Oil - a global perspective

Contents |

[edit] Supply and demand

The total world proven oil reserves at the end of 2014 were estimated as 1,655,561 million barrels, with OPEC member countries accounting for 73% of the total.

In 2013, the total reported oil consumption was 91 million barrels per day, and this is expected to increase to 111 million barrels per day by 2020. Over this period, OECD demand is predicted to fall, while demand from non-OECD countries rises with the growth in demand being driven by developing countries, in particular China, India and other Asian countries.

Proven reserves of oil refer to those quantities which are recoverable in future from known reservoirs under existing economic and operating conditions, given available geological and engineering information.

[edit] UK oil

[edit] Reserves, production and consumption

The total UK proven oil reserves stood at 3 bn barrels in January 2015. The large majority of UK's oil reserves are located offshore in the UK Continental Shelf (UKCS) with 90% of the total UK production in 2013 based in the central and northern section of the North Sea.

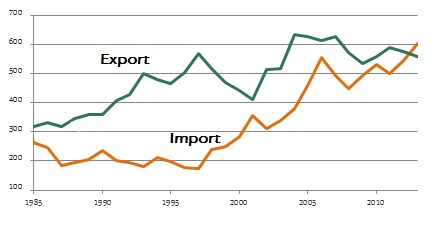

UK crude oil production peaked in the mid-1980s and late 1990s and has been gradually declining since. The country has been a net importer of oil since 2013. Despite this, the UK is still one of the largest European exporters, with the majority of the exports being to other EU countries, primarily the Netherlands (for onward trade to other countries) and Germany (for refining and consumption).

Although UK oil consumption has been gradually falling since 2005, demand for middle-distillates, particularly diesel and aviation fuel, has risen. According to the Department of Energy and Climate Change (DECC), domestic UK refineries met 61% of the oil demand in 2012, with the remaining 39% met by crude oil imports.

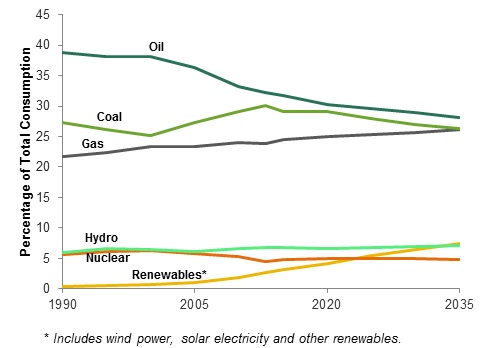

(Figure above: Shares of primary energy)

[edit] Pipelines and refining

The UK has an extensive network of pipelines which transport oil from platforms in the North Sea to coastal terminals in Scotland and northern England. The UK also has a number of onshore crude oil pipelines, including a 90-mile underground pipeline which links the Wytch Farm field to the refinery at Fawley and the export terminal at Southampton. Norpipe is the single international crude oil pipeline and it connects the Norwegian oilfields in the Ekofisk system to the oil terminal and refinery at Teeside.

The UK oil refining capacity was 1,526 thousand barrels daily in 2013 – a 16% decrease from the 2003 capacity. The UK refineries typically produce motor gasoline and residual fuel oil and therefore, they do not satisfy the domestic demand for distillate fuel oil and aviation fuel.

Three main grades of oil produced in the UK are Flotta, Forties, and Brent blends. Flotta is the smallest and lowest quality of crude and is loaded at the Flotta terminal in the Orkney Islands. The Forties stream contributes to approximately half of the total UK North Sea production, and is shipped, via pipelines, to Cruden Bay, where it is pumped to the Hound Point terminal. The Brent stream, which peaked in the mid-1980s, is transported to the Sullum Voe terminal via pipelines. Despite the declining production levels of the Brent blend, it serves as a key financial benchmark (Brent price).

Following increasing production of tight, sweet oil from shale and other tight formations in the United States, it is expected that EU refineries will continue to lose their traditional export lines with further closure of refineries. This is in spite of strong investment in the UK import capacity.

[edit] UK offshore oil and gas industry challenges

The UK faces a number of key challenges in maintaining its offshore oil production, including access to new fields in more aggressive environmental conditions, managing ageing and life extension of existing infrastructure, maximising economic recovery and maintaining fiscal stability, and decommissioning of offshore installations. In 2013, £13.5 bn was invested in the sector and this is expected to rise in the future.

In order to (i) sustain existing production, and (ii) to encourage new investment, the UK Government announced – in the 2015 Budget – a reduction in the North Sea Tax Rate from 62% to 50% for most UKCS production, applying retrospectively from January 2015.

Furthermore, a 15% reduction in the Petroleum Revenue Tax (PRT), which applies to pre-1993 UKCS fields, will follow in 2016. In addition to other interventions, this is expected to maximise economic recovery in UKCS fields and according to the independent Office of Budget Responsibility, it is predicted that North Sea production will increase by 15% by 2019 as a result of these changes.

[edit] Oil outlook

[edit] Availability and demand for oil

According to the U.S. Energy Information Administration (EIA), the global supply of crude oil and other liquid hydrocarbons will be sufficient to meet the word's demand for liquid fuels over at least the next 25 years. This prediction is governed by a range of uncertainties over the future supply and demand for oil, including economic growth, supply through tight crude and unconventional natural gas liquids (NGLs), climate-change policies, man-power constraints, and technological developments.

Figure below demonstrates the trend in oil demand in relation to other sources of primary energy:

[edit] Emissions and climate change

The 2014 Fifth Assessment Report (AR5) by the Intergovernmental Panel on Climate Change (IPCC) provides a comprehensive assessment of climate change mitigation options through limiting and/or preventing greenhouse gas (GHG) emissions and highlights the associated spectrum of uncertainties.

There is general agreement that the average global temperature rise caused by GHG emissions should not exceed 2°C above the average global temperature of pre-industrial times. However, meeting the emission goals pledged by countries under the United Nations Framework Convention on Climate Change (UNFCCC) would still leave the world 13.7 bn tonnes of CO2 above the level required to avoid exceeding a 2°C warming by 2035.

As oil accounted for 35.3% of the world CO2 emissions in 2012, it is considered a key contributor to GHG emissions. The following emission mitigation strategies associated with extraction, transport and conversion of oil will be important:

- New technological developments providing access to substantial reservoirs of unconventional oil.

- Increased focus on fugitive methane emissions.

- Increased effort required for oil extraction.

- Improved technologies for energy efficiency and emission prevention or capture.

[edit] Alternatives

Availability of ‘cheap’ oil is less certain in the coming decades, but there are a number of technologies being developed that are designed to extract from unconventional sources of oil, including development of carbon capture and sequestration. By 2035, fossil fuels are set to lose share in aggregate but are expected to still remain the dominant form of energy. In OECD countries, declines in oil and coal are expected to be offset by increases in consumption of gas and renewables, while growth in non-OECD energy is expected to be evenly spread across oil, gas, coal and non-fossil fuels.

This article originally appeared as ‘Oil’, published by the Institution of Civil Engineers on 31 July 2015. It was written by Rose Haziraei-Yazdi.

--The Institution of Civil Engineers

[edit] Related articles on Designing Buildings Wiki

- Articles by ICE on Designing Buildings Wiki.

- Biogas.

- Carbon capture and storage.

- Electricity supply.

- Energy storage.

- Fossil fuel.

- Gas Safe.

- Hydroelectricity.

- Liquefied petroleum gas (LPG).

- Marine energy and hydropower.

- Microgeneration.

- Natural gas.

- Renewable energy.

- Shale gas.

- Synthetic oil.

- The future of electricity in domestic buildings.

- Types of fuel.

[edit] External references

- U.S. Energy Information Administration, EIA, International Energy Statistics, www.eia.gov/countries/data

- Organisation of the Petroleum Exporting Countries, OPEC, 2014 World Oil Outlook, www.opec.org

- BP, Energy Outlook 2035, 2014, www.bp.com/energyoutlook

- BP, Statistical Review of the World Energy, 2014, www.bp.com/statisticalreview

- U.S. Energy Information Administration, EIA, United Kingdom Country Profile,www.eia.gov/countries/analysisbriefs/United_Kingdom

- Department of Energy and Climate Change, DECC, Energy Development Unit, UK Production Data Release, 2015.

- Health and Safety Executive, HSE, Offshore Oil and Gas, www.hse.gov.uk/offshore

- Sir Ian Wood, UCKS Maximising Recovery Review: Final Report, 2014, www.woodreview.co.uk

- Office for Budget Responsibility, Economic and Fiscal Outlook, 2015, available online at:budgetresponsibility.org.uk/economic-fiscal-outlook-march-2015

- U.S. Energy Information Administration, EIA, Annual Energy Outlook 2014 with projections to 2040, 2014.

- Intergovernmental Panel on Climate Change, IPCC, Climate Change 2014 Mitigation of Climate Change, Contribution to the Fifth Assessment Report (AR5), 2014, www.ipcc.ch/report/ar5/wg3

- UN Framework Convention on Climate Change (UNFCCC), Report of the Conference of the Parties on its Fifteenth Session, Copenhagen, 2009, Part Two: Action taken by the Conference of the Parties at its Fifteenth Session, United Nations Climate Change Conference Report 43,unfccc.int/resource/docs/2009/cop15/eng/11a01.pdf

- International Energy Agency, IEA, Key World Energy Statistics.

- UK Public General Acts, Climate Change Act 2008, www.legislation.gov.uk/ukpga/2008

- Department of Energy and Climate Change, DECC, 2013 UK Greenhouse Gas Emissions, Final Figures, 2015, www.gov.uk/government/statistics/final-uk-emissions-estimates

Featured articles and news

The Home Energy Model and its wrappers

From SAP to HEM, EPC for MEES and FHS assessment wrappers.

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.