Joint industry statements on cladding issues

[edit] Background

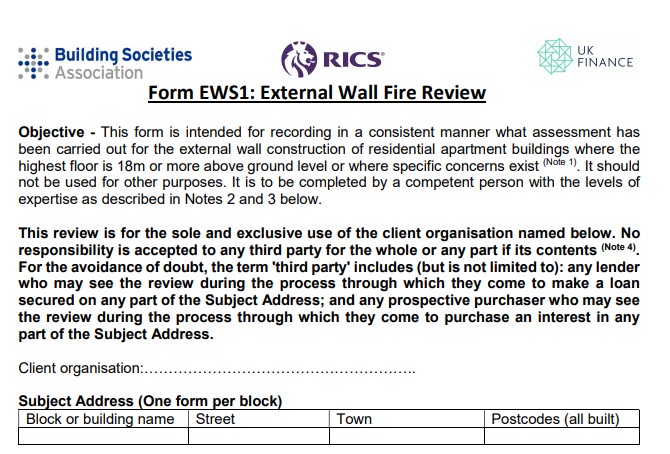

On 23 February 2022 a new industry-wide process was agreed for valuation of high-rise buildings, in effect leading to the first Joint industry statement on cladding in March. RICS led the cross-industry working group to establish a standardised process for the valuation and reporting of high-rise residential buildings over 18m with external walls or balconies containing potentially combustible materials, addressing difficulties in mortgage approval, valuation, and insurance. Endorsed by RICS, UK Finance, the Building Societies Association, IRPM, and ARMA, and supported by MHCLG, the new External Wall Fire Review method required a single fire safety assessment by a qualified professional, valid for five years, providing assurance to lenders, valuers, residents, buyers, and sellers, and ensuring consistency and transparency across the market.

On 31 March 2022 mortgage lenders issued an Industry Statement committing to provide customers with access to a range of mortgage products when purchasing or re-mortgaging flats affected by cladding. The statement was supported by Barclays Bank, HSBC, Lloyds Banking Group, Nationwide Building Society, NatWest, Santander, with RICS, UK Finance and the BSA also endorsing the statement and UK Finance and the Building Societies Association working on a second phase, to expand the agreement to include more lenders.

On 15 July 2022 the Industry Statement was updated stating:

"The lending and valuation industries welcome the work the government has undertaken to ensure that leaseholders in properties impacted by cladding and building safety issues will be protected from the costs of remediation. The introduction of the developer self-remediation scheme, government’s plans to re-open the Building Safety Fund and a new remediation scheme for buildings between 11-18 metres will help to remove the financial risk to leaseholders in blocks of flats 11 metres and above. We also recognise that the costs for remediating non-cladding defects is capped in law for qualifying leaseholders."

"We welcome the government’s agreement to make available, as permitted, details of the buildings included in these schemes for use by sectors and key participants in the home purchase process, ensuring transparency for all. Alongside this, providing the mortgage application meets individual lenders’ policy and regulatory requirements, lenders will lend on buildings that will be self-remediated by developers or captured under a recognised government scheme or there is evidence of a qualifying lease certificate."

"Anyone purchasing a flat that is eligible for remediation under one of the above schemes is advised to talk to their estate agent and conveyancer in the first instance. RICS agrees that the Building Safety Act has played a critical role in unlocking the lending market regarding properties with cladding and this will create a vehicle to allow valuations on all blocks of flats as identified above."

"A transparent approach to valuing properties with building safety defects is instrumental in underpinning confidence of lenders and purchasers. RICS will continue to safeguard housing market stability for buildings 11 metres and above, and support valuers to take a consistent valuation approach, to help facilitate lending. This will be reflected in forthcoming RICS guidance which ensures valuers take a consistent approach to advising their lender clients."

The statement was supported by Barclays Bank, HSBC, Lloyds Banking Group, Nationwide Building Society, NatWest, Santander with RICS, the Building Societies Association and UK Finance also support the statement. The remediation schemes recognised by the bodies at the time were:

- The Developer Remediation Contracts (11 metres+)

- The Medium Rise Scheme (11-18 metres)

- The Building Safety Fund (18 metres+)

As of April 2025, the Industry Statement on cladding has been updated to cover the reliance on EWS1 forms that would now be more than 5 years old and those signed by invalid signatories in the mortgage process. As the EWS1 form was originally developed in 2019, they were nominally given a 5-year life as it was anticipated that buildings with defective cladding would have been remediated within this timeframe. Because, by 2025 some early forms were approaching their five-year anniversary there is a need to ensure the market for flats in affected blocks continues to operate without friction. To ensure this happens, the lender signatories to this statement further pledge not to require wholesale reviews of EWS1 forms which are more than 5 years old. (see also RICS clarifies future for EWS1 forms)

This means that, subject to individual lender policy and risk appetite, where the EWS1 form is required by a lender, they can continue to be used in the mortgage application journey past their original 5-year life. Lenders may also consider alternative evidence about a building’s remediation status and leases qualifying for statutory protection from cladding remediation costs. Some lenders may, however, not require an EWS1 and ask instead for other evidence, such as the statutory Fire Risk Assessment of the External Wall (FRAEW), where available.

Where there is an invalid signatory of EWS1 forms, the lender signatories to this statement further pledge not to require wholesale reviews of affected EWS1 forms. This is subject to individual lender policy and risk appetite. Lenders may consider alternative evidence about the remediation status of a building and whether the lease is a qualifying lease under the Building Safety Act 2022, in England. This alternative evidence could include:

- The inclusion of a building in a recognised remediation funding scheme

- The statutory Fire Risk Assessment of the External Wall (FRAEW), if available

- A valid Leaseholder Deed of Certificate

- Other evidence which might support reliance on the original EWS1 form, if available.

Where the building is below 11 metres, individual lender policy and requirements will continue to apply.

- The signatory must, at the time of completion of the EWS1, have met the EWS1 professional body and competence criteria

[edit] Related articles on Designing Buildings

- BS 8414 Fire performance of external cladding systems.

- Chartered surveyor.

- Cladding for buildings.

- EWS1 forms not required for buildings without cladding.

- External Fire Review Form EWS1.

- Fire risk assessments and historic buildings.

- Fire risk in high-rise and super high-rise buildings DG 533.

- Fire Safety Bill.

- Fire safety exclusions - the insurance position.

- High-rise building.

- High rise residential building.

- Medium-rise building.

- Royal Institution of Chartered Surveyors RICS.

- Site surveys.

- The Regulatory Reform (Fire Safety) Order 2005.

[edit] External links

https://www.ukfinance.org.uk/policy-and-guidance/guidance/joint-statement-cladding

https://ww3.rics.org/uk/en/journals/built-environment-journal/ews1-fire-safety-forms-future.html

Quick links

[edit] Legislation and standards

Fire Safety (England) Regulations 2022

Regulatory Reform (Fire Safety) Order 2005

Secondary legislation linked to the Building Safety Act

Building safety in Northern Ireland

[edit] Dutyholders and competencies

BSI Built Environment Competence Standards

Competence standards (PAS 8671, 8672, 8673)

Industry Competence Steering Group

[edit] Regulators

National Regulator of Construction Products

[edit] Fire safety

Independent Grenfell Tower Inquiry

[edit] Other pages

Building Safety Wiki is brought to you courtesy of: