Homes England and development finance lending platform expand alliance to boost support for SME house builders

[edit] Homes England and Invest & Fund expand lending alliance

In January 2025, Homes England and Invest & Fund, announced a significant expansion of their Lending Alliance, reinforcing their commitment to supporting small and medium-sized enterprise (SME) developers as part of the government’s plans to deliver 1.5 million new homes over the next five years.

The expanded partnership will offer development loans up to £4 million, at a maximum 70% Loan to Gross Development Value and maximum 85% Loan-to-Cost. The partnership is projected to facilitate the construction of an additional 600 new homes, building on the 107 homes already supported through the original lending alliance.

In 2020, the Agency announced a seven-year partnership with Invest & Fund, to increase the amount of finance available to SME developers, helping them to grow and deliver more homes at pace. The collaboration created a £25 million revolving fund to enable the support of small builders with construction loans of up to £2.5 million, funding schemes of two homes and upwards, at up to 80% Loan-To-Cost.

The refinanced agreement will:

- Increase the fund from £25 million to £47.5 million.

- Extend the term of the fund to March 2030.

- Continue to focus on supporting micro-SMEs.

This ongoing support complements Home England’s existing direct lending offer, which provides development funding to housebuilders building five or more homes a year and follows the £700 million extension to the current Home Building Fund for SME developers announced by the government last December, which will support the delivery of up to 12,000 additional homes.

Marcus Ralling, Chief Investments Officer at Homes England, said: "Small and medium housebuilders play a vital and essential role in driving the delivery of new homes where they are needed most. This refinancing demonstrates our ongoing commitment to supporting the small builders that are crucial to building a diverse and resilient housing sector. By nearly doubling the fund and extending its availability, we’re providing sustained, long-term support to help SME developers grow and deliver more homes at pace."

Robert Burgess, Chairman at Invest & Fund, said: "Invest & Fund are delighted to be working with Homes England to support SME developers and ensure that they have access to vital funding to deliver much needed new homes across the country."

[edit] Long-term public-private partnership to deliver thousands of affordable homes

The press release above follows the separate announcement from November 2024 regarding the new public-private partnership, Habiko, developed by a pension insurance corporation, a major investor in UK housing and infrastructure, nationwide place maker, Muse, and Homes England. The joint venture plans to deliver 3,000 low-carbon, low-energy affordable homes for the rental market, unlocking institutional investment. Habiko aims to become self-funding over its 12-year lifespan and diversify the supply chain for future efficient housing developments.

Habiko is targeting up to 100% affordable homes for rent for those whose needs are not met by the market, with rents set at 20% below the local market rent. During the 12-year lifespan of the partnership, PIC will have the ability to continue to forward fund the development of the affordable homes and will ultimately own the homes and places they have helped to create through its investment and long-term stewardship approach.

The homes will be built across England in areas of high demand for this type of housing. The developments aim to create social value for these communities, including boosting the local economy through job creation and new skills to drive green innovation. The homes will be in accessible locations, close to employment opportunities and be designed to help residents save money on their energy bills.

Tracy Blackwell, CEO of PIC, said: "Meeting the UK’s affordable housing needs is a challenge that is best met through effective collaboration between government, developers, and private investors. Habiko is a great example of public-private partnership, which brings forward thousands of low-carbon, low-energy affordable homes. PIC has invested around £4 billion in social and affordable housing to date, helping provide the secure, long-dated, inflation linked cashflows to back the pensions of its policyholders over coming decades, creating considerable social value."

Phil Mayall, Managing Director at Muse, said: "The government has set out a bold and ambitious challenge to deliver a significant number of new affordable homes over the next five years. Working together with PIC and Homes England, we can bring together our collective resources and unique experience to deliver thousands of low carbon and low energy homes which, by working alongside our local partners, meet the needs of communities across the country.”

Peter Denton, Chief Executive of Homes England, said: "Attracting institutional investment into the housing sector is critical to build the new homes the country needs. This partnership supports our partners’ objective to deliver low carbon, low energy, affordable homes, bringing together the technical expertise and capability of Muse with the financial capacity of one of the UK’s largest pension fund insurers, cementing PIC as a significant force in delivering affordable housing."

For further information see News story Long-term public-private partnership to deliver thousands of affordable homes Dated 4 November 2024 and https://habiko.uk/

The first sections of this article were issued via press release as 'Homes England and Invest & Fund boost support for small housebuilders' 16 January 2025.

[edit] Related articles on Designing Buildings

- Consultation on proposed reforms to NPPF and other changes to the planning system.

- Design Council Homes Taskforce launched to support 1.5 million homes target within UK climate commitments.

- Golden rules for the release of land.

- Grey belt.

- Killian Pretty Review.

- Local plan.

- Localism Act.

- National Planning Framework.

- National Planning Practice Guidance.

- Neighbourhood planning.

- NPPF consultation briefing notes on terms.

- NPPF inquiry.

- Planning overhaul to reach 1.5 million new homes.

- The grey, the brown and the golden rules of housing.

Featured articles and news

Delivering for tenants; National Retrofit Hub

New report offers recommendations to strengthen energy efficiency standards to protect private renters.

Government consultations for the summer of 2025

A year of Labour, past and present consultations on the environment, the built environment, training and tax.

CMA competitiveness probe of major housing developers

100 million affordable housing contributions committed with further consultation published.

Homes England supports Greencore Homes

42 new build affordable sustainable homes in Oxfordshire.

Zero carbon social housing: unlocking brownfield potential

Seven ZEDpod strategies for brownfield housing success.

CIOB report; a blueprint for SDGs and the built environment

Pairing the Sustainable Development Goals with projects.

Types, tests, standards and fires relating to external cladding

Brief descriptions with an extensive list of fires for review.

Latest Build UK Building Safety Regime explainer published

Key elements in one short, now updated document.

UKGBC launch the UK Climate Resilience Roadmap

First guidance of its kind on direct climate impacts for the built environment and how it can adapt.

CLC Health, Safety and Wellbeing Strategy 2025

Launched by the Minister for Industry to look at fatalities on site, improving mental health and other issues.

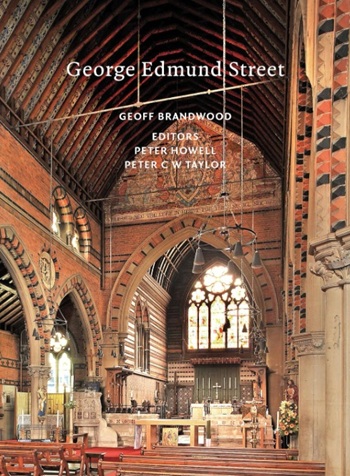

One of the most impressive Victorian architects. Book review.

Common Assessment Standard now with building safety

New CAS update now includes mandatory building safety questions.

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.