EV Charging Infrastructure Market

Contents |

[edit] Value

The EV charging infrastructure market was valued at US$ 8,805.35 million in 2021 and is projected to reach US$ 23,395.77 million by 2028; it is expected to grow at a CAGR of 15.0% from 2021 to 2028.

[edit] Market

Presently, EV charging stations are more common in private residences. However, rising consumer demand has led to active adoption of on-site commercial charging as a standard building feature. China, the EU-27 plus the UK, and the US, are expected to implement charging in residential and commercial buildings to scale up the EV charging infrastructure in the near future, which requires upgrading buildings' electrical infrastructure to satisfy the rising demand for EV charging.

Additionally, EV charging at scale is subject to the careful planning of a building's electrical distribution system, along with the local electric-grid infrastructure. To enhance the accessibility and affordability of electric chargers, a large number of building developers, urban planners, and electrical-equipment suppliers are actively integrating the EV charging infrastructure into standard building design plans, thereby creating growth avenues for the EV charging infrastructure market.

Furthermore, public charging stations in workplaces and dedicated EV charging hubs create massive opportunities to expand the EV charging infrastructure market due to rising adoption by less affluent buyers, including those residing in multiunit housing (having limited access to in-home charging). This is particularly evident in China and the EU-27 plus the UK, where a limited number of single-family homes with in-home parking has led to a higher ratio of EVs to public charge points than in the US.

The increase in the number and type of charging infrastructure—beyond single-family homes, including installation in apartment complexes, offices, fleet depots, parking lots, and commercial centres—is creating growth opportunities for the scaling-up of the global EV charging infrastructure market.

[edit] Impact of COVID-19 Pandemic

The onset of the COVID-19 crisis in 2020 led to a slowdown in automotive and its infrastructure activities worldwide. All regions reported in the analysis suffered a significant downturn in workload during the first half of 2020. However, the pandemic accelerated the need for emission-free mobility, especially in the developed regions. According to estimates by IEA, global electric car sales rose to more than 3 million, reaching a market share of over 4%. Sales during the 2020 peak of the pandemic, rose by 40% from the 2.1 million electric cars sales in 2019.

Notably, electric vehicle sales rose by a significant 160% in the first half of 2021 compared to 2020, representing 26% of total new sales in the global automotive market. As the sales of EV worldwide sore, major global EV charging infrastructure market players have been implementing smart charging solutions to create a supporting ecosystem complementing the development of future-ready connected, hassle-free, and safer mobility. For instance, during the pandemic period of 2020-21, EV charging infrastructure companies, like EVBox and Tritium, entered into a number of partnerships, acquired several significant players, and have focused on the research and development of smart charging solutions, accelerating the growth of the EV charging infrastructure market.

Furthermore, systems supporting EV charging infrastructure market reduces the operational costs and environmental impact for agencies and government departments compared to present ICE vehicle scenario, thereby amplifying the growth prospects of major global players in the EV charging infrastructure market. For instance, the US government released an EV Charging Action Plan to lay down steps for the federal agencies to support the development and deployments of chargers in American communities across the country. Therefore, there has been no major impact of the COVID-19 pandemic on the EV charging infrastructure market, and it is witnessing steady progressive growth in major parts of the world.

Tritium; Blink Charging Co.; ChargePoint, Inc.; BP p.l.c.; EVBox; EVgo Inc.; Tesla, Inc.; Webasto Group; RWE AG; and Delta Electronics, Inc. are among the key players operating in the global EV charging infrastructure market. Several other players have also been analyzed to understand the EV charging infrastructure market.

[edit] Related articles on Designing Buildings

- Boosting electric vehicle use.

- ECA and UKPN launch EV guide.

- Electric vehicles.

- Electric vehicle future.

- Integrated transport system.

- New style EV charging stations

- Pop-up electric vehicle charge points.

- The future of transport in the UK.

- Two thirds of local authorities have no plans to install EV chargers.

Featured articles and news

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

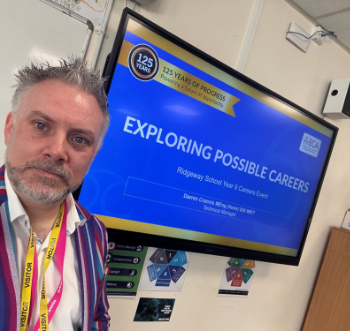

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.