The SME's updated guide to Brexit

|

Contents |

[edit] Introduction

With Brexit on the cards, the number of procedural changes business owners must keep up with can appear daunting. This article should serve to identify some key issues for SMEs to be aware of, and some immediate actions to take.

[edit] Risk assessment guidance

This guidance note is intended to provide practical considerations for ECA Members as to what level of risk their business may face as the UK prepares to leave the EU.

[edit] EU Settlement Scheme

This guidance note is about the EU Settlement Scheme (which fully opened on March 2019) in line with the draft Withdrawal Agreement.

View EU Settlment Scheme Information

[edit] ECA Brexit Briefing – March 2019

ECA held a Brexit Briefing with BEIS in January 2019 for ECA members on the commercial implications of the UK leaving the EU. This included useful information on contractual clauses and is still valid given that the default of a ‘no deal’ scenario has not changed.

Download the 'Force Municipal' contractual clause information

Read Rob Driscoll's blog on the event

Watch a replay of the event in full

[edit] Importing and exporting

HM Revenue & Customs have provided guidance with videos about trading with the EU in a no-deal Brexit: Help and support for traders in a no-deal Brexit.

[edit] Transitional simplified procedures for imports

In addition to registering for (or now being sent an) EORI number, firms that are importing from the EU that wish to make use of transitional simplified procedures will need to register for these. The main benefits to firms of using these procedures are that they enable them to defer duties and the submission of an import declaration, minimising delays in the transport of products.

To register to use these procedures, firms will need:

- An EORI number.

- A VAT registration number.

- Their UK business name and address, and

- The contact details of the relevant person responsible for making the import declaration.

There is full guidance on the Gov.UK website, https://www.gov.uk/guidance/register-for-simplified-import-procedures-if-the-uk-leaves-the-eu-without-a-deal.

[edit] Further information and guidance on Brexit:

ECA is working with the government’s Business Energy and Industrial Strategy team for Construction on an awareness programme to ensure industry is ready for trading in a ‘no deal’ scenario. Updates in this regard are being shared regularly via the member newsletter.

The government has created a 'Get ready for Brexit' site, please click here.

Furthermore, for a view from the Confederation of British Industry (CBI) on the impact of Brexit, please click here.

[edit] For those who import products

HMRC has announced that businesses will be able to use simplified declarations and postpone payment of duties under Transitional Simplified Procedures (TSP) if there is a no-deal Brexit (although there will be additional information needed for controlled goods). The measures will be reviewed after three to six months and businesses will be given 12 months’ notice if they are to be withdrawn.

Businesses can sign up for TSP online from 7 February but they will need an EORI number to do this. Registration and information, including which ports TSP applies to, is available at www.gov.uk/hmrc/eu-simple-importing. The list does include Hull, Tilbury, Dover, Immingham (Hull) and Felixtowe.

HMRC has written to all VAT-registered businesses which, if they import, they should have received already. Click to read letter.

The European Commission has also issued guidance on how industrial products will be handled under Brexit. Click here for guidance.

[edit] About this article

This article was written by Rob Driscoll, Director of Legal & Business at the Electrical Contractors' Association (ECA). It previously appeared on the ECA website in September 2019 and can be accessed HERE.

Click HERE for other ECA articles on Designing Buildings Wiki.

[edit] Related articles on Designing Buildings Wiki

- Buildings of the EU.

- European Union.

- EU Referendum - Environmental and climate change consequences for the built environment.

- Architects' Brexit statement.

- Brexit.

- Brexit - the case for infrastructure.

- Brexit Topic Guide.

- BSRIA response to Brexit white paper.

- HVAC and smart energy post-Brexit.

- Overcoming the challenges of Brexit.

- Post brexit, house building and construction remains a safe sustainable industry.

- Post-Brexit vision for construction.

- Skills shortage and Brexit.

- The commercial implications of Brexit.

- Transforming Public Procurement Green Paper.

- Triggering article 50 of the Treaty of Lisbon.

--ECA

Featured articles and news

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

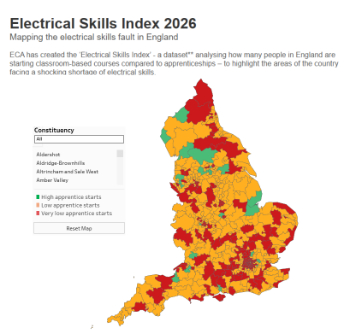

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.