HVAC 2030: BSRIA puts opportunities and challenges to the industry

|

Contents |

[edit] Introduction

BSRIA Worldwide Market Intelligence (WMI) has planned a study to investigate what is likely to happen by the end of this decade based on the status of the HVAC market as of November 2021 and known future enablers for change.

[edit] Initial observations

On 3 November 2021, BSRIA hosted a virtual discussion forum with the title “HVAC 2030” to discuss this initiative. Nigel Cotton moderated the event which was attended by a global audience.

Krystyna Dawson, BSRIA commercial director, introduced the event by highlighting the key role that HVAC products and systems play in the construction industry’s efforts to minimise carbon emissions in buildings as we enter a decisive decade for climate action.

Anette Meyer Holley, BSRIA WMI business manager, set out the climate ambitions and targets of governments in the US, China and the EU. Ultimately, legislation and incentives will be key to meet carbon neutrality targets.

In China, the target to become carbon-neutral is by 2060, 10 years later than Europe and the US. As 99% of buildings are existing buildings it is not enough to target only new buildings with legislation and incentives, rather it will require solutions for existing buildings which might involve building envelopes – including insulation. The risk is that incentives dry up before producing the desired effect.

While the US is a consumer driven, conservative market with regionalised legislation, the European market is policy driven, and there is greater awareness and incentive to switch to more efficient and lower-GWP products. In China, the market is heavily influenced and directed by government legislation, and the switch to renewables is a little longer term.

Steve Nadel, executive director of ACEEE, the American Council for an Energy-Efficient Economy, shed more light on the situation in the US, looking at energy, electrification and the uptake on heat pumps. His main message was that energy efficiency will get you halfway to decarbonisation. One of the major drivers is utilities spending on energy efficiency programmes.

In terms of HVAC decarbonisation options, most of the attention is on electrification. Can we switch over to heat pumps using a carbon-free grid? Two limitations are low payback due to low natural gas prices and growing winter peaks. The second option is to decarbonise fuel and use energy efficiency, but supplies, like renewable natural gas and hydrogen, are limited and expensive. Thirdly, a combination of the two options, especially in cold climates, was presented – particularly with a growing interest in cold climate heat pumps.

[edit] Opportunities and threats for the HVAC sector

Dr Aaron Gillich, associate professor and director of the Net Zero Building Centre, a collaborative venture between BSRIA and the London South Bank University, talked about the need to decrease heating and cooling loads, and examined where the opportunities and threats for the HVAC sector are. These are centred around the two ideas of decarbonisation and digitalisation.

The opportunity is to treat the two together as we enter a space where, due to shifting demand in the electricity grid, every single kWh is going to be increasingly competitive. The idea is that it is not about the performance of any individual device but how we set these devices up to communicate with one another and integrate towards an overall energy-use intensity target.

Looking at drivers for 2030, the most impactful is the reality itself, as climate change is moving faster than we are, and the impacts and consequences are accelerating. Targets have been - and will keep being - brought forward affecting other drivers including regulations, planning and markets. Additionally, as we saw with COVID, the recognition of an emergency can significantly change the regulatory landscape.

[edit] Balancing energy efficiency against indoor air quality

Tom Garrigan, BSRIA’s technical director, argued that the challenge that the built environment faces is balancing energy efficiency against maintaining indoor air quality. He illustrated some of the energy efficiencies and indoor environmental quality provisions that need to be considered.

The performance envelope of the building needs to be fully understood to maximise both. Energy efficiency depends on fabric performance (including airtightness and thermal performance), correctly specified HVAC equipment, fully integrated single functional building management system, planned preventative maintenance and the behaviour of people.

Indoor air quality is made up of five key elements, thermal comfort, indoor air quality, noise, odours and light. There are many considerations, and in some instances a balance needs to be struck to maximise energy efficiency and indoor environmental quality. They should both equally form an integral part in the design brief whether in new build or retrofit.

A far greater emphasis needs to be put on treating the building as a system where there is a holistic approach to integrating components, products and other interrelated systems. Additionally, in-use performance is going to be a more prominent metric in the future, and this requires the gap between design and reality to be significantly reduced.

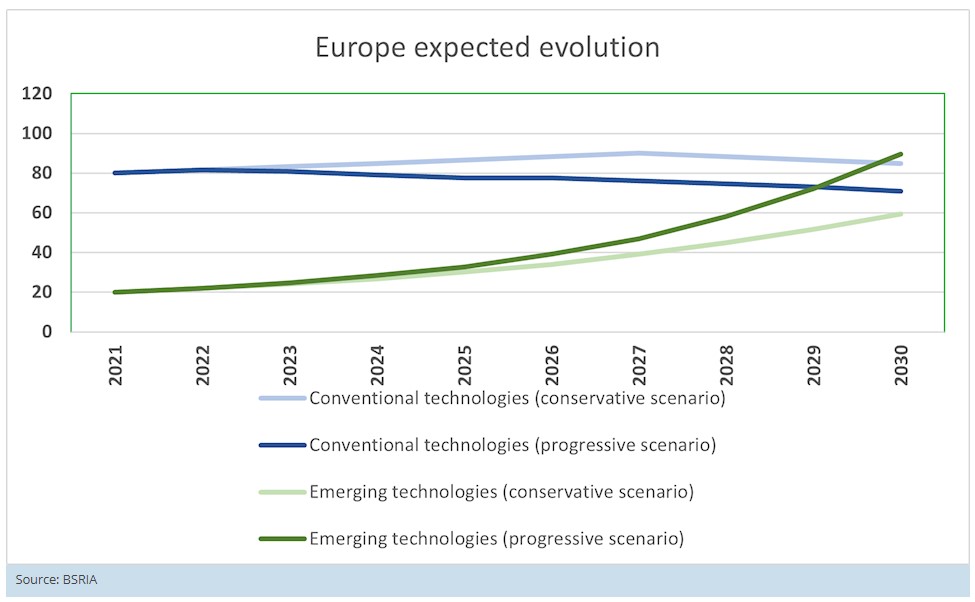

Socrates Christidis, research manager for Heating & Renewables, completed the presentations by looking at global sales of the two main heating technologies. The first was heat pumps, which were the only HVAC product that continued to grow in 2020 (despite COVID). Their growth in 2021 continued to accelerate. The second was boilers, which have recovered well from the COVID crisis. For 2021, boilers were close in terms of growth to those of heat pumps. This trajectory is something of an anomaly.

He argued that beyond COVID recovery, it indicates substantial consumer insecurity about the future, including energy prices and the banning of technologies consumers and installers are familiar with. Plans for bans on fossil fuel boilers are, in effect, ambitions rather than outright targets. Boilers that can be converted to use hydrogen may still be allowed, so if there is insufficient hydrogen by the ‘ban’ day, they will continue, very likely, to burn natural gas.

So, while Europe moves faster than both China and the US, ambitions do not match market realities when it comes to the pace of change. Amongst the many challenges is consumer engagement, and the key for progress relies on building trust, increasing knowledge of technologies and making the transition easy and simple.

Affordability sits at the heart of the decarbonisation challenge, and despite some expectations, low carbon technology prices and running costs will not change much. Fair taxation and easy to access incentives are needed to accelerate transition.

The event was staged around three topical sessions, policy ambition, building performance and market readiness. Each of those was followed by a discussion forum in which the audience was invited to participate.

Martin Lee, BSRIA general manager China, Alfonso Oliva, BSRIA’s expert on the North American HVAC market and Bruno Aleonard, associate consultant for BSRIA in North America also joined the panel during the discussion. Panellists evaluated how climate related policies and visions fare against the market readiness for a massive change that is needed to achieve them. Attention was given to the climate and COVID impact on changes in end user behaviour and expectations that put HVAC products under pressure in terms of delivering the right value to their customers.

This article originally appeared on the BSRIA website. It was published in November 2021.

--BSRIA

[edit] Related articles on Designing Buildings

Featured articles and news

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.