Mixed results for construction in January 23 as planning approvals fall

Barbour ABI has completed its latest snap analysis of construction industry performance for January, finding a mixed result across planning with a strong start for contract awards but slower performance across earlier planning stages.

Notably, residential planning approvals and applications fell to just £2.7bn and £3.6bn respectively against £3.4bn and £4.2bn averages in 2022. This highlights the continued impact of the cost-of-living crisis and suggests annual house-building targets may come under threat.

Contents |

[edit] Narrative

Barbour ABI Chief Economist Tom Hall explained:

“Contract awards were £7.4bn in January: a positive rebound after December’s disappointing £5bn. The main contributors to the strong performance were the residential and industrial sectors, with £2.6bn and £1.6bn respectively. Only the commercial sector performed below the historical average, falling back by 18% to £600m following a good finish to 2022. However, January is often a good month and there remain many headwinds to contend with.

Planning approvals experienced a weak start to the year, falling 34% to just £6.5bn, driven by large falls in industrial and infrastructure. Meanwhile, underlying activity for planning applications fell at the end of 2022 with notable falls in commercially sensitive sectors, such as residential. however overall activity held up thanks to the £4.1bn Berwick Bank offshore wind farm in Scotland.”

[edit] Sector-by-sector analysis

[edit] Contract awards

- Overall- After a weak December, contract awards came back strongly, with £7.4bn awarded in January.

- Residential is up by 83% month on month, with £2.6bn in January. This is the strongest monthly value since last March.

- Infrastructure was consistent at above-average levels, with £1.5bn worth of contracts awarded. More renewable power generation this month included several Energy from Waste (EfW) schemes.

- Commercial sector contract awards weakened in Jan with £600m – the only sector below average levels in January. However, it had a good Q4 in 2022.

- Industrial sector was a fantastic January, with £1.6bn awarded, a 90% month-on-month increase. This comes after a disappointing December.

[edit] Planning approvals

- Overall, approvals see their lowest level since June 2022, falling by 34% to £6.5bn. Similar levels were seen last in the summer lull as the cost-of-living crisis started to bite.

- Residential sector approvals fell back to low levels of £2.7bn - the smallest value since July.

- Infrastructure sector planning approvals reduced by 31% in January to £1.4bn. Two major battery storage factory approvals prevented a further slide.

- Commercial sector positively the commercial sector increased by £31% month on month – consistent with levels from the second half of last year.

- Industrial saw a massive fall of 80% - from record levels in December to low levels. However, the sector remains bright.

[edit] Planning applications

- Overall, £11.8bn of planning applications in December ensures a strong finish to 2022 thanks to offshore wind farm applications.

- Residential sector finished weakly in December with £3.6bn in planning applications- a very low number when compared to an average of £4.2bn in 2022 and £4.5bn in 2021.

- Infrastructure, £4.1bn in planning applications ensured 2022 ended on a positive note thanks to the Berwick Bank offshore wind farm in Scotland.

- Commercial sector had a poor month with just £400m worth of planning applications, a fall of 50% compared to the £700m average over 2022.

- Industrial sector planning applications fell by a third in December to more normal levels of £1.1bn.

[edit] About Barbour ABI

Barbour ABI was founded to support the UK construction industry – helping businesses to sustain and grow.

As the market leading provider of construction project information, it strives to allow clients to access the very best, most accurate and up-to-date data on construction projects and the key decision makers that are involved. With the largest team of UK-based expert researchers in the industry, making over one million calls a year and real-time updates to database – creating invaluable insight at client’s fingertips.

Not only generating construction project leads, but able to inform the industry of the latest trends and developments using data to analyse and form a complete picture of the past, present and future, considering current affairs and their impact on industry, where the opportunities and threats lie, and therefore how clients can future-proof themselves. Their mission is to provide clients with the best experience and that the service and product provided is an extension of their own business and something they can’t do without.

This article was sent via Press Release under the same title on February 16, 2023

[edit] Related articles on Designing Buildings

Featured articles and news

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

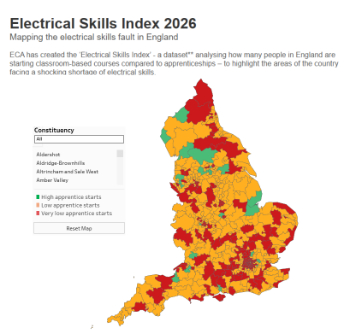

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Comments

[edit] To make a comment about this article, click 'Add a comment' above. Separate your comments from any existing comments by inserting a horizontal line.