Business premises renovation allowance

Contents |

[edit] Introduction

Business Premises Renovation Allowance (BPRA) was introduced by the Finance Act 2005. The scheme started in April 2007 and ended in March 2017 for Corporation Tax and April 2017 for Income Tax.

The Business Premises Renovation Allowance allowed business investors to claim tax allowances for 100% of the amount invested when empty business premises were converted or renovated back into usable condition. It was designed to act as an incentive to bringing back derelict or unused business properties that have not been used for at least a year.

Disadvantaged areas include Northern Ireland and areas that are specified in the Assisted Areas Order 2014 for Great Britain.

[edit] Conditions

A person must incur 'qualifying expenditure' in order to claim BPRA.

Qualifying expenditure is capital expenditure on:

- Converting a qualifying building into qualifying business premises.

- Renovating a qualifying building that is, or will be, qualifying business premises.

- Repairs to qualifying business premises.

The specific expenditure that qualifies is:

- Building works which includes the cost of labour and materials.

- Architectural and design services which includes the detailed design of the building and its future layout.

- Surveying or engineering services, which could include for example an asbestos survey or services to check the structure of a building.

- Statutory fees and permissions, for example building regulations fees or getting listed building consent.

- Planning applications, for example the costs of obtaining planning permissions to alter a listed building.

Expenditure on the following items of machinery and plant qualifies for relief:

- Integral features within the meaning of section 33A Capital Allowances Act 2001.

- Window cleaning installations.

- Automatic control systems for opening and closing doors, windows and vents.

- Fitted cupboards and blinds.

- Protective installations such as lightning protection, sprinkler and other equipment for containing or fighting fires, fire alarm systems and fire escapes.

- Building management systems (computer-based control system installed in buildings that control and monitor the building’s mechanical and electrical equipment such as: ventilation, lighting, power systems, fire systems and security systems.

- Cabling for telephone, audio-visual data installations and computer networking facilities which are incidental to the occupation of the building.

- Sanitary appliances and bathroom fittings including: hand driers, counters, partitions, mirrors and shower facilities.

- Kitchen and catering facilities for producing and storing food and drink for the occupants of the building.

- Signs.

- Intruder alarm systems.

- Public address systems.

Expenditure only qualifies for BPRA if the building is situated in a disadvantaged area and has been unused for a year immediately before the conversion or renovation begins. The last use must not have been as a dwelling.

A 'qualifying building' is a commercial building or structure situated in a disadvantaged area. 'Qualifying business premises' means any building or structure, which must be used, or available and suitable for use, for the purpose of a trade, profession or vocation, or offices.

The following are NOT qualifying business premises:

- Premises used or available for use as a dwelling.

- Premises the relevant interest in which is held by a person carrying on a relevant trade.

- Premises used wholly or partly for the purposes of a relevant trade.

A 'relevant trade' is a trade in the following sectors:

- Fisheries and aquaculture.

- Shipbuilding.

- The coal industry.

- The steel industry.

- Synthetic fibres.

- The primary production of certain agricultural products.

- The manufacture or marketing of products which imitate or substitute for milk and milk products.

Expenditure on acquiring land, extending a building or developing land next to a building does not qualify for BPRA.

[edit] Allowances and charges

There is an initial allowance equal to 100% of the qualifying expenditure.

If the 100% initial allowance is not claimed, or is not claimed in full, the person that incurred the qualifying expenditure and holds the relevant interest in the qualifying building may claim Writing Down Allowances (WDAs) which are given at an annual rate of 25% on the straight-line basis to the person holding the relevant interest until all the qualifying expenditure has been allowed.

The 'relevant interest' in the building in relation to the qualifying expenditure is the interest to which the person incurring the qualifying expenditure was entitled when the qualifying expenditure was incurred.

There is a 'balancing adjustment' if there is a balancing event within 7 years of the first use of the building after conversion or renovation. A balancing adjustment is a balancing charge or a balancing allowance. The main balancing events are the sale of the relevant interest and the grant of a long lease for a premium out of the relevant interest.

[edit] How allowances are given and charges made

If the person entitled to BPRA has a trade, profession or vocation the allowance is treated as an expense and a balancing charge is treated as income of that trade, profession or vocation.

If the person entitled to BPRA has a property business, that is, if the person is the landlord of the building, the allowance is treated as an expense and a balancing charge is treated as income of that property business.

Where the person entitled to BPRA does not have a trade, profession or vocation or a property business, the person is treated as if they were carrying on a property business (a virtual property business) and the allowance is an expense of that virtual property business. This means that the allowance can be set against the person’s other income. Again, a balancing charge is treated as income of that virtual property business.

The HM Revenue and Customs website has a detailed guide which provides further information on the allowance.

[edit] External references

Featured articles and news

What they are, how they work and why they are popular in many countries.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

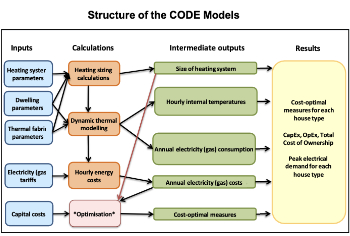

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.

The Warm Homes Plan details released

What's new and what is not, with industry reactions.

Could AI and VR cause an increase the value of heritage?

The Orange book: 2026 Amendment 4 to BS 7671:2018

ECA welcomes IET and BSI content sign off.

How neural technologies could transform the design future

Enhancing legacy parametric engines, offering novel ways to explore solutions and generate geometry.

Key AI related terms to be aware of

With explanations from the UK government and other bodies.

From QS to further education teacher

Applying real world skills with the next generation.

A guide on how children can use LEGO to mirror real engineering processes.

Data infrastructure for next-generation materials science

Research Data Express to automate data processing and create AI-ready datasets for materials research.

Wired for the Future with ECA; powering skills and progress

ECA South Wales Business Day 2025, a day to remember.

AI for the conservation professional

A level of sophistication previously reserved for science fiction.

Biomass harvested in cycles of less than ten years.

An interview with the new CIAT President

Usman Yaqub BSc (Hons) PCIAT MFPWS.

Cost benefit model report of building safety regime in Wales

Proposed policy option costs for design and construction stage of the new building safety regime in Wales.

Do you receive our free biweekly newsletter?

If not you can sign up to receive it in your mailbox here.