Real estate investment types and potential profitability

Contents |

[edit]

[edit] What type of real estate is the most profitable investment?

Investing in real estate is a trend that has been hot over the past few decades. Rightfully so, as it is one of the most efficient ways to build wealth and provide you with a steady income. Now more than ever, people are educating themselves about how to invest in real estate appropriately and what type of investments will give them the edge. When it comes to making such a decision, challenges arise.

It is not often easy to say which type of real estate investments are the most profitable because many factors impact the situation. The location, the rental demand, and the property type are just a few of these factors that might make or break an investment plan.

However, there is common knowledge of different kinds of real estate investments that might help you decide the best fit for you. We’ll list them from most profitable to least profitable based on the general statistics. However, remember that the order is not a one-size-fits-all type of thing; each individual should evaluate which type will work best for them.

[edit] Real estate investment type by indicative profitability

[edit] Commercial real estate

Commercial real estate properties are, without a doubt, the most lucrative way to ensure a steady income flow. They offer higher cash potential and lower vacancy rates when compared to the other types of real estate investments. Commercial real estate properties include office spaces, retail stores, industrial properties, multi-family buildings, and hospitality projects.

These rental properties require significant investment in advance and a good understanding of commercial tenant management and local zoning regulations. When investing in commercial real estate, you will be renting to a business instead of an individual, which means the process is expected to be much more straightforward and seamless. Companies make sure their reputation stays good, and thus, the chances for proper property management are increased. In addition, businesses that rent out commercial space pay their rent regularly because they want to keep their distance, which enables a steady income flow.

[edit] High-tenant properties

Next in line are the properties that accommodate a high number of tenants or high-tenant properties. Such properties are RV parks, self-storage facilities, apartment complexes, and office spaces. The fact that multiple tenants who occupy the premises need to pay guarantees significant returns on investment. The more tenants there are - the more influential the income becomes. Plus, the higher demand for the property is, the less concern you will have to find tenants with little notice.

However, you must be prepared to deal with different personalities since the more tenants, the more diverse characters you will have to do business with. One thing to make the whole process smooth is to have an apparent agreement signed by both parties, yours and the tenants.

[edit] Triple net lease properties

Triple net lease properties are properties are usually single-tenant spaces, with a higher likelihood of tenants signing long-term leases. Also, they are a good investment plan for investors with little to no experience. This is because tenants usually take responsibility for paying real estate taxes, maintaining maintenance, and taking care of insurance alone. This makes it easier for the investor to collect the money on payday.

[edit] Residential rental properties

Residential rental properties properties include single-family, multi-family, vacation, and duplexes. Tenants pay monthly rent so that you will generate a consistent money flow. This type is a real money-maker, but you must be ready to handle the possible challenges; first, residential rental properties require regular maintenance, and late rent payments or vacancies might complicate the steady flow of money.

In such cases, you need a plan to address momentary financial setbacks to overcome such struggles. In the worst case - if you cannot keep your head above the water in such financially struggling items, you can always sell the rental property and profit from the sale.

[edit] Real Estate Investment Trusts (REITs)

Real estate investment trusts (REITs) are companies that own different commercial real estate types, including shops, hotels, offices, restaurants, and malls. The investment in this type is through the stock exchange. A great thing about this investment plan is that while you invest in the property these businesses own, you aren’t exposed to the risk of owning the property.

There is a requirement, though, that you must return 90% of their taxable income to shareholders per year. The publicly traded REITs are the most lucrative ones because they provide flexible liquidity compared to other real estate investments. What does this mean? You sell your company shares on the stock exchange if you need emergency funds. Or you can simply buy to leave.

[edit] A few final words

Real estate investment gives you profitable opportunities to make more money. However, choosing the right type can be challenging. To help you choose the most lucrative type, we listed the real estate investment properties from most profitable to least. So, commercial properties provide the highest income potential, while properties with multiple tenants offer steady returns; triple-net lease properties give you stability, especially for inexperienced investors, while residential rentals provide consistent income with added management responsibilities. Real estate investment trusts offer dividends. The best thing to do when choosing the right type for you is to consider your goals and risk tolerance when selecting the best option.

[edit] Related articles on Designing Buildings

- Business plan.

- Buyer-funded development.

- Cash flow.

- Corporate finance.

- Developer.

- Development appraisal.

- Internal rate of return.

- Investment.

- Investment decision maker.

- Investment property.

- Investment Property Databank (IPD).

- Land value.

- Mixed use property investment.

- Off-plan property.

- Premises.

- Profitability.

- Real estate investment trust REIT.

- Speculative construction.

- Stakeholders.

- Types of development.

- Yield.

[edit] External links

https://financesonline.com/real-estate-statistics/

https://investproinc.com/reducing-vacancy-rates-strategies-for-miami-property-owners/

https://theearnesthomes.com/blog/how-to-invest-in-high-end-properties-as-an-out-of-state-investor/

Featured articles and news

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

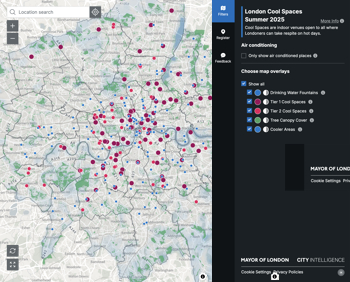

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.