Factors affecting property insurance premiums

Contents |

[edit] Introduction

Buildings and contents insurance can provide owners with a level of security, and potentially, remuneration following adverse events such as fire, flooding, settlement, structural collapse and public liability.

However, buildings insurance can be costly and a drain on financial resources. It may therefore be in the interests of owners to select and adapt their policies to ensure the best cover at the most affordable cost.

There are several factors that can affect the ‘premium’ – the annual cost of the insurance policy. These include:

[edit] Multi-year cover

This is the insurance equivalent of buying in bulk. At the outset, it may be possible to arrange a longer period of cover, e.g three years as opposed to annual renewal. This could bring a discount in the region of 5-10% off the premium.

[edit] Selecting the perils covered

Adjusting the extent of the perils covered may also reduce premiums. For example, some policies offer cover against vandalism, but a farmhouse on a remote hillside, or a townhouse in a gated development may be at far less risk of vandalism than other properties. It may therefore be possible to exclude vandalism from the policy and thereby reduce the cost of the premium. The same may apply to perils such as riot and malicious damage, impact by aircraft and falling trees.

[edit] Adjusting the extent of cover

If the property contains expensive jewellery, fine furniture or works of art, it may be possible to reduce the premium by moving these to another location e.g a bank vault or storage facility.

[edit] Reducing the excess

Generally, insurance policies have an ‘excess’ to be paid in the event of a claim. The excess is the amount the insured has to cover themselves before the policy pays out. If the policy has an excess of £500, and water leakage causes £1,000 of damage, the insured will only get £500 from the policy as they have to bear the £500 excess. If on the other hand the damage amounts to £400, it would not be worth making a claim (although the insurer should be notified of the event). The higher the excess the insured is willing to bear, the lower the premium will be.

[edit] Group policies

People over the age of 50 may get reduced premiums through organisations such as Saga, a specialist insurer for older people. Other group policies exist, for example, for owners of historic buildings: churches may get lower premiums through the Ecclesiastical Insurance Group.

[edit] Risk management

Insurers like to see owners instigate risk management measures aimed at safeguarding a property. Where these are in place there could be lower premiums. Measures can include:

- Smoke and fire detectors;

- Fire-fighting equipment;

- Smoke venting to minimise smoke damage;

- Burglar alarms;

- Lightening protection and

- Secure approved locks.

[edit] Managed occupation

In the case of a residence, reducing the time it is left empty (e.g vacations) can lead to lower premiums. Some policies require a house or flat to be left empty for no more than 60 days per year.

[edit] Related articles on Designing Buildings

- 3D animation for insurance risk analysis.

- Building Users' Insurance Against Latent Defects.

- Collateral warranties.

- Contractors' all-risk insurance.

- Contract works insurance.

- Decennial liability.

- Design liability.

- Directors and officers insurance.

- Employer's liability insurance.

- Excepted risk.

- Flood insurance.

- Flood Re.

- Future of construction insurance.

- Indemnity to principals.

- Integrated project insurance.

- JCT Clause 6.5.1 Insurance.

- Joint names policy.

- Latent defects insurance.

- Legal indemnities.

- Legal indemnity insurance.

- Non-negligent liability insurance.

- Performance bond.

- Professional Indemnity Insurance.

- Public liability insurance.

- Residual value insurance.

- Reverse premium.

- Specified perils.

- Subcontractor default insurance (SDI).

- Warranty.

Featured articles and news

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

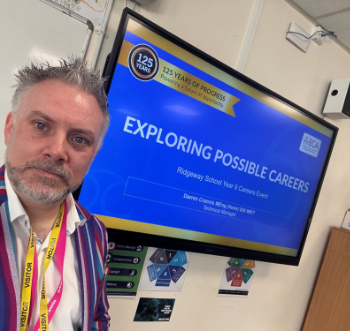

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.