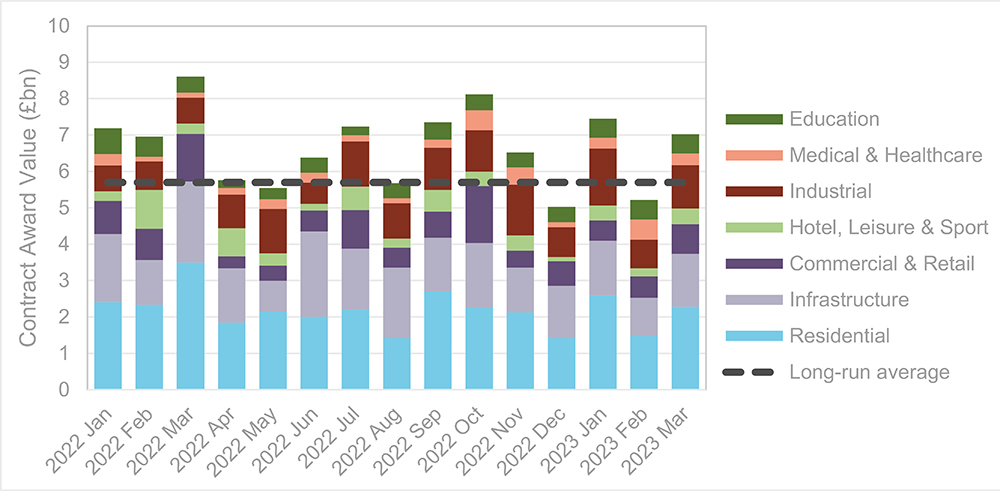

2023 Quarter 1 ends on a high with 7bn in construction contracts awarded in March

Contents |

[edit] Snap Analysis

A late rebound in contract awards and a boost in planning approvals have rounded off a difficult first quarter for the construction industry.

- Latest analysis from Barbour ABI shows all sectors performing at or above long-term average

- Education at highest level for 12 months and industrial still strong, but commercial continues to struggle

- As well as contract awards, £11.3bn in new projects received planning approval

In a time of continued volatility in the sector, the latest monthly figures from construction intelligence provider Barbour ABI show that there is still work to be had.

“At the end of Q1 it’s broadly good news with new activity being brought forward in the face of uncertainty and ongoing constraints,” explained Tom Hall, chief economist at Barbour ABI. “And, while activity is very volatile at the moment the smoothed trend shows that the pipeline is looking solid going forward too, albeit at slightly lower levels compared to the recent past.”

[edit] Varied performance

However, performance varies across sectors. While the majority are at or above their average year-on-year levels, both the residential and commercial sectors are continuing to struggle. Compared with the end of last year, the commercial sector is down by nearly a third when it comes to contract awards and new planning applications for residential are weak.

Tom added: “Residential has finished the quarter with a solid performance after two weak months. However, it is a sector that is expected to struggle this year. We’re seeing the lowest level of new planning applications since May 2020, when the country was in the first Covid-related lockdown.

“This is common in the face of wider economic uncertainty but is going to cause issues when it comes to supply in the market and the wider trend around property values and pricing. It could be a rocky period as the sector finds a new level of consistency.”

The data was published as part of Barbour ABI’s monthly Snap Analysis Report which reviews activity in the residential, infrastructure, commercial, hotel and leisure, industrial, healthcare and education sectors.

[edit] Contract awards

- Overall: Contract awards are back up to £7bn in March and all sectors have had a reasonable month – new work is clearly continuing in face of uncertainties. While month-on-month performance is volatile, the trend is relatively stable with slightly lower activity than 2022.

- Residential: The residential sector is back to trend with £2.3bn – a solid performance for a sector expected to struggle in 2023. March and Q1 are broadly consistent with 2022 levels, with no sign of a downturn yet.

- Infrastructure: Back up after poor March with £1.5bn in new awards.

- Commercial: The commercial sector returns to trend with £800m in March, but Q1 has fallen by 28% compared to Q4.

- Hotel and Leisure: Sector doubled in March and activity remains consistent at lower-than-average levels.

- Industrial: Industrial sector back up to high levels with £1.2bn due to a further glut of warehouses and distribution hubs.

- Healthcare: Sector falls by 42% after record Feb but remains high with £300m – Q1 continuing strong activity with £400m per month.

- Education: £500m in March continues recent higher activity and puts Q1 at its best performance for over a year.

[edit] Planning approvals

- Overall: Approvals have a strong month in March with £11.3bn, the strongest monthly result since Apr 2022. However, this comes on the back of two weak months. It has been driven by a 64% increase in residential and 144% increase in commercial. March’s strong result saves Q1, with £8.6bn compared with £8.8bn over 2022.

- Residential: Residential sector reaches £4.9bn in March, the highest monthly value since July 2021, 88 on the Relative Strength Index. March’s strong result sees Q1 at average levels after Jan & Feb weakness.

- Infrastructure: Infrastructure sector £1.6bn, a 36% fall which takes it back to average levels. Q1 has been more subdued with £1.6bn per month compared with £2.3bn over 2022.

- Commercial: Commercial sector £1.1bn up 144% - the highest level in a year. However not spectacular compared to LR avg. Q1 has seen a small improvement compared with 2022 thanks to March’s above-average number.

- Hotel and Leisure: HLS sector £800m up 54% month-on-month and nearly at average levels over Q1.

- Industrial: Industrial sector back up to higher levels in Mar w £1.2bn. Not enough to save slower result in Q1 with £900m compared to 2022’s £1.3bn average per month.

- Healthcare: £1.3bn – a record level thanks to £800m for Jersey Hospital redevelopment and £200m for Velindre Cancer Centre in Wales.

- Education: Sector has a decent March with £400m, consistent with Q1’s slightly elevated level compared to last year.

[edit] Planning applications

- Overall: Applications fall to lowest level since January 2021 with £7.7bn in Feb. Falls across the board save industrial and education.

- Residential: The residential sector, already weak, saw a further 12% fall in Feb to £3.3bn. Just 12 on the Relative Strength Index – the lowest monthly level since May 2020, when country was in 1st Covid lockdown.

- Infrastructure: Infrastructure has been holding up overall applications activity over last year – 28% fall in Feb was the single largest downward contributor to Feb’s poor result. This was thanks to a single £500m solar farm & battery storage project. One positive is that the sector remains above average levels.

- Commercial: Commercial sector fell by 24% to £500m. It is at the lower end of recent activity levels, 32 on the Relative Strength Index is not an outlier.

- Hotel and Leisure: £300m for HLS in Feb – consistent, and only slightly weaker compared to past activity.

- Industrial: Industrial sector increased by 42% month-on-month back to high levels now expected. £1bn not out of line but slightly below 2022’s £1.3bn monthly average.

- Healthcare: Sector falls by a massive 83% month-on-month to £100m. Activity is very peaky at the minute due to reliance on major projects.

- Education: Sector stable at weak levels with £300m, 25% increase month-on-month but only back to previous (lowish) levels.

[edit] About Tom Hall

Tom is Chief Economist at Barbour ABI and AMA Research, providing analysis and economic insight for construction and its related sectors, assessing the trends and developments that impact the industry. Tom has over a decade of experience in a variety of strategic and economic roles within the water and utilities sector and joined the team in early 2019. Offering bespoke research and tailored analysis to our clients, Tom also speaks at industry events and works closely with journalists and other industry bodies to provide commentary on the built environment.

This article was supplied via Press Release as "Q1 ends on a high with £7bn in contracts awarded in March" including sector analysis notes to editors from Barbour ABI via Liz Male dated April 19, 2023.

[edit] Related articles on Designing Buildings

- 2023 Spring Budget summary and industry response.

- A second spring budget of 2023.

- Chancellor's 2022 Autumn statement industry response.

- Construction organisations and strategy.

- Corporate finance.

- Economic development and construction.

- Funding options for building developments.

- How does the state of the economy influence the construction industry?

- Investment.

- Microeconomics.

- Modular buildings.

- Prefabrication.

- Property development finance.

- Working capital.

Featured articles and news

What it is and how to use it.

Investors in People: CIOB achieves gold

Reflecting a commitment to employees and members.

Scratching beneath the surface; a guide to selection.

ECA 2024 Apprentice of the Year Award

Entries open for submission until May 31.

UK gov apprenticeship funding from April 2024

Brief summary the policy paper updated in March.

For the World Autism Awareness Month of April.

70+ experts appointed to public sector fire safety framework

The Fire Safety (FS2) Framework from LHC Procurement.

Project and programme management codes of practice

CIOB publications for built environment professionals.

The ECA Industry Awards 2024 now open !

Recognising the best in the electrotechnical industry.

Sustainable development concepts decade by decade.

The regenerative structural engineer

A call for design that will repair the natural world.

Buildings that mimic the restorative aspects found in nature.

CIAT publishes Principal Designer Competency Framework

For those considering applying for registration as a PD.

BSRIA Building Reg's guidance: The second staircase

An overview focusing on aspects which most affect the building services industry.

Design codes and pattern books

Harmonious proportions and golden sections.

Introducing or next Guest Editor Arun Baybars

Practising architect and design panel review member.

Comments

[edit] To make a comment about this article, click 'Add a comment' above. Separate your comments from any existing comments by inserting a horizontal line.