Drivers of change in global heating markets

|

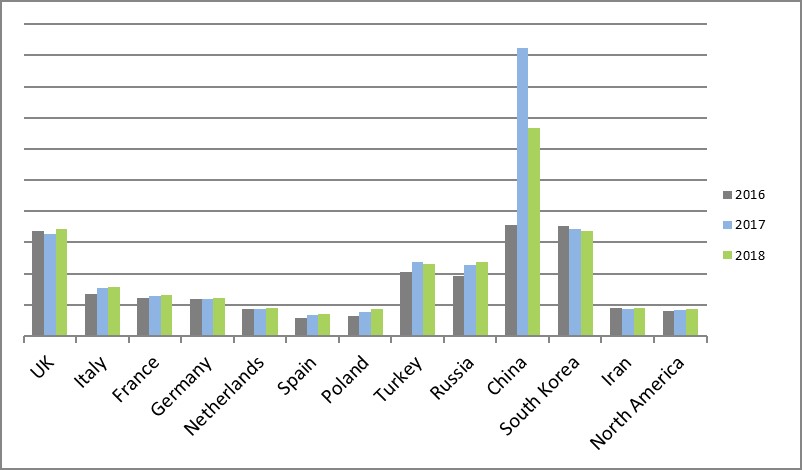

| World domestic boiler-sales dynamics, 2016 - 2018. BSRIA investigation of the countries’ market shares reveals a dynamic change of the competitive landscape as big players keep moving into emerging or faster growing markets. |

The Asia and Pacific region remains the largest heating market in the world, in volume terms, despite a decline in sales volume in 2018 by 8%. Wall-hung, non-condensing boilers dominate but heat pumps are increasingly important, reaching 40% of the heating market in that region. China, by far the largest heating market in the region, has seen mixed performance in 2018 with domestic boilers recording a significant fall in sales.

In Europe, ErP legislation has ensured that condensing boilers dominate the marketplace; Turkey has just introduced similar legislation making condensing technology mandatory. The trend away from floor-standing boilers towards wall-hung type continues and we saw a 6% swing in 2018, that is happening in both Western and Eastern Europe alike.

Europe has also recorded the dynamic growth of 13% in the hydronic heat-pump market, with France being a strong market leader in terms of the number of units sold and Germany, Ireland, Italy, Netherlands and UK being the most important markets in terms of growth recorded.Heating in North America continues to be dominated by furnaces, however wall-hung condensing boilers continue to make strong inroads to the residential market where they now account for 36%. Condensing technology is also progressing strongly with condensing residential and commercial boilers reaching the 57% share of the total boiler market.

The recently published BSRIA World Market Intelligence studies on heating monitor the global and regional heating markets and their dynamics in technology, sales volume and competitive environment. The reports explain heating practices of the countries, look at the impact of policies and technology innovations that aim to reduce CO2 emissions and respond to consumer expectations.

BSRIA reports include information on sales, with a high level of granularity in segmentation, on legislation, regulations and incentives, technology shifts, changes in energy prices and analysis of how all these factors affect each country’s market. Following its proven methodology, BSRIA also provides five years' forecast for market sales.

Globally, nearly all the biggest world markets have seen positive developments in both domestic boilers and heat pump sales. While heat pumps are mainly installed in new buildings, boilers are mostly sold for replacement. While legislation plays an important role for both type of products, energy efficiency, comfort and connectivity (that enables smartness) are becoming increasingly potent influencers too.

[edit] Key information

Global geographical coverage

Data in the reports supplied for 2017 and 2018, with forecasts to 2023.

Products coverage includes domestic and commercial applications

Based on primary and secondary research, face-to-face and telephone interviews

For more information on the availability and costs of BSRIA’s reports, contact the WMI sale department:

EMEA sales enquiries contact: BSRIA UK: bsria.co.uk wmi@bsria.co.uk or +44 (0) 1344 465 540

America sales enquiries contact: BSRIA USA: bsria.com sales@bsria.com or +1 312 753 6800

China sales enquiries contact: BSRIA China: [email protected] or +86 10 6465 7707

[edit] About this article

This article was written by Socrates Christidis, Research Manager – Heating & Renewables - BSRIA’s World Market Intelligence Division. It was previously published in July 2019 on the BSRIA website and can be accessed here.

Other articles by BSRIA on Designing Buildings Wiki can be accessed here.

[edit] Related articles on Designing Buildings Wiki

- BSRIA global heat pump market 2019.

- Building services engineer.

- Combustion plant.

- Cooling.

- Corrosion in heating and cooling systems.

- Fan coil unit.

- Global challenges and opportunities in heating markets in 2020.

- Heat meter.

- Heat metering.

- Heat pump.

- Heat recovery.

- Heat stress.

- Heat transfer.

- Heating large spaces.

- Hot water.

- HVAC.

- Low carbon heating and cooling.

- Radiant heating.

- Radiator.

- Thermal comfort.

--BSRIA

Featured articles and news

The Home Energy Model and its wrappers

From SAP to HEM, EPC for MEES and FHS assessment wrappers.

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.