Furnished holiday lettings and tax

The UK has very favourable Inheritance Tax (IHT) treatment for the owners of business assets used in a trade and, in general, the value of these will be outside the charge to IHT on death provided certain criteria are met.

The IHT relief available on business assets is called Business Property Relief (BPR), or Agricultural Property Relief in the case of agricultural assets. It is only available for assets used in a trade, not those used to generate investment income, such as the letting of land.

There is a clear grey area, however, when it comes to the provision of furnished holiday lettings (FHLs), as these are subject to a special tax regime. For capital gains tax purposes they qualify for Entrepreneurs’ Relief, Business Asset Rollover Relief and other reliefs. For income tax purposes, capital allowances can be claimed and the earnings qualify as earnings against which pension payments can be treated as a tax deduction.

HM Revenue and Customs (HMRC) have an advice page on FHLs here. Interestingly, this talks little about the level of services that must be provided for lettings to qualify as FHLs;even though the level of services provided is the criterion that HMRC use to claim that lettings of property do not qualify for the reliefs available for FHLs.

In the case of Re. the Estate of Marjorie Ross [2017], HMRC contested a claim that a property worth more than £1 million was an FHL that was eligible for BPR and thus excluded from the estate of a deceased woman partner in the business for IHT purposes. The property concerned consisted of a number of self-catering cottages, the rental terms of which included several features and services which are not frequently found in mere lettings.

HMRC contended that the business was primarily one of the letting of land and that it should not be;treated as anything other than a business investing in land with ancillary services;the essence of the activity remains the exploitation of land in return for rent. HMRC made a point of commenting on the business profits, which had been low for many years, compared with the capital gain, which was in the order of £1 million.

The First-tier Tribunal did not accept that the provision of the additional services, which were supplied directly by the partnership or by an adjacent hotel, made the properties FHLs.

The case is important reading for those considering going into the FHL business or those engaged in holiday letting. There is no doubt that HMRC are upping their efforts to increase the tax yields from IHT.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Encouraging individuals to take action saving water at home, work, and in their communities.

Takes a community to support mental health and wellbeing

The why of becoming a Mental Health Instructor explained.

Mental health awareness week 13-18 May

The theme is communities, they can provide a sense of belonging, safety, support in hard times, and a sense purpose.

Mental health support on the rise but workers still struggling

CIOB Understanding Mental Health in the Built Environment 2025 shows.

Design and construction material libraries

Material, sample, product or detail libraries a key component of any architectural design practice.

Construction Products Reform Green Paper and Consultation

Still time to respond as consultation closes on 21 May 2025.

Resilient façade systems for smog reduction in Shanghai

A technical approach using computer simulation and analysis of solar radiation, wind patterns, and ventilation.

Digital technology, transformation and cybersecurity

Supporting SMEs through Digitalisation in Construction.

Villa Wolf in Gubin, history and reconstruction. Book review.

[[w/index.php?title=W/index.php%3Ftitle%3DW/index.php%3Ftitle%3DW/index.php%3Ftitle%3DW/index.php%3Ftitle%3DW/index.php%3Ftitle%3DConstruction_contract_awards_down_1bn%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1%26action%3Dedit%26redlink%3D1&action=edit&redlink=1|Construction contract awards down £1bn]]

Decline over the past two months compared to the same period last year, follows the positive start to the year.

Editor's broadbrush view on forms of electrical heating in context.

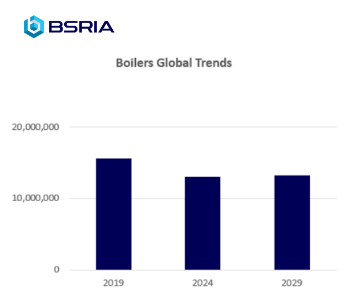

The pace of heating change; BSRIA market intelligence

Electric Dreams, Boiler Realities.

New President of ECA announced

Ruth Devine MBE becomes the 112th President of the Electrical Contractors Association.

New CIAT Professional Standards Competency Framework

Supercedes the 2019 Professional Standards Framework from 1 May 2025.

Difficult Sites: Architecture Against the Odds

Free exhibition at the RIBA Architecture Gallery until 31 May.

PPN 021: Payment Spot Checks in Public Sub-Contracts

Published following consultation and influence from ECA.

Designing Buildings reaches 20,000 articles

We take a look back at some of the stranger contributions.

Lessons learned from other industries.