COVID-19 and the global heat pump market

|

Contents |

[edit] Introduction

BSRIA released its annual Heat Pump Study in March 2020, just when the first measures to limit the spread of the COVID-19 virus were taken in Asia. At the time of the publication, the extent of the pandemic was far from clear; even less so was the impact it would have on the market in the short and medium terms. In order to assess the impact of COVID-19 on the heat pump sector, BSRIA Worldwide Market Intelligence carried out the research in Europe, China and the U.S.

[edit] Impact of COVID-19 in China

Sales of heat pumps started declining in March 2020 as the lockdown was first implemented by the government in China. A substantial part of Chinese workers left their work and were then unable to return due to the quarantine.

As a result, several manufacturing companies could not resume work, new construction projects were at a standstill and installers were restricted to access sites. While restrictions and the quarantine extended to neighbouring countries, delays in the supply of air conditioners and heat pumps piled up during March-April 2020.

As of November 2020, the COVID-19 pandemic continued to have an impact on the industry. Demand is expected to recover as early as 2021, as construction activity bounces back.

[edit] Impact of COVID-19 in the EU

Looking at the impact of COVID-19 on the European heat pump industry, suppliers reported similar issues faced by the local building sector: most construction projects that had already started continued at a slower pace; however, some others were cancelled. Production lines at some HVAC manufacturers had to be put on hold for several weeks, and installers saw their new installation projects limited by sanitary guidelines.

Meanwhile, the measures put in place to pull the market towards more energy efficient buildings and products proved to be successful. A meaningful number of private households and project owners embraced their new ways of living to undertake renovation works.

In addition, installers took advantage of opportunities to upskill and promote the benefits of heat pumps. This, along with the financial support allocated to replace old heating systems helped reverse the dip in sales in the new-build sector. Overall, sales of heat pumps in France, Germany, Italy, the Netherlands and the UK remained on an upward trend.

[edit] Overall projections

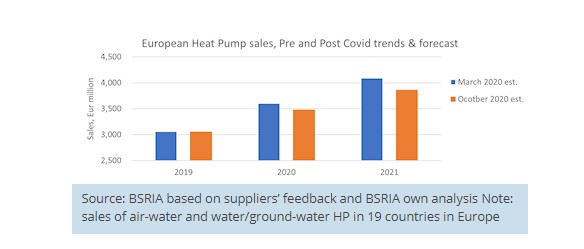

Feedback from European suppliers indicate that the market started to recover over the third quarter with sales to existing homes offsetting the drop in new projects. Provisional forecast until the end of 2020 point towards a positive result in the main European markets. The package of financial incentives voted under the EU Recovery Fund are foreseen to keep the demand growing, particularly in the replacement sector.

BSRIA expects 2020 to mark another year of strong progression in sales. Double-digit growth rates are likely to be posted in most major European countries.

During a second COVID-19 wave across Europe and elsewhere, the uncertainty surrounding the duration and severity of this crisis make it hard to anticipate how a recovery could unfold for the new construction industry in the medium term. The number of new building permits declined during the second half of 2020, which will undoubtedly have negative effects through 2021 and beyond. Nevertheless, BSRIA remains optimistic on the development of the market in the coming years.

The announcement made by EU Commission’s President Ursula von der Leyen to reduce CO2 emissions more drastically by 2050 is a clear signal in favour of renewable energies. The Renovation Wave Strategy and a “New European Bauhaus” launched in the EU in October 2020 provide a further boost for low emissions buildings and, indirectly, for heat pumps

Thanks to the financial support available to homeowners, BSRIA expects a strong surge in sales to the renovation sector. People and businesses are getting used to the “New Normal”, with comfort and energy savings becoming topics of strong focus. Finally, it is expected that environmental awareness will be another driving force to the heat pump market.

This article originally appeared on the BSRIA website under the headline, 'COVID-19 Update: Heat Pump markets expected to recover in the short term.' It was published in November 2020.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.