Impact of the sharing economy on construction craft labour and equipment markets

With the success of Uber and AirBnB, most people have heard of the new sharing (or 'gig') economy - unused resources and demand are matched through the internet to the mutual satisfaction of the parties involved.

For labour, the concept is not new. In the music and publishing industries, it is called getting a 'gig', and it has been around for centuries. In construction, the hiring hall helped make it work for over a century. What is radically new is how the sharing economy works now and how broadly it is spreading. It may substantially reshape the construction and real estate industries.

Kevin Forestell, Founder and CEO of Dozr, an equipment sharing start-up, claims:

“Not only does Dozr create revenue for equipment owners, rates on the contractor-to-contractor platform tend to be about 40% less than retail rental rates and the variety of equipment is greater. Dozr offers both construction and agricultural equipment and is free to join.”

Another company called EquipmentShare offers the ES Tracker system, which gives users real-time data about the location and usage of their various machines or vehicles they’re renting out. EquipmentShare picks up and delivers the equipment as well.

While United Rentals in North America offers similar services technically, it does not enable sharing among owners. The rise of rental agencies coincided in the last twenty years in the US with precipitous declines in equipment ownership by construction firms because of the risk of unused capital and consequential low rates of return on that equipment.

With the sharing economy, rising rates of return on equipment ownership may radically disrupt the rental business model. Caterpillar’s awareness of the disruptive risks, and opportunities involved, has driven it to start up its own equipment sharing platform called Yard Club. It will compete with Dozr and Equipment Share, as well as Ramirent in Finland, Getable in San Franscisco, and other niche service providers. Competition is not limited to equipment.

Could the age old construction hiring hall and temp agency model be vulnerable to disruption as well?

In the Small Business BC (a province in Canada) Awards website, a start-up called Faber is described:

“Faber is disrupting a $260 billion industry by providing construction companies with a software platform to automatically connect with construction workers. Faber addresses a major gap in the construction market by offering standardised pay at a fair wage, supplying workers with skills appropriate to the job and creating an automated system for finding instant work.

"Our rating system for both workers and contractors motivates both parties to do their best work during each project, ensuring a level of transparency that the Canadian industry has not yet seen. This, in turn, provides a much-needed boost in morale for those within the construction sector. Since launching in April, Faber has partnered with over 15 construction companies and empowered 600 workers to instantly connect with projects.”

Faber and the equipment sharing models present opportunities and threats that are identified below.

Cost of information:

Good decision making and efficient markets depend on complete information, yet information can be costly, time consuming to obtain and of dubious quality. Telematics for on-demand versus scheduled maintenance, equipment location tracking, activity rates monitoring, detection of machine operating abuse and maintenance, etc., offer highly valuable information for fleet management that seeks to maximise return on investment, and the cost of this information is magnitudes lower than conventional manual monitoring processes.

Cost of information on labour and machine market status and availability has always been high, yet large firms have been willing to spend large sums on local labour market and availability surveys for large projects in distant locations. Often, these involve expensive travel by experts and substantial time delays. Sharing platforms claim to offer this type of information at a lower cost and with greater reliability.

Emergence of new service opportunities and competition:

Traditional providers of labour and equipment offer related services. Sharing economy competitors offer new equipment finance options as well as fleet management practices and logistics support. Competitiveness of such services should improve now.

Trust and verification:

In North America, trade certifications and qualifications are typically tracked and maintained by unions, joint training committees, government agencies, and open shop organisations such as NCCER (National Center for Construction Education and Research).

How will the new sharing platforms track and assure this information? How do we know who to trust?

Social impacts:

Ratings exist for restaurants and almost everything else found on the internet. Behaviour changes because of these rating systems. How will construction industry behaviour change when craft workers and employers can rate each other and those ratings are publicly posted?

Health and safety are key concerns. A sharing platform must ensure that the worker or equipment operator has the proper certifications. It must ensure that the equipment been inspected as specified. And, it must clarify who assumes liability if an accident does occur.

Risks and insurance:

One of the early criticisms of Uber was that its drivers were not insured (or licensed) to drive for paying customers and that the customers themselves might be liable in the case of an accident.

In Dozr’s case, its insurer was also one of its main venture capital investors. Fairfax Financial Holdings Ltd.’s subsidiary, Fair Ventures, invested $2.5 in Dozr, and one of its other subsidiaries, Federated Insurance, provides accident and theft coverage.

Market efficiencies:

Transaction costs are radically reduced with sharing platforms for search and match activities. As well, such matches occur faster. While HR departments may not be entirely replaced, and fleet managers will still exist, it is reasonable to expect their size and cost within sharing companies will be reduced.

Additional unknowns emerge. What will happen to wage and rental rate variability? Will the impact on utilisation of capital truly be improved and by how much? And, who will deliver the equipment, especially if sharing becomes more common. Will entrepreneur equipment owners emerge in high demand markets? What will be the boundaries of those markets? These questions are likely only to be answered with time.

Role of the state:

Craft labour training infrastructure in the US is weak. It will be interesting to see if state governments finally accept a lead role in training and certification decades after the demise of the construction trade unions. Government regulation of fair wages may be necessary if a more efficient competitive market created by sharing platforms drives wages down. Geographic, jurisdictional and liability limitations may also need to be imposed.

So, in the end, how will the sharing economy impact the construction industry? Proponents are making aggressive claims. Some of the advantages are obvious, and risks as well. Investors, constructors and governments must maintain vigilance over this emerging industry, and at the same time, welcome the change it represents.

Author: Carl Haas

Contact: POC

Please find the original article here

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- 5 things leaders can do to create a truly circular economy.

- Circular economy.

- Circular economy - transforming the worlds number one consumer of raw materials.

- Industry Disruption: 10 ways real estate is changing.

- Is Disruptive Innovation possible in the Construction Industry?

- The key trends making our cities greener, safer and smarter.

--Future of Construction 16:23, 15 Jun 2017 (BST)

Featured articles and news

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

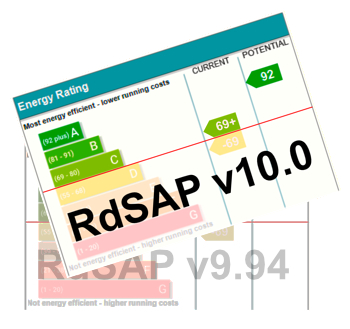

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.

Skills England publishes Sector skills needs assessments

Priority areas relating to the built environment highlighted and described in brief.

BSRIA HVAC Market Watch - May 2025 Edition

Heat Pump Market Outlook: Policy, Performance & Refrigerant Trends for 2025–2028.

Committing to EDI in construction with CIOB

Built Environment professional bodies deepen commitment to EDI with two new signatories: CIAT and CICES.

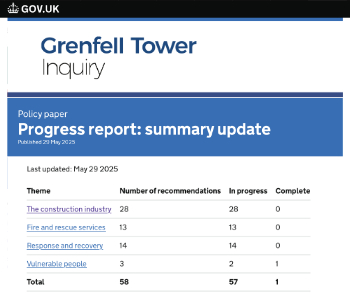

Government Grenfell progress report at a glance

Line by line recomendation overview, with links to more details.

An engaging and lively review of his professional life.

Sustainable heating for listed buildings

A problem that needs to be approached intelligently.

50th Golden anniversary ECA Edmundson apprentice award

Deadline for entries has been extended to Friday 27 June, so don't miss out!

CIAT at the London Festival of Architecture

Designing for Everyone: Breaking Barriers in Inclusive Architecture.

Mixed reactions to apprenticeship and skills reform 2025

A 'welcome shift' for some and a 'backwards step' for others.