Cash flow in construction

Contents |

[edit] Introduction

In general terms, 'cash flow' is the movement of income into and expenditure out of a business (or other entity) over time. If more money is coming into the business than is going out of it, cash flow is said to be 'positive'. If more money is going out, this is negative cash flow.

In construction, however, the term 'cash flow' typically refers to an analysis of when costs will be incurred and how much they will amount to during the life of a project.

Predicting cash flow is important in order to ensure that an appropriate level of funding is in place and that suitable draw-down facilities are available.

[edit] Client cash flow

Until the main contractor has been appointed, client cash flow projections are likely to be based only on agreed fee payment schedules for consultants and a simple division of the construction cost over the likely construction period (or perhaps an allocation of construction cost over an s-curve distribution). It is only when the main contractor is appointed, a master programme prepared and some form of payment schedule agreed that cash flow projections become reliable.

Cash flow projections may be affected by the need for the early purchase of long-lead time items or by items that the client may wish to purchase that are outside of the main contract (such as furniture or equipment).

[edit] Contractor cash flow

Contractors have to have money coming in to pay suppliers and subcontractors and for the day-to-day running of the business. For example, Carillion's cash flow was very low, leading to their liquidation in January 2018.

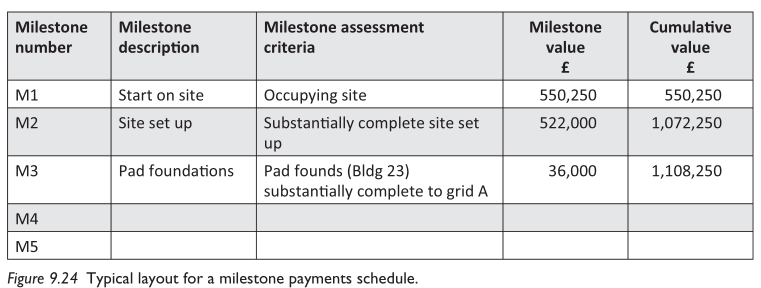

At the start of any contract, a payment scheme or table is drawn up and agreed with the client or their quantity surveyor, e.g.:

[Brook, M., 2016. Estimating and Tendering for Construction Work. 5th Edition. ed. Taylor & Francis.]

[edit] Supply chain cash flow

Cash flow is also an issue for the construction supply chain, and is a common reason for contractors and sub-contractors becoming insolvent. This can be catastrophic for a project in terms of time and money. It is in the client's interest therefore to ensure that the supply chain is paid promptly.

The government suggest that, 'Historically, it is has not been unusual for lower tier supply chain members to have to wait for up to 100 days to receive payment, which damages their cash flow and can harm their business.' (Ref. Cabinet Office, Project Bank Accounts – Briefing document.)

A number of measures can be adopted to improve payment and so cash flow in the supply chain, including:

In addition, there are a number of remedies for late payment.

[edit] Related articles on Designing Buildings

- Accruals.

- Balance sheet.

- Budget.

- Building society.

- Business administration.

- Cash flow forecast.

- Cash flow statement.

- Commodity.

- Construction supply chain payment charter.

- Credit crunch.

- Demand chain.

- Discounting.

- Discount rate.

- Discounted cash flow.

- Drawdown.

- Earned value.

- Fair payment practices.

- Financial hedging.

- Financial year.

- Microeconomics.

- Net Present Value.

- Payment schedule.

- Profit.

- Project bank accounts.

- Prompt payment.

- Prompt Payment Code boosted to help SMEs.

- Quote.

- Relevant cost.

- Remedies for late payment.

- Retention.

- Solvency.

- Time value of money.

- The Late Payment of Commercial Debts Regulations 2013.

- Trade credit insurance.

- Turnover.

- Whole life costs.

- Working capital.

Featured articles and news

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

Comments

Cash flow is the movement of income into and expenditure out of a business over time. If there is more money going out than in, this is negative cash flow.

Possible cash flow problems may be:

To minimise the risks of future cash flow problems, the firm could establish a financial system that includes: