Global challenges and opportunities in heating markets in 2020

|

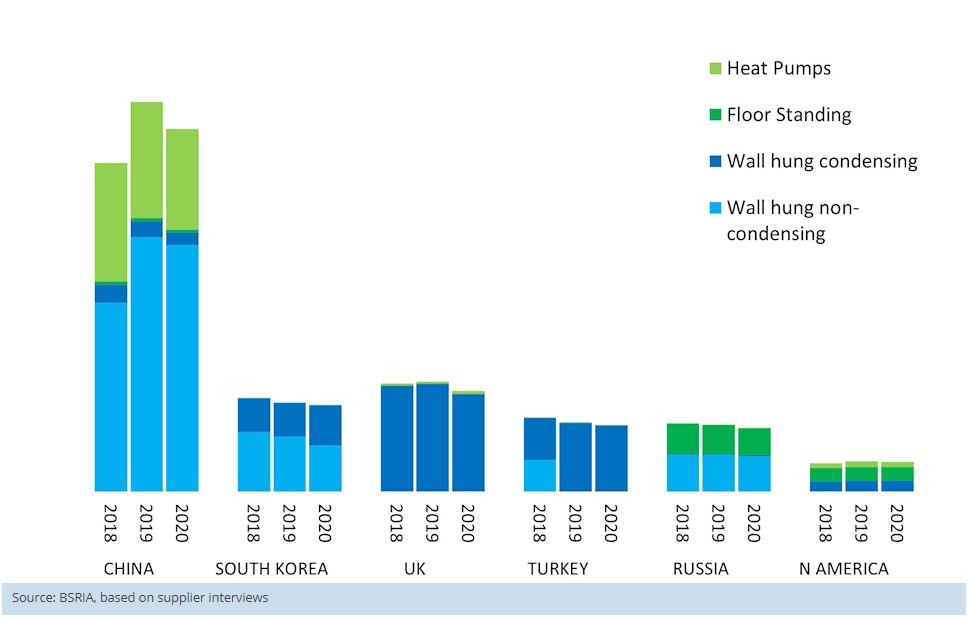

| Top six heating markets in 2020 |

Contents |

[edit] Introduction

When looking back at the domestic and commercial boiler market in 2020, we can see how the overall heating industry – worth some €40 billion – fell sharply due to the impact of the COVID-19 pandemic. Across the world we saw lockdowns which impacted on construction, and redundancies which diminished purchasing power. We saw heating manufacturers trying to conserve cash, wholesalers reducing their inventories, installers staying away from work and supply chains interrupted. The cost of components, transport and labour went up, but prices of boilers have generally stayed level.

[edit] Residential heating market

However, markets have been impacted in different ways. On the residential side, people spent more time at home and have increasingly been working from home; in many cases they spent less money and, sometimes aided by country incentives, invested more in their homes, which has benefited the domestic heating industry. However, growth and recovery in 2021-2022 varies significantly by country.

[edit] Chinese heating market

China, for example, is by far the largest heating market in the world but very volatile and challenging to forecast. China was the only major economy to grow in 2020 but ended up having its weakest GDP growth for nearly 30 years. The domestic boilers market was heavily affected in the first four months of 2020, but it was also the first market to recover and rather well.

There are huge differences between condensing and non-condensing boiler sales behaviours. They are all linked to the three very distinct aspects of the market (i.e. retail, new build, “coal-to-clean”) and in turn depend to varying degrees on government support, the policies that drive these markets and the building regulations – or lack of them, as is the case for national regulations to convert into condensing boilers, and of course the price of natural gas. China is a heavily policy-driven market.

[edit] Italian heating market

Italy is the largest manufacturing base for heating components in Europe. It is also one of the hardest to be hit by COVID-19 – which has caused a severe economic recession – as Italy was the first European country to impose strict lockdown measures, paralysing economic activity from March to June 2020.

The economy started to recover in subsequent months and is now driven by government spending programmes, alongside the EU recovery fund, but it may nevertheless still take longer to fully recover. Significantly, existing incentives were improved to make payments easier to access, more upfront, or earlier to pay.

[edit] North American heating market

The North America market is very different and has a unique heating market, with a huge furnace market linked to the domestic ducted air conditioning market. This has been a stable, steady, unspectacular boiler market for some years. However, with elections now out of the way there is a lot of discussion on the “Green New Deal” and other good intentions from the Biden administration.

Meanwhile, there are some quite radical state policies coming from California on the electrification of heating, and we see big manufacturers scrambling to see exactly how this will affect them. Certainly there is more scope for change.

In terms of recovery, it is doing well in areas like house finances, but there are question marks on unemployment and how it will impact the heating market, which is heavily reliant on replacement and the ability to afford a newer, more efficient boilers.

[edit] Challenges in the heating industry

Ultimately COVID-19 is only one of the challenges that the heating industry is facing, alongside the climate crisis and net zero targets, urbanisation, adoption of greener gas solutions, increasing demand for electricity, integration of HVAC solutions and sovietisation, to name a few, which create challenges and opportunities and will certainly cast a very different landscape by 2030.

BSRIA Worldwide Market Intelligence world domestic and commercial boilers reports offer comprehensive and detailed views of the latest market trends in each country, including the size, the competitive landscape, the drivers, five-year forecast and 2030 market vision, looking into each country’s legislation, building regulations, financial incentives and energy prices.

Contact BSRIA market intelligence specialists now for the latest insight on global, regional, and individual markets:

- BSRIA UK (Europe): wmi@bsria.co.uk, +44 (0) 1344 465 540

- BSRIA USA (Americas): sales@bsria.com, +1 312 753 6803

- BSRIA China (China): [email protected], +86 10 6465 7707

This article originally appeared on the BSRIA website. It was published in March 2021.

--BSRIA

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.