Campaign for cash retentions reform

|

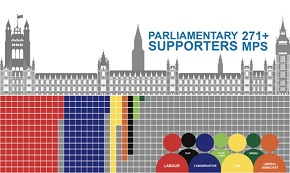

| A total of 271 MPs across all parties support the reform of cash retentions. |

Contents |

[edit] Introduction

Cash retentions are monies held back by larger contractors and clients from subcontractors where issues of non-performance arise, such as defects arising on work undertaken.

Retentions are held by private and public sector clients against their subcontractors, with over £10.5bn of SME working capital locked in retentions annually. Some £7.8 billion of this has been unpaid in the last three years.

However, the system is often abused, negatively impacting many businesses in construction, particularly SMEs.

As a result, ECA, BESA and various partner organisations have been pressing Government to reform this practice. Reform of cash retentions in construction is now supported by a broad range of politicians, business bodies, construction trade associations, and professional bodies.

[edit] Impact of retentions

Deprivation of working capital leaves businesses unable to grow (bid for new work), invest (engineering R&D and investment in digital transformation), recruit (new workers and apprentices), pay tax bills, and therefore precludes productivity improvement.

As retention monies are not protected, ring-fenced or held in trust, if a contractor goes bust, the money is lost by subcontractors, and goes to other creditors, often outside the industry.

In the UK, recent government research shows £700m of retentions were lost from upstream insolvency over a three-year period (prior to the collapse of Carillion). For each working day, the industry loses almost £1m, £4.5m per week or £20m per month.

Research has found that SMEs spend on average 130 hours per year chasing late payment from larger firms. And 34% of SMEs borrow to cover cash-flow issues caused by cash retentions. Often this is written off as bad debt, due to the resource implications of chasing monies due.

Cash flow issues leave businesses unable to:

- bid for new work

- take on new workers and apprentices

- pay tax bills, and

- improve productivity.

The knock-on effects of cash retentions can also include stress and mental health issues.

The current system is also a causal factor in bringing about a less efficient public procurement system and results in lower tax receipts for the public purse.

[edit] About this article

This article is an amalgamation of two articles that first appeared on the website of the Electrical Contractors’ Association (ECA) in March 2019: 'About the campaign' can be accessed here ; the 'Impact of retentions' can be accesed here.

--ECA

[edit] Related articles on Designing Buildings Wiki

- Retention bond

- Retention in construction contracts

- Defects liability period DLP

- Construction (Retention Deposit Schemes) Bill 2017-19

- Performance bond for construction

- Defects in construction

- Bonds in construction contracts

- ECA articles

- Final account

- Final certificate for construction contracts

- Liquidated damages in construction contracts

- Valuation of interim payments

- Right to payment

- Variations in construction contracts

- Contract sum

- Domestic sub-contractor

- Insolvency in the construction industry

[edit] External references

- Construction Manager, 20 November 2017, 60% of engineering firms say turnover is held in retentions.

Featured articles and news

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.