UK Construction saw an 11.1bn fall in spending in 2023

Contents |

[edit] UK construction in 2023

- Spending on construction projects fell 14% in 2023

- Sectors most affected by the cost-of-living crisis were hardest hit including residential, commercial and hotel & leisure developments

- Infrastructure remains a crutch for the industry, maintaining spending 47% higher than in pre-pandemic levels.

Contracts Awarded for construction projects in the UK fell £11.1bn to £69.2bn in 2023, a 14% reduction from a record £80.4bn in 2022, according to the latest analysis from construction analysts Barbour ABI.

Sectors hit by the cost-of-living crisis were particularly affected with residential housebuilding down 14%, commercial developments down 15% and Hotel and Leisure falling dramatically by 29%.

A lack of confidence in the market was also reflected in applications for new construction projects, which fell by 16% to under £100bn. Housing applications are now 21% down on pre-pandemic levels.

Barbour Consulting Economist Kelly Forrest commented: “2023 was challenging for the UK construction sector. In addition to viability challenges from higher construction costs and borrowing rates, consumers and business confidence remained weak.

[edit] The positives from the year

2023’s good news stories were largely confined to the public sector as the government’s flagship school and hospital building programmes finally started to build some momentum amid moderating cost inflation and mounting political pressure.”

Barbour ABI found that education awards bounced back to £6.1bn in 2023, a 20% uplift compared with 2022, and a 19% increase from 2019. Meanwhile, Healthcare beat 2022 by 4% and is now 160% higher than pre-pandemic levels.

Forrest continued: “Overall weakness concealed pockets of buoyant sub-sector activity. Energy was a particular bright spot as investment poured into energy from waste and energy storage facilities, along with offshore wind.”

[edit] Infrastructure projects

Infrastructure spending, including government-funded projects, remained an important crutch for the industry in 2023. Contract awards fell 22% to £15.2bn but remained 47% higher than in 2019.

Energy projects were a big driver. Windfarms, battery storage facilities and large waste-to-energy contracts all helped maintain awards momentum.

[edit] Looking toward 2024

Meanwhile, applications remained 62% higher than pre-pandemic levels and analysis of demand side approvals, still double pre-pandemic levels, suggests infrastructure will continue to perform in 2024.

Looking ahead Forrest concluded:

“In early 2024 there are a few reasons to be optimistic. Interest rates are likely to have peaked and inflationary pressures have eased markedly. Entering what is very likely to be an election year there is a risk there will be a hiatus in public sector investment as key decisions are postponed. The speed and resilience of the private sector recovery will be pivotal.”

[edit] Related articles on Designing Buildings

- 2023 Spring Budget summary and industry response.

- 2023 Quarter 1 ends on a high with 7bn in construction contracts awarded in March.

- 2023 Spring Budget summary and industry response.

- A second spring budget of 2023.

- Chancellor's 2022 Autumn statement industry response.

- Construction organisations and strategy.

- CIBSE Case Study Bushbury Hill Primary School.

- Economic development and construction.

- Education and Health applications shine in subdued construction October market.

- Funding options for building developments.

- How does the state of the economy influence the construction industry?

- Investment.

- Priority School Building Programme PSBP.

- Property development finance.

- Working capital.

Featured articles and news

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

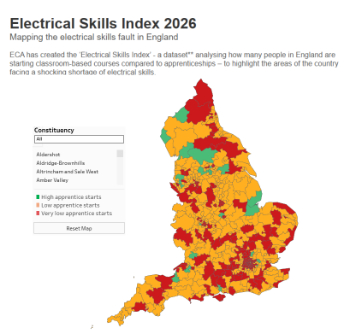

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.