European connected and smart home market

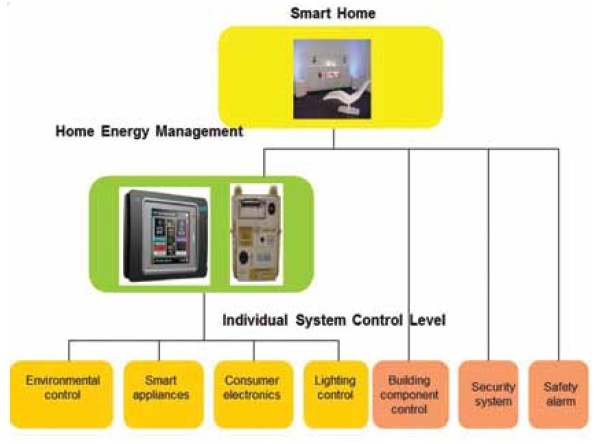

Before delving too deeply into information about market sizes and country-specific data, we need to be clear about what we mean by a smart home. There are myriad definitions for smart homes and connected homes in the industry, with companies’ own definitions of such systems often differing widely from their competitors. BSRIA (Building Services Research and Information Association) defines smart homes as ‘…a building control system, which provides integrated, centralised control of two or more individual systems’.

Effectively this is the residential extension of commercial type controls. These individual systems can be any of the following:

- Environmental control system (heating ventilation and air conditioning - HVAC).

- Household appliances (clothes dryers, washing machines, refrigerators, freezers, dishwashers, ovens, coffee-makers, microwaves, etc.)

- Consumer electronics (TV, radio, audio-video equipment, game consoles, etc.)

- Building components (blinds, curtains, windows, doors, etc.).

Devices may be connected through a wired or wireless network to allow control via a personal computer, and may allow remote access via the internet (using a PC, smartphone or tablet). If the Smart Home system is accessible remotely via the internet, BSRIA refers to it as a Connected Home.

Home Energy Management Systems (HEMS) are increasingly part of the Connected and Smart Home offering. HEMS provide updated energy and budgeting information to help optimise home energy use. They may provide an easy-to-use application that allows a utility to schedule demand to avoid peak periods, and can integrate all components in the home (including electric vehicles, energy storage, and micro generation).

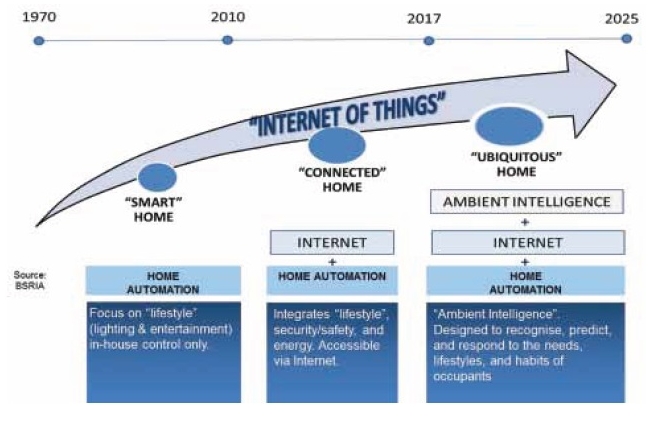

Figure 2: Evolution of Connected and Smart Homes.

While early Smart Home systems tended to be stand-alone solutions, focusing on ‘lifestyle’ needs such as lighting and entertainment (Figure 2), current versions generally encompass energy management and are accessible via the internet. Within a decade as we move towards the ‘internet of things’, we expect to see the emergence of the ‘ubiquitous home’, where sophisticated ‘ambient intelligent’ systems learn about users’ behaviour and lifestyles, and enable the house to predict and respond to all the occupants’ needs and activities. Internet connectivity and the arrival of standard, multifunctional elements present an opportunity that is being seized by telecoms and utility companies which are now offering a range of ‘connected home’ solutions.

In 2013, BSRIA published a study on Europe Smart Homes Market 2013 and UK Smart Homes market 2013 covering; Germany, France, UK, Netherlands, Belgium, Norway, Rest of Europe and North America (US and Canada).

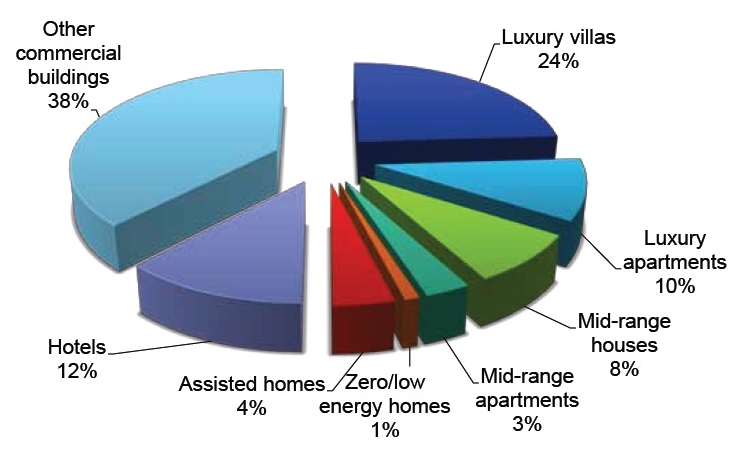

Figure 3: Europe - Smart Homes Sales by End-Use Segment 2012.

According to these studies, the European connected and smart home product market grew by almost 19% in the period 2010-2012 to reach just over €0.5 billion (at manufacturer selling price - msp) and is predicted to grow by 8% on average each year until 2015 to reach €0.6 billion (msp). The current connected and smart home market still remains a niche high-end market in Europe, although penetration in light commercial applications (offices, hotels, restaurants) has been growing, from 34% in 2010 to 50% in 2012 (Figure 3.).

Sales of connected and smart home systems for residential applications, are still concentrated in the high-end housing segment.

Residential consumer awareness has been increasing across Europe, not least due to the growing popularity of smart phones/tablets and their role as possible user interfaces (via apps) in smart home solutions. Nevertheless, in these times of austerity in Europe the high cost of a smart home solution prevents these systems from reaching the mass market. In the meantime BSRIA sees an uptake of more standardised mid-market ‘plug-and-play’ connected home solutions, which can be installed by electrical contractors.

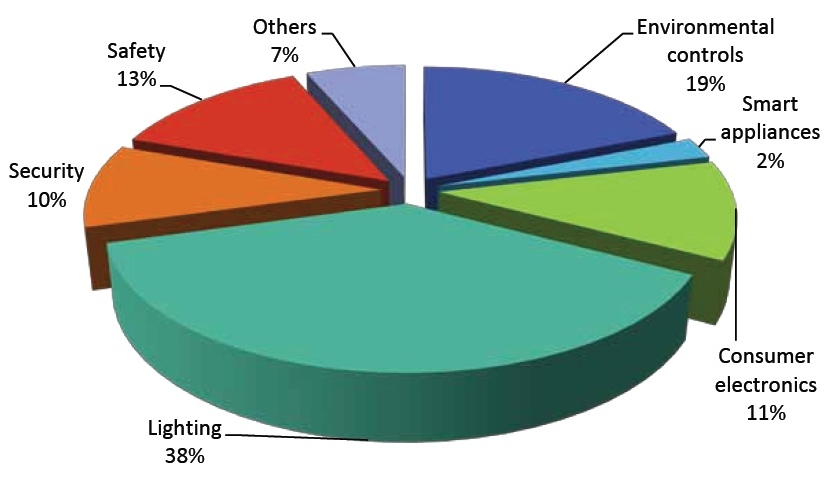

Figure 4: Europe - Smart Homes Sales by Application 2012.

Lighting controls are the main application (Figure 4.) for these systems, with environmental controls second largest, as customers have been increasingly worried about their energy bills and the need to reduce consumption of energy. Homes offering assisted living are an important market in the Netherlands with financial support from the Government.

So far most of the smart home suppliers have tended to be highly regionalised, competing either in Europe or in North America. Only a few players are significant in both markets. However Honda USA’s much publicised announcement of its ‘Smart Home USA’ in April 2013 and Google’s acquisition of Nest in January 2014 could herald the arrival of other types of global players in this market.

This article originally appeared in the May 2014 edition of BSRIA’s Delta T magazine. It was written by Zoltan Karpathy, Senior Manager intelligent Buildings and Homes BSRIA Worldwide Market Intelligence. It has been posted here by --BSRIA 08:51, 10 December 2014 (UTC)

[edit] Related articles on Designing Buildings Wiki

- Big data.

- Internet of things.

- PAS 180:2014 Smart cities – Vocabulary.

- PAS 181:2014 Smart city Framework.

- PAS 182 Smart city data concept model.

- Smart buildings.

- Smart cities design timeframe.

- Smart cities.

- Smart city.

- Smart connected HVAC market.

- Smart home.

- Smart home and light commercial market in 2017.

- Smart homes in Germany.

- Smart materials market.

- Smart meter.

- Smart meter owners report higher, not lower, bills.

- Smart technology.

- The smart buildings market.

- What are the benefits of smart homes for Millennial end-users?

Featured articles and news

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.