The world is ‘awash with cash’, so why aren’t we investing in infrastructure?

It is breathtaking to watch world leaders put aside their differences and agree to a single strategy to boost global economic growth. It is heartbreaking when that strategy doesn’t do much good. At the G20’s recent summit in Hangzhou, China – its tenth since the 2008 global financial crisis – member governments once again pledged to invest in infrastructure in advanced economies to boost growth, and in the developing world to fight poverty. But it is still mainly a pledge.

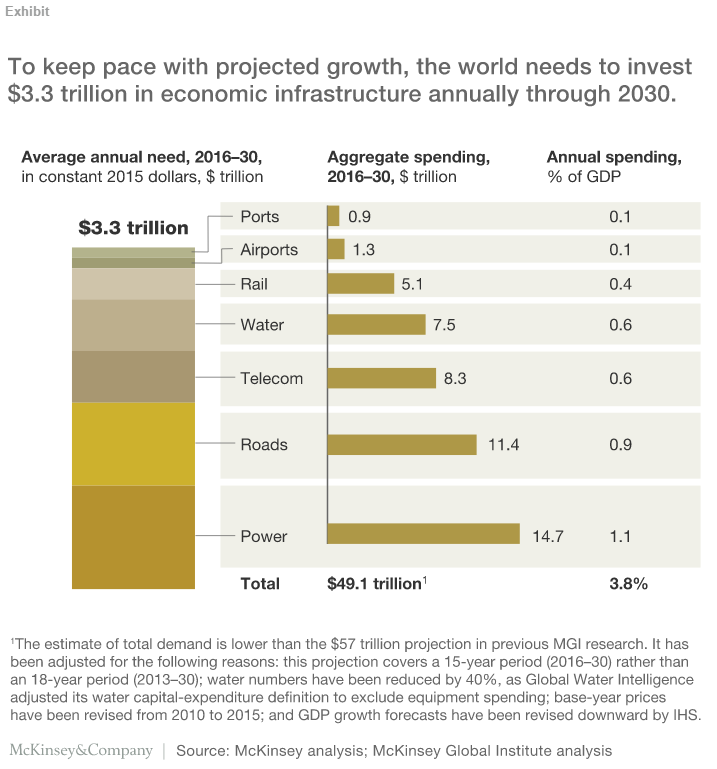

According to the McKinsey Global Institute, the world still invests only $2.5 trillion annually in transportation, water, power, and telecommunication networks, well short of the estimated $3.3 trillion needed just to keep up with current trends. In fact, most G20 countries actually invest less today in infrastructure than they did before the financial crisis, even as national leaders acknowledge that these investments can spur growth.

Image: McKinsey and Company

This is still more confounding at a time when the world is awash with cash. With central banks keeping interest rates near zero – and in some cases even probing negative territory – it is hard to find another time in history when borrowing was so cheap.

While governments may be reluctant to take on new debt, private investors seeking higher returns than government bonds can offer have always participated in infrastructure financing. Even if post-financial crisis regulations are tying banks’ hands, pension funds and insurance companies still need precisely the kinds of long-term, steady-return investments that infrastructure projects offer. So why does so much infrastructure remain unbuilt?

One problem is that, while the infrastructure-investment shortfall is a global challenge, the solutions are mostly local. Investors must look at the specific risks and rewards of the project in front of them. That means that governments at all levels need to start on a long list of granular, targeted reforms that will slowly increase transparency and reduce the risk of these inherently large, complex, and immovable outlays.

So far, G20 governments have done what governments do best: commit money. They have also pushed the World Bank and other global lenders to free up more funding for infrastructure projects. In some cases, they have even conjured new multilateral banks from scratch – witness China’s Asian Infrastructure Investment Bank and the New Development Bank, established by the BRICS countries (Brazil, Russia, India, China, and South Africa).

Because bridges, power plants, and ports are complicated undertakings that often require extensive feasibility studies, environmental reviews, and regulatory approvals, G20 countries are also trying to boost the number of potential projects. After its 2014 summit in Brisbane, Australia, the G20 launched a “Global Infrastructure Hub” to help accelerate project preparation.

These efforts are a good start, but raising more money and generating longer lists of projects isn’t enough. Investors today are focusing overwhelmingly on all the different ways they could lose their money. They are unlikely to be drawn toward infrastructure projects until they get some help in dealing with the potential risks.

This doesn’t necessarily entail government guarantees, but it does mean that governments should make all the contingencies surrounding a project as clear and predictable as possible.

For starters, policymakers can improve the investment climate by making laws clearer, taxes simpler, courts faster, and bureaucrats cleaner. Potential investors will avoid projects where it is too hard to complete feasibility studies or secure licenses. Deficiencies in any of these basic areas are usually the first thing investors complain about, which reflects how important they are.

Governments can also improve their own long-term planning to anticipate future needs and make it easier for investors to understand the context of a project, and to sign up for a second one if the first one goes well.

As a part of planning, governments should help develop an impartial set of benchmarks, based on past and current comparable projects, to set reasonable expectations about returns. If a project’s returns are set too low, it will fail; if they are set too high, people will suspect incompetence or corruption. Benchmarks can help facilitate negotiations and protect both public and investor interests.

Moreover, governments should do more to create model contracts that are easier to analyze and negotiate, regardless of where a project is located. Legal systems differ across countries, but that does not mean that contracts to build similar power plants cannot be more alike.

Governments should also develop local capital markets and encourage more securitization. Despite securitization’s bad name since the United States subprime mortgage crisis, pooling and distributing highly concentrated risks can attract a larger group of potential investors with the right risk tolerance.

Finally, policymakers should embrace the Internet of Things. Cheaper sensors and better data analytics are already enabling infrastructure operators to track maintenance issues and predict investment obsolescence more accurately, and in real time. IoT technology can thus enhance project transparency, to the benefit of governments and investors alike.

While G20 leaders have already given a nod to some of these reforms, a far wider range of officials, regulators, and investors, across many local, national, and regional jurisdictions, must do the difficult work to deliver results. More money and more projects can help, but only more transparency and a clearer view of risks will jump-start progress.

- Written by

Christopher Smart, former Special Assistant to the US President, International Economics, Trade and Investment and Senior Fellow, Mossavar-Rahmani Center for Business and Government, Harvard Kennedy School of Government

This article was also published on the Future of Construction Knowledge Sharing Platform and the WEF Agenda Blog.

--Future of Construction 13:36, 19 Jun 2017 (BST)

Featured articles and news

Encourage individuals to take action to save water at home, work, and in their communities.

Takes a community to support mental health and wellbeing

The why of becoming a Mental Health Instructor explained.

Mental health awareness week 13-18 May

The theme is communities, they can provide a sense of belonging, safety, support in hard times, and a sense purpose.

Mental health support on the rise but workers still struggling

CIOB Understanding Mental Health in the Built Environment 2025 shows.

Design and construction material libraries

Material, sample, product or detail libraries a key component of any architectural design practice.

Construction Products Reform Green Paper and Consultation

Still time to respond as consultation closes on 21 May 2025.

Resilient façade systems for smog reduction in Shanghai

A technical approach using computer simulation and analysis of solar radiation, wind patterns, and ventilation.

Digital technology, transformation and cybersecurity

Supporting SMEs through Digitalisation in Construction.

Villa Wolf in Gubin, history and reconstruction. Book review.

[[w/index.php?title=W/index.php%3Ftitle%3DW/index.php%3Ftitle%3DW/index.php%3Ftitle%3DW/index.php%3Ftitle%3DW/index.php%3Ftitle%3DConstruction_contract_awards_down_1bn%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1&action=edit&redlink=1|Construction contract awards down £1bn]]

Decline over the past two months compared to the same period last year, follows the positive start to the year.

Editor's broadbrush view on forms of electrical heating in context.

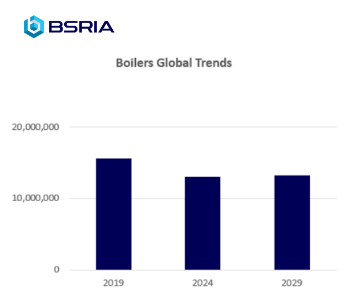

The pace of heating change; BSRIA market intelligence

Electric Dreams, Boiler Realities.

New President of ECA announced

Ruth Devine MBE becomes the 112th President of the Electrical Contractors Association.

New CIAT Professional Standards Competency Framework

Supercedes the 2019 Professional Standards Framework from 1 May 2025.

Difficult Sites: Architecture Against the Odds

Free exhibition at the RIBA Architecture Gallery until 31 May.

PPN 021: Payment Spot Checks in Public Sub-Contracts

Published following consultation and influence from ECA.

Designing Buildings reaches 20,000 articles

We take a look back at some of the stranger contributions.

Lessons learned from other industries.