Cost-benefit analysis in construction

|

A cost-benefit analysis (CBA) is a systematic process in which decisions relating to proposals are analysed to determine whether the benefits outweigh the costs, and by what margin. A CBA serves as a basis for comparing alternatives proposals and making informed decisions about whether to proceed.

In terms of proposed developments, by evaluating all the potential costs, and comparing these with possible revenues and other benefits that might derive from a new building, a developer is able to assess whether the proposal is financially worthwhile or whether an alternative is needed.

The first step typically involves listing, in as much detail as possible, all the costs and benefits that are associated with the project. Costs could include direct and indirect costs, hard and soft costs, opportunity costs and the cost of potential risks. Benefits could include direct and indirect benefits, and intangible benefits (e.g. increased productivity and cost savings). It is better to be conservative with the benefits as an over-estimation (or under-estimation of the costs) will result in an inaccurate CBA.

Once the list has been made, a common unit of monetary measurement should be applied to all the items before quantitatively comparing them to ascertain whether the benefits outweigh the costs. If they do not, then a review should be undertaken to determine how the benefits might be increased and/or the costs decreased to try and make the project financially viable.

If, once this is done, the benefits are still outweighed by the costs, it may be necessary to reassess whether the project should proceed as planned. If the benefits outweigh the costs then the project can be taken forward to the next stage of planning.

As an assessment tool, CBA is of more value for smaller construction projects with a length of time to completion that is short to intermediate. This is because greater accuracy in the cost estimating can be achieved. Larger projects with a long programme may be exposed to more cost uncertainties (e.g. interest rates, inflation, availability of labour, price of materials, etc.). For these larger and more uncertain projects, analysis models that may be more suitable include net present value (NPV) and internal rate of return (IRR).

For more information see:

NB Glossary of Capital Budgeting and Infrastructure Governance, published by the Organisation for Economic Co-operation and Development (OECD) in 2018, states: ‘Cost-benefit analysis is a systematic process for calculating and comparing benefits and costs of a government policy. It has two purposes: a) to determine if it is a sound investment/decision (justification/feasibility); b) to provide a basis for comparing different government policies. It involves comparing the total expected cost of each option against the total expected benefits, to see whether the benefits outweigh the costs, and by how much. Cost-benefit analysis is related to, but distinct from cost-effectiveness analysis. In cost-benefit analysis, benefits and costs are expressed in monetary terms, and are adjusted for the time value of money, so that all flows of benefits and costs over time are expressed on a common basis in terms of their "net present value."’

[edit] Related articles on Designing Buildings

Featured articles and news

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

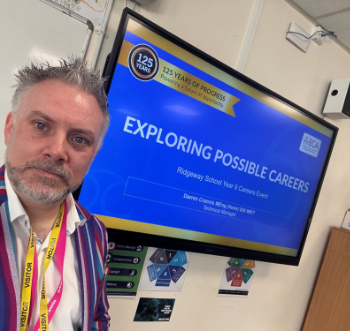

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.