PFI vs PPP

Contents |

[edit] 1. Private finance initiative (PFI)

A private finance initiative (PFI) is a way of financing public sector projects through the private sector. PFIs alleviate the government and taxpayers of the immediate burden of coming up with the capital for these projects.

Under a private finance initiative, the private company handles the up-front costs instead of the government. The project is then leased to the public, and the government authority makes annual payments to the private company. These contracts are typically given to construction firms and can last as long as 30 years or more.

PFIs are used primarily in the United Kingdom and in Australia. In the United States, PFIs are also called public-private partnerships.

[edit] Understanding private finance initiatives

Private finance initiatives were first implemented in the United Kingdom in 1992 and became more popular after 1997. They are used to fund major public works projects such as schools, prisons, hospitals, and infrastructure. Instead of funding these projects upfront from taxpayers, private firms are hired to finance, manage, and complete the projects.

Depending on the type of project, PFI contracts typically last 25 to 30 years. It is not unusual, though, for firms to have contracts that are less than 20 or even more than 40 years. The consortium provides certain services during the period of the contract, which was previously provided by the public sector. The consortium is paid for the work over the course of the contract on a "no service, no fee" performance basis.

Firms make their money back through long-term repayments plus interest from the government. Thus, the government does not have to lay out a large sum of money at once to fund a large project.

Termination procedures are highly complex, as most projects are not able to secure private financing without assurances that the debt financing of the project will be repaid in the case of termination. In most termination cases, the public sector is required to repay the debt and take ownership of the project. In practice, termination is considered only a last resort.

[edit] Examples of PFI projects

Many of the projects that are the subject of private finance initiatives are infrastructure projects that benefit the public sector. These include highways and roadways, transport projects such as railroads, airports, bridges, and tunnels. Private sector firms may also be contracted to construct water and wastewater facilities, prisons, public schools, arenas, and sports facilities.

[edit] Key takeaways

- A private finance initiative is a way for the public sector to finance projects through the private sector.

- PFIs eliminate the immediate burden of financing projects from governments and taxpayers.

- PFIs eliminate the burden of coming up with the capital for these projects from the government and taxpayers.

- Governments repay private firms over time with interest.

- PFIs are typically used in the U.K. and in Australia. In the United States, they're called public-private partnerships.

[edit] Advantages of PFI

Governments have traditionally had to raise money on their own in order to fund public infrastructure projects. If they are not able to find the money, governments may also borrow from the bond market, and then hire and pay contractors to complete the job. This can often be very cumbersome, which is where the PFI comes in.

PFIs are intended to improve on-time project completion and also transfer some of the risks associated with constructing and maintaining these projects from the public sector to the private sector. Financial advisers such as investment banks help manage the bidding, negotiating, and financing processes.

PFIs also improve the relationship between the public and private sector, while providing both long-term advantages. Through this relationship, both sectors can share knowledge and resources.

[edit] Disadvantages of PFI

A key drawback is that since the repayment terms include payments plus interest, the burden may end up being transferred to future taxpayers. In addition, the arrangements sometimes include not only construction but ongoing maintenance once the projects are complete, which further increases a project's future cost and tax burden.

[edit] Criticism of PFI in the United Kingdom

In the United Kingdom in the 2000s, a scandal surrounding PFI revealed the government was spending significantly more on these projects than they were worth in order to benefit of the private firms running them and to the taxpayers' detriment. In addition, PFIs have been criticised as an accounting gimmick to reduce the appearance of public-sector borrowing.

[edit] 2. Public-private partnerships

Public-private partnerships involve collaboration between a government agency and a private-sector company that can be used to finance, build, and operate projects, such as public transportation networks, parks, and convention centers. Financing a project through a public-private partnership can allow a project to be completed sooner or make it a possibility in the first place.

[edit] How public-private partnerships work

A city government, for example, might be heavily indebted and unable to undertake a capital-intensive building project, but a private enterprise might be interested in funding its construction in exchange for receiving the operating profits once the project is complete.

Public-private partnerships typically have contract periods of 25 to 30 years or longer. Financing comes partly from the private sector but requires payments from the public sector and/or users over the project's lifetime. The private partner participates in designing, completing, implementing, and funding the project, while the public partner focuses on defining and monitoring compliance with the objectives. Risks are distributed between the public and private partners according to the ability of each to assess, control, and cope with them.

[edit] Key takeaways

- Public-private partnerships allow large-scale government projects, such as roads, bridges, or hospitals, to be completed with private funding.

- These partnerships work well when private sector technology and innovation combine with public sector incentives to complete work on time and within budget.

- Risks for private enterprise include cost overruns, technical defects, and an inability to meet quality standards, while for public partners, agreed-upon usage fees may not be supported by demand — for example, for a toll road or a bridge.

Although public works and services may be paid for through a fee from the public authority's revenue budget, such as with hospital projects, concessions may involve the right to direct users' payments — for example, with toll highways. In cases such as shadow tolls for highways, payments are based on actual usage of the service. When wastewater treatment is involved, payment is made with fees collected from users.

[edit] Advantages and disadvantages of public-private partnerships

Partnerships between private companies and government provide advantages to both parties. Private-sector technology and innovation, for example, can help provide better public services through improved operational efficiency. The public sector, for its part, provides incentives for the private sector to deliver projects on time and within budget. In addition, creating economic diversification makes the country more competitive in facilitating its infrastructure base and boosting associated construction, equipment, support services, and other businesses.

There are downsides, too. Physical infrastructure, such as roads or railways, involve construction risks. If the product is not delivered on time, exceeds cost estimates, or has technical defects, the private partner typically bears the burden.

In addition, the private partner faces availability risk if it cannot provide the service promised. A company may not meet safety or other relevant quality standards, for example, when running a prison, hospital, or school.

Demand risk occurs when there are fewer users than expected for the service or infrastructure, such as toll roads, bridges, or tunnels. If the public partner agreed to pay a minimum fee no matter the demand, that partner bears the risk.

[edit] Public-private partnership examples

Public-private partnerships are typically found in transport infrastructure such as highways, airports, railroads, bridges, and tunnels. Examples of municipal and environmental infrastructure include water and wastewater facilities. Public service accommodations include school buildings, prisons, student dormitories, and entertainment or sports facilities.

[edit] Related articles on Designing Buildings Wiki

- Build, own, operate and transfer (BOOT).

- Concession agreement.

- Construction contract.

- Crown build.

- Crown Representative.

- Design build finance transfer (DBFT).

- Design build operate (DBO).

- Equivalent project relief provisions.

- Flexibility in PPP Contracts: Best practices from countries where Abertis operates.

- Government Construction Strategy.

- Independent Client Advisers.

- Integrated Supply Team.

- Managing the procurement process.

- Major Projects Authority.

- Midland Expressway Ltd v Carillion Construction Ltd & Others.

- OGC.

- Output-based specification.

- PF2 (successor to PFI).

- Partnership.

- Pre-Contract Services Agreement.

- Private developer scheme.

- Private Finance Initiative.

- Private sector.

- Procurement route.

- Public procurement.

- Public project definition.

- Renovate, operate, transfer (ROT).

- Shadow tolls.

Featured articles and news

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

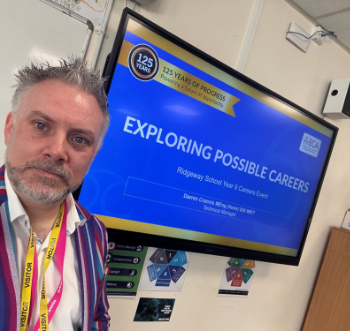

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.