Reverse premium

A reverse premium is a capital sum paid by a landlord or outgoing tenant to induce a new tenant to enter into a leasehold agreement. This differs from an ordinary premium whereby the capital sum is paid by the purchaser of a leasehold interest to the landlord or outgoing tenant.

The reasons for a reverse premium being paid could be to do with the rent on a building being above market rates, there being something undesirable about the building, or some other reason which makes the leasehold onerous in some way for the landlord or current tenant. The reverse premium acts as an incentive for the purchaser to take on the leasehold liability.

The letting of commercial properties can often involve reverse premiums. Common situations can include a developer wanting a newly-built office block to be fully let at the time they come to sell it to an investment company, or the developer of a shopping centre or entertainment complex wanting to secure an ‘anchor tenant’ (a particularly well-known brand, for example) so that other tenants will be interested in taking up leases.

The VAT and stamp duty land tax applicable to reverse premiums is complex and it is wise to obtain professional advice as each case is usually considered on its individual facts. What must be considered is whether the receipt of the reverse premium is chargeable as a trade receipt by a tenant who is granted the lease for trade, professional or vocational purposes.

If the reverse premium has been paid to enhance the value of the landlord’s interest in the property, then it will normally be deductible as being incurred expenditure. The landlord’s interest is enhanced because the rental income payable under the lease is secured.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Assignment.

- Difference between assignment and novation.

- Insurance for building design and construction.

- Landlord.

- Leasehold.

- Legal and equitable assignment.

- Practical considerations of collateral warranties.

- Property development finance.

- Recovery of third party losses.

- Rental method of rating valuation.

- Tenant.

Featured articles and news

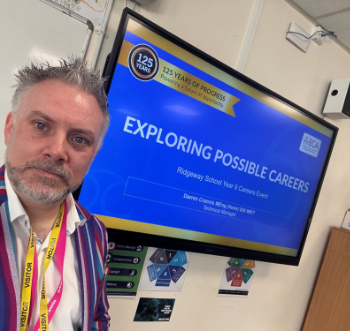

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this.