally, the bank will support small and medium-sized enterprises (SMEs) with tailored lending products and help fund infrastructure for complex housing developments, making it easier to unlock challenging sites and accelerate construction.

The National Housing Bank will:

- Provide a wider range of debt, equity and guarantee products supporting SMEs to accelerate housebuilding and grow.

- Expand the use of lending alliances with the private sector, to increases access to finance for housebuilders.

- Support unlocking large, complex sites to increase confidence and boost housing supply through the provision of infrastructure finance and guarantees.

- Scale up partnership investments to draw more institutional funds into housing and mixed-use schemes such as Schroders Real Estate Impact Fund, the MADE Partnership with Lloyds Bank Group and Barratt Redrow and HABIKO joint venture with PIC and Muse, and PPPs with Oaktree Capital and Greycoat Real Estate.

- Work with Mayors and local leaders to develop integrated packages of financial support to deliver their housing and regeneration priorities, alongside wider land and grant funding.

- Provide the low-interest loans announced at the Spending Review to support the delivery of more social and affordable homes – recognising their importance in tackling the housing crisis.

Following this announcement MHCLG and Homes England will work with the Greater London Authority, and established Mayoral Strategic Authorities, to agree how to support them to deliver on regional housing priorities.As part of this, MHCLG and Homes England may agree that some of this £16bn allocation for the National Housing Bank will be devolved to the GLA or Mayoral Strategic Authorities – and would therefore be delivered outside the remit of the Bank, but with the same targets and objectives

The National Housing Bank is a permanent institution which will deliver debt, equity and guarantees. In many cases CDEL grant will also be a critical part of the capital stack to deliver large scale, complex and transformational housing regeneration and infrastructure projects.

To support this, alongside these financial products MHCLG will provide c.£5bn CDEL grant to invest across the country. This CDEL grant will sit alongside the financial products delivered by the National Housing Bank to ensure large, transformative and otherwise unviable projects nationwide can be delivered.

[edit] Related articles on Designing Buildings

- A social and affordable housing renewal decade: The long term government plan for delivery.

- Affordable housing.

- Affordable rented housing.

- Buy-to-let mortgage.

- Councils and communities highlighted for delivery of common-sense housing in planning overhaul.

- Design Council Homes Taskforce launched to support the new government in creating 1.5 million homes within UK climate commitments.

- Help to buy.

- Housing associations.

- Killian Pretty Review.

- Laying the foundations: a housing strategy for England.

- Real estate investment trusts.

- Rent to buy.

- Right to buy.

- Social rented housing.

Featured articles and news

One of the most impressive Victorian architects. Book review.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The National Housing Bank

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

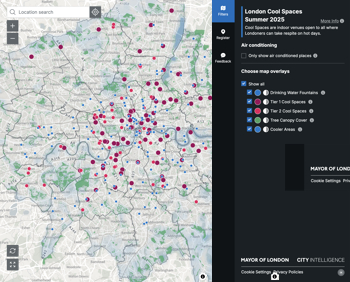

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.