Partnering and joint ventures for construction

Partnering is a way of sharing risk and reward. This often involves the concept of ground rents in recognition of a landowner’s contribution to the final development value.

Contents |

[edit] Local authorities

Local authorities, often the site owner, can enter into partnership arrangements in an effort to regenerate areas or encourage development of difficult sites. Such arrangements give more control to an authority than can be exercised through the planning system. Successfully implemented, such joint ventures can produce unfettered revenue streams that can be used by the authorities for whatever projects they are promoting.

A developer partner will provide skill sets that local authorities are unlikely to hold such as expertise in funding, design, procurement and marketing. Conversely the local authority provides knowledge and contacts in relation to transport, employment, infrastructure and planning. Under compulsory purchase legislation the local authorities may also have the power to acquire any sites necessary to maximise the potential value of any given scheme.

From a developer’s viewpoint any such partnership is likely to speed up the process of assembling land for development and to simplify the planning process.

In order to remove letting risk from a project a local authority may enter into a sale and leaseback agreement with a funding organisation and developer guaranteeing rent and so giving certainty about revenues. This is attractive to funding institutions providing the capital for building the development. Generally the local authority is given a 25 year lease with provisions allowing them control over operational sub leases for letting space in a manner that meets its political and economic objectives.

[edit] Ground rents

Ground rents are usually generated when landowners wish to retain the freehold ownership of a site and retain a share in future financial growth of the developed site. Long leases of as much as 125 years are usually negotiated throughout which a landowner and its successors will be entitled an annual ground rent. Such arrangements allow the landowner a measure of control as to how the site is to be developed.

Ground rents can be calculated by taking the residual value of land as a percentage proportion of development costs (including finance and profit) and applying the percentage to a share of the annual revenue proceeds. In future rent reviews the percentage of the ground rent share remains the same. Thus a landlord shares any rental growth.

[edit] Equity partnerships

There are many ways of allocating the returns of a development among participants, reflecting levels of risk and reward. Overage agreements offer a land vendor on housing developments a share in any additional sales revenue beyond a base figure at a time when densities and planning outcomes are uncertain.

However, most equity partnerships are governed by slicing arrangements. Examples include:

- A four slice of income approach, which involves three equity partners:

- A first charge as ground rent (landlord).

- The second charge on development cost (funding institution and developer with the funding organisation having first call on development costs).

- The third charge on development profit (developer).

- The fourth charge as a three way split of any additional profit.

- A three slice of income approach might be employed when the funding institution is not an equity partner but is lending funds on a loan draw down agreement.

- The first charge as ground rent (landlord).

- The second charge on development costs including anticipated profit (developer).

- The third as a two way split on additional profit.

- A two way slice of income approach might be used when a local authority or landlord carries the major portion of development risk.

- The first charge on development costs and profit (landlord with incentive fee to developer project manager).

- The second charge two ways split incentive arrangement.

There are also numerous hybrid arrangements based on shared gain and pain formula making initial negotiations of deals paramount to the outcome for each participant in the development process.

[edit] Related articles on Designing Buildings Wiki

- Consortium.

- Funding options.

- Joint venture.

- Leaseback.

- Overage.

- Partnering.

- Partnering charter.

- PPC 2000.

- Procurement.

- Property development finance.

- Special purpose vehicles.

- Types of construction organisation.

[edit] External links

- Property Development Appraisal and finance, by David Isaac, John O’Leary and Mark Daley, published by Palgrave.

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

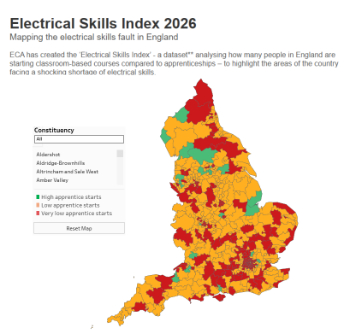

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.