Balance sheet

This article provides a brief introduction to balance sheets.

The balance sheet of any business, whether it is a company, a partnership or a sole trader, is simply a statement, or list, of assets and liabilities at a given date.

Typically assets will include such items as:

- Cash in the bank.

- Money owed to the business in the form of debtors.

- Stock.

- Tangible assets such as; computers, equipment and furniture.

Liabilities will include such items as:

- Net overdraft at the bank.

- Money owed to suppliers in the form of trade creditors.

- Loans to the business.

- Hire purchase contracts.

- Money owed to HMRC in the form of VAT or other taxes.

- Share capital and accumulated reserves (these are amounts invested or retained in the business by its owners).

And in addition to the obvious items above, accounting practice allows for many other categories to be accounted for, such as:

There are timing considerations to be taken into account when listing these items out. The Companies Acts require that liabilities are identified by reference to when they fall due to be paid, so that it can be seen if a business’s immediate payment obligations to creditors exceeds its short-term ability to find the cash to meet those obligations.

It is for this reason that balance sheets of entities who report to Companies House will show 'current assets' and 'current liabilities' and will also show whether current assets exceed current liabilities (good) or whether current liabilities exceed current assets (bad).

In fact, the Companies Acts stipulate the broad formats in which accounts, including the Balance Sheet, must be presented. There are a variety of reporting options depending upon the nature and size of the business in question and guidance is available from Companies House.

Not only is it good business practice to have this information readily available, but it is also information that lenders or statutory bodies will be interested in as the balance sheet is effectively a record of a business’s life since birth; how much profit has been retained in the business over the years and how healthy it now looks. And because balance sheets are published once a year, usually to the same accounting date, it is possible to see a progression year by year in the net asset value of a business.

Not all businesses are legally required to prepare a balance sheet. Unincorporated businesses that do not have to file accounts with Companies House do not need to do so. It is, nonetheless, good practice to ensure that a balance sheet is maintained and is up to date. Many businesses are wound up because they cannot pay their debts when they fall due (effectively this is the definition of insolvency), and this often arises because business owners have lost track of exactly what they owe, particularly to HMRC in the form of VAT, PAYE or Corporation Tax.

In addition to the balance sheet itself, published accounts frequently contain 'Notes to the Balance Sheet' which, to the experienced practitioner, is where much of the essential detail which lies behind the bare numbers can be found.

When considered together with the annual profit and loss account, the balance sheet should provide an accurate snapshot of a business’s well-being at a given point in time.

This article created by:--Martinc 13:12, 30 June 2014 (BST)

[edit] Related articles on Designing Buildings Wiki

- Accruals.

- Cash flow.

- Construction organisations and strategy.

- Construction supply chain payment charter.

- Cost value reconciliation.

- Demand chain.

- Fair payment practices.

- Financial Reporting Standard for Small Entities.

- Housing Grants, Construction and Regeneration Act.

- Insolvency.

- Microeconomics.

- Outturn cost.

- PAYE.

- Payment notice.

- Remedies for late payment.

- Scheme for construction contracts.

- VAT.

- Working capital.

[edit] External references.

Featured articles and news

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description fron the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

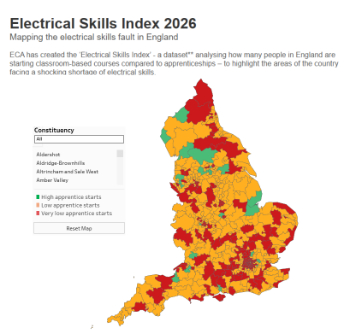

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

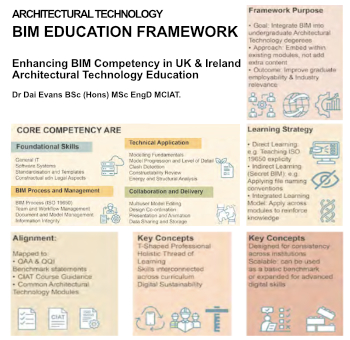

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”

Guidance notes to prepare for April ERA changes

From the Electrical Contractors' Association Employee Relations team.

Significant changes to be seen from the new ERA in 2026 and 2027, starting on 6 April 2026.

First aid in the modern workplace with St John Ambulance.

Solar panels, pitched roofs and risk of fire spread

60% increase in solar panel fires prompts tests and installation warnings.

Modernising heat networks with Heat interface unit

Why HIUs hold the key to efficiency upgrades.