Heat Interface Units: Powering Europe's Decarbonisation Journey in Buildings

Heat interface units (HIUs), on the European market for just over two decades, are becoming increasingly central to the building industry's efforts to decarbonise heating and improve energy efficiency. HIUs serve as the crucial connection between a centralised heat source and a building's internal heating and domestic hot water (DHW) systems, primarily designed for smaller heating or cooling loads, typically found in residential applications. They provide the functionality traditionally offered by domestic-sized boilers but within a network-dependent framework.

It is important to distinguish between "district networks," where an energy centre supplies multiple independent buildings (mixed domestic and non-domestic), and "community networks," where an energy centre serves a single building with multiple independent users, such as an apartment block. Currently, the majority of HIUs (over 70%) are installed in these centralised (community) heating systems within single buildings. Less than 30% are found in larger, multi-building district heating networks, including both new expansions and established systems. This suggests that while district heating expansion is a key driver for future growth, the existing prevalence of multi-occupancy buildings with in-building communal heating plants is the dominant, historically and currently, market for HIUs.

Most HIUs are installed in residential flats. While commercial users also adopt HIUs, particularly in multi-storey buildings connected to a central heating source, their needs vary. Often, commercial premises with existing air conditioning or ventilation systems for space conditioning primarily use HIUs for domestic hot water only.

New builds continue to take the majority of HIU installations. However, the refurbishment market is gaining importance, driven by the need to upgrade Europe's vast, older, and often poorly insulated building stock. Refurbishment projects involve not only the replacement of old, inefficient individual boilers with a central boiler and HIUs in multi-dwelling units but also the critical connection of existing buildings to new low-carbon communal or district heating sources. HIUs offer clear advantages over individual gas boilers, allowing integration with any heat source, including renewables and removing the need for annual gas inspections.

Technological evolution is broadening HIU applications. As European climates warm, the uptake of units providing both heating and cooling, or cooling only, is emerging (specific percentages 1% to 3% depending on the country). While sales are currently limited, they are expected to grow significantly, driven by the increasing demand for cooling solutions, as cooling is no longer comfort-driven but an actual need. There is also a growing market for Fresh Water Modules (FWMs), which are HIUs supplying only domestic hot water, estimated at 1% to 10% of units sold, depending on the country. FWMs offer flexibility, providing a solution for electric heating-only buildings or catering to communal spaces in mixed-use developments where only DHW from a central source is required.

There is a clear trend towards interconnected and smart heating systems. While heat meters currently handle much of the digitalisation, the future points to more data-driven HIU systems. Integrating smart technologies and IoT capabilities offers significant opportunities for optimised energy consumption, real-time monitoring, and enhanced user experience. The market is evolving towards modular, compact, and smart HIUs that can seamlessly integrate with diverse low-carbon and renewable energy sources like large-scale heat pumps.

Significant factors for future HIU potential include the accelerating conversion of commercial buildings into residential apartments. This BSRIA insight is something not reported by construction forecasters. And, while primarily for flats, HIUs are also seeing increased penetration into offices for specific zones or DHW, and, to a lesser extent, into villas connected to new district heating extensions where the infrastructure makes it viable. This diversification, along with the growing refurbishment market, will likely drive demand for more robust, "heavy-duty" HIU units.

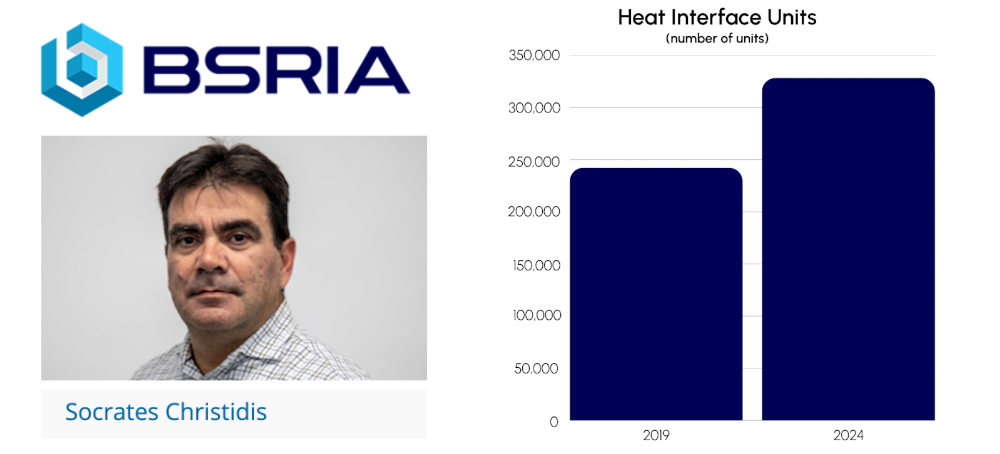

The European HIU market, according to BSRIA research, reached approximately 330,000 units in 2024, exhibiting a moderate growth of around 6% CAGR.

This growth rate has been influenced by slower new construction in recent years. Overall, European sales volumes are growing steadily at rates between 4% to 10%, depending on the country. The market is split almost equally between mechanical and electronic units. While electronic units offer advanced controls and data capabilities, aligning with future smart building trends, mechanical units remain popular due to their lower cost and simpler design, particularly in the entry-level segment. This split is expected to evolve as demand for smarter, data-integrated heating solutions increases.

Future market growth will be supported by economic recovery driving new construction, the conversion of commercial spaces into apartments, increased penetration into offices, and the sustained demand from the refurbishment sector. The drive for "zero carbon" ratings in new developments strongly positions HIUs as a key solution. Stronger policies and government funding (as seen in Germany, Netherlands, and the UK) directed towards creating new district heating networks and improving existing ones are significantly bolstering HIU growth.

In new-build apartments, HIUs offer a compelling alternative to individual apartment-level heat pump installations, which often face practical as well as monetary constraints. Instead, HIUs seamlessly connect apartments to centralised heating solutions, which may themselves be powered by large-scale heat pumps or other low-carbon sources. BSRIA estimates that by 2030, approximately 20% to 30% of new-build flats will come with HIUs as their main heating interface. In older apartments, HIUs are replacing traditional boilers or direct electric heating, integrated with a central condensing boiler (of commercial output) in a community network arrangement.

In conclusion, HIUs are becoming the favoured heating solution in many multi-occupancy buildings, closely tied to new apartment constructions and the expansion of centralised heating networks. Their growth is supported by legislation, technological advancements (including heating and cooling capabilities), increased district heating penetration, ease of operation, and relatively competitive pricing. While growing demand will naturally highlight design performance considerations, proactive collaboration among manufacturers, designers, installers, and regulators is crucial to develop robust solutions, standardise best practices, and ensure proper commissioning to unlock HIUs' full potential for Europe's decarbonisation journey.

This article appears on the BSRIA news and blog site as "Heat Interface Units: Powering Europe's Decarbonisation Journey in Buildings" dated July 2025 and was written Socrates Christidis; the Research Manager for Heating and Renewables at BSRIA, focusing on the developments and trends as the market transitions towards low carbon heating.

--BSRIA

[edit] Related articles on Designing Buildings

- A technical guide to district heating (FB 72).

- Allowable solutions.

- Big growth in district heating markets - now and on the horizon.

- Biomass boiler.

- BSRIA guide to heat interface units

- BSRIA guide to heat interface units.

- CHP boiler.

- Combined heat and power.

- Direct heat interface unit.

- District energy networks

- Domestic micro-generation.

- Heat exchanger.

- Heat interface units.

- Heat network mains.

- Heat Networks Investment Project HNIP.

- Heat pump.

- Heat sharing network.

- High temperature heat network.

- Indirect heat interface unit.

- National heat map.

- Renewable energy.

- Smart cities.

- Thermostatic bypass valve.

- Two-port (variable flow) control strategy.

- Types of domestic boiler.

- Water source heat map.

Featured articles and news

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.