Africa tops world AC growth forecasts

|

In 2018, the total African aircon (AC) market for the continent grew by 4% in volume from 2017. The market is forecast to grow at a compound annual growth rate (CAGR) of around 5.5% between 2017-2023 by volume, which exceeds the global forecast of 4.9% for the same period. This is according to the first-ever African air conditioning study released by BSRIA.

The countries with the strongest growth forecast are Ghana, Kenya, Nigeria and Tanzania. The main drivers are growth in population, better performing economies, more stable governments, new construction, urbanisation and rising disposable income.

There are still a myriad of challenges faced by the countries in the region, including a recovering economy in Egypt with strong growth in construction and a planned new capital city; economic stagnation in the run-up to the passing of the ‘Expropriation Bill’ in South Africa; shortage of foreign currency in Ethiopia and economic reforms in Tanzania restricting imports, as well as tough economic conditions challenging the growth of the Tunisian AC market.

Many African countries are looking to ‘diversify and develop’ their economies. This should help them to cope with ‘the storms of global trade wars and protectionism’ which currently threaten the world.

Saziye Dickson, BSRIA research manager (Air Conditioning, Ventilation and Refrigeration, Worldwide Market Intelligence) said: “In spite of its political uncertainty and economic challenges, the continent continues to attract investors’ attention, especially from China. Chinese interest is evident with Chinese AC manufacturers accounting for a significant market share in 2018, followed by the South Korean players.

“The main reason behind the growing interest in the region is its strong economic growth. According to the latest Oxford Economics forecast, GDP growth for Africa is set to outstrip that of any other world region from 2012 to 2030. This is driven by rapid economic and population growth, resulting in faster urbanisation than any other continent over this period.

“BSRIA’s strong relationship with global HVAC manufacturers and its expert researchers enable the company to provide valuable insight into market dynamics, as well as reliable market sizing and forecasts.

“The annual sale of 2.8m units per year mostly consists of single un-ducted splits which enjoy the strongest forecasted growth (6%) due to demand from residential and light commercial projects. The VRF sector (4% growth) is the second-fastest growth area in Africa.

“It is still early days as contractors and installers are slowly trained regarding these systems and the industry needs more specialist knowledge to make the right choices in selecting a HVAC system. The growth of 3% CAGR (2017 – 2023) in the chiller market is matching the growth levels of the Americas and the European AC market.

“The research also found that most global HVAC manufactures are present through independent dealers instead of having a presence with their own sales offices. However, this is slowly changing as companies figure out their entry strategy into these markets. This investment should help to develop growth in the AC sector, as marketing and sales spend starts to drive the market.”

The study covers 10 key country markets in detail and offers the HVAC industry a “much-needed” total African market data by estimating the remaining countries in a further five separate regions.

The regions: Central Africa, Eastern Africa, North Africa, Southern Africa and Western Africa.

The countries: Algeria, Egypt, Ethiopia, Ghana, Kenya, Morocco, Nigeria, South Africa, Tanzania and Tunisia.

More details on the size, trends and key issues in the Africa and Middle-Eastern AC markets are available from tina.fahmy@bsria.co.uk

EMEA sales enquiries: BSRIA UK: wmi@bsria.co.uk ¦ +44 (0) 1344 465 540 www.bsria.co.uk

America sales enquiries: BSRIA USA: sales@bsria.com ¦ +1 312 753 6800 www.bsria.com

China sales enquiries: BSRIA China: [email protected] ¦ +86 10 6465 7707 www.bsria.com.cn

This article was authored by BSRIA's Worldwide Market Intelligence (WMI) division and first appeared on the BSRIA website in February 2019.

BSRIA is a non-profit distributing, member-based association providing specialist services in construction and building services. More information at www.bsria.co.uk.

Other articles by BSRIA can be seen here

--BSRIA

[edit] Related articles on Designing Buildings Wiki

- Air conditioning.

- Air conditioning inspection.

- Air conditioning inspection procedure.

- BSRIA completes 2021 World Air Conditioning market studies.

- BSRIA: new Global Air Conditioning Market Studies.

- Global air conditioning Study 2016.

- Ground pre-conditioning of supply air.

- Heating, ventilation and air conditioning.

- Smart connected HVAC market.

- World air conditioning market study 2015.

Featured articles and news

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherit assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

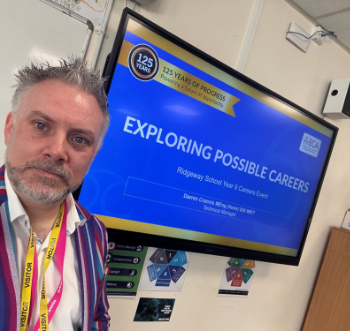

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.