What does Brexit mean for construction?

Contents |

[edit] The result

As the United Kingdom woke up to the news that the electorate voted to leave the European Union, many wondered what the implications could be for the construction industry.

The industry, throughout the campaign, had displayed mixed views on the prospect of Brexit, with particular concern about how it might affect the skills shortage, the import and export of materials, and regulations and standards.

A survey undertaken by Smith and Williamson prior to the referendum, found that only 15% of construction executives favoured a UK exit from the EU.

Lord Bamford, the chairman of JCB, was an oft-cited voice for the Leave campaigners, as he was convinced that a Brexit would reduce the costs of bureaucracy so much that any additional costs of leaving the EU would be easily covered.

The industry must come to terms with the reality of the UK's departure from the EU. But what are possible implications?

[edit] Skills shortage

[edit] Overview

The construction industry relies heavily on foreign migrant labour for skilled and non-skilled roles. It is feared that outside of the EU, which guarantees the right to free movement, the skills shortage could worsen. If immigration is limited, particularly for skilled workers, the UK could witness higher project costs where labour demand outstrips supply.

This could have a knock-on effect on the capacity of housebuilders to meet the government's housing targets, with cost increases possible for the housing market and construction companies. This further decline in housebuilding could deepen the housing crisis especially in London.

Alternatively, if global investors start to take their money out of the UK property market, this could lead to a reduction in prices and free up investment properties that are currently sitting empty.

[edit] Updates

In October 2018, Mark Reynolds, chief executive of Mace, attacked Prime Minister Theresa May over the government's plans to focus post-Brexit immigration on high-skilled workers with no priority for those in the EU. May said that the free movement of workers between the UK and EU would end "once and for all".

The most high-profile construction industry figure to express views on the issue, Reynolds accused the government of completely ignoring industry worries over access to 'un-skilled' labour after March 2019. Office of National Statistics (ONS) figures showed that one-third of workers on construction sites in London were from overseas, with 28% coming from the EU.

Reynolds said; “The future of the UK’s construction and engineering sectors relies on the availability of both highly skilled specialists and so-called ‘low skilled’ labour. I believe that the policy should be urgently reviewed and business consulted once again; as without access to the right mix of skills we will be unable to deliver sustainable construction growth after Brexit.”

Julia Evans, Chief Executive at BSRIA, said;"...members must be able to access skills and talent – at all levels – swiftly and easily when they can demonstrate that they haven’t been able to hire or train the staff they need here in the UK. This will halt more and more unnecessary and messy red tape and bureaucracy.”

[edit] Import and export of construction materials

As well as the free movement of people, membership allowed for the free movement of goods within the EU, eliminating duties and other restrictions. A 2010 study by the Department for Business Skills and Innovation estimated that 64% of building materials were imported from the EU. The same report estimated that 63% of building materials were exported to the EU. After Brexit, importers and exporters may face duties or limits on quantities, which could potentially lead to a shortage of construction materials or an increase in costs.

However, Brexit could also allow UK public procurement policy to stipulate the use of 'UK firms and materials only', supporting UK-based and enterprises. It is unclear whether Brexit might enable the UK government to impose tariffs on cheap steel imports from China that have led to the decline of the UK's steel industry. Historically, UK governments have not been in favour of propping up industries in this way, and there is always the potential for retaliation from affected countries.

On the positive side, the UK may be able to negotiate and develop its own trade agreements with the EU and other large importing companies, such as China and the USA.

[edit] Red tape

The general perception is that Brexit could result in the removal of the extensive red tape mandated by the EU. However, it is important to note that Brexit will not result in the breaking of all ties between the UK and EU. Whatever model is adopted, it is almost certain that a condition of a trade agreement with the EU would be compliance with existing trading standards.

[edit] Infrastructure

As a member of the EU, the UK has access to the European Investment Bank (EIB) and the European Investment Fund (EIF). Together these institutions invested €7.8 billion in major infrastructure projects, and lent €665.8 million to SMEs in 2015. Losing both these revenue streams could have a significant impact on the delivery of big infrastructure projects such as High-Speed 2 (HS2) as well as start-ups across the UK.

Whist this may be replaced by some of the money saved from EU membership, it seems unlikely in the face of ongoing cuts to government spending that this would be invested in infrastructure.

[edit] Planning laws

In October 2018, the government published statutory instruments relating to environmental assessments and the planning regime, ensuring continuity of policy post Brexit.

Developers will still be required to carry out environmental impact assessments (EIA) in certain circumstances to ensure environmental considerations are properly factored into the planning process. In addition, strategic environmental assessments will still be required to inform strategic plan-making, and hazardous substances regulations will still need to be adhered to.

The government confirmed it is; "...committed to maintaining the highest environmental standards after we leave the EU, and will continue to uphold international obligations through multilateral environmental agreements".

What are your views? Click Add a comment at the bottom of the page and let us know.

[edit] Related articles on Designing Buildings Wiki

- Buildings of the EU.

- European Union.

- EU Referendum - Environmental and climate change consequences for the built environment.

- Architects' Brexit statement.

- Brexit.

- Brexit still unclear for some in engineering services sector.

- Brexit - the case for infrastructure.

- Brexit Topic Guide.

- BSRIA Brexit white paper.

- BSRIA calls for clarity following Brexit Article 50 High Court ruling.

- BSRIA response to Brexit speech.

- BSRIA response to Brexit white paper.

- HVAC and smart energy post-Brexit.

- Interview with Ann Vanner.

- Overcoming the challenges of Brexit.

- Post brexit, house building and construction remains a safe sustainable industry.

- Post-Brexit vision for construction.

- Skills shortage and Brexit.

- The commercial implications of Brexit.

- Triggering article 50 of the Treaty of Lisbon.

[edit] External resources

- RICS - EU Referendum

- LABC Warranty - How will Brexit affect the construction industry?

Featured articles and news

Government consultations for the summer of 2025

A year of Labour, past and present consultations on the environment, the built environment, training and tax.

CMA competitiveness probe of major housing developers

100 million affordable housing contributions committed with further consultation published.

Homes England supports Greencore Homes

42 new build affordable sustainable homes in Oxfordshire.

Zero carbon social housing: unlocking brownfield potential

Seven ZEDpod strategies for brownfield housing success.

CIOB report; a blueprint for SDGs and the built environment

Pairing the Sustainable Development Goals with projects.

Types, tests, standards and fires relating to external cladding

Brief descriptions with an extensive list of fires for review.

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

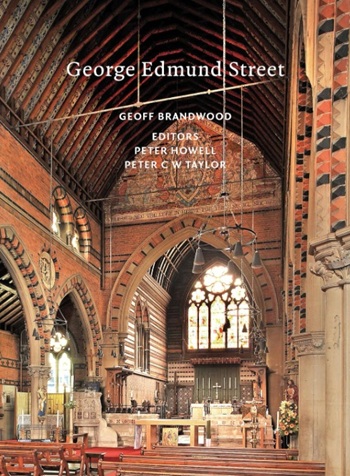

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Comments

Bear in mind that changes to any EU trading agreements involving labour or materials will not come into effect until 2019 or even later if the EU wish to extend the negotiations. What might have a more immediate effect is market perception that devalues sterling and UK inward and domestic investment decisions.

There will be many people in the industry who will be glad to see the end of the obligation to advertise forthcoming public sector commissions in OJEC . The procedure has cost unnecessary delays and additional cost to many projects.

This may give many in the UK Construction Industry the impetus to start apprenticeships or increase the number of apprenticeships, to overcome the skills shortage.