The Indian construction chemical market

Construction chemicals are added to construction materials to improve their workability, performance, functionality, chemical resistance and durability. Use of construction chemicals has seen significant growth over the past decade due to increasing infrastructure development activities in developing economies.

Future Market Insights (FMI), in its recent report titled, “Construction Chemical Market: India Industry Analysis and Opportunity Assessment 2014 - 2020”, projects that the India construction chemical market will exhibit a CAGR of 17.2% from 2014 to 2020. The market is projected to reach US$ 1,890 million by 2020.

Government regulations, an increase in foreign investment activities, urbanisation, and a growing preference for ready-mix concrete (RMC) are some of the factors driving the growth of the construction chemicals market in India. The challenges faced by this market include; low availability of skilled manpower, volatility in raw material prices, and a lack of interest in the implementation of quality standards by infrastructure developers.

Some major trends in the Indian construction chemical market include; an increase in investment in research and development, entry of new players, adoption of sustainable products and technological advancements.

The Asian region is becoming the focus point for most of the major construction chemicals companies for investment in R&D.

Indian construction chemicals can be categorised as:

- admixtures.

- flooring chemicals.

- water proofing compounds.

- adhesives and sealants.

- repair and rehabilitation.

- others.

Adhesives and sealants and admixtures are expected to account for a 61.2% share of the Indian construction chemicals market by 2020. It is anticipated that there will be a decline in the growth of the repair, rehabilitation and others segments from 12.7% in 2014 to 11.9% in 2020, indicating a lack of inspection and maintenance in the construction industry in India.

On the basis of end use sectors, the market is segmented into infrastructure and the residential and commercial sector. Infrastructure is likely to grow at a CAGR of 18.3%. The residential and commercial segment has a share of 34% with a steady year on year growth of 16%.

From a regional perspective, India market is segmented into; the northern region, eastern region, western region and southern region. Currently, the northern region is expected to experience the highest CAGR of 17.8% compared to other regions. The southern region is likely to become three times the value it was in 2013. The southern region comprises the states of Tamil Nadu, Andhra Pradesh, Karnataka and Kerala. This region has the potential of IT services and hence is able to attract significant investment from these service and manufacturing companies. Chemical and engineering industries are the main drivers of growth in the western region particularly in Maharashtra and Gujarat.

Key market participants include BASF India, Pidilite, Sika India Pvt. Ltd., Forsoc Chemicals (India) Ltd., Chembond Chemicals and CICO Technologies

Featured articles and news

Lighting Industry endorses Blueprint for Electrification

The Lighting Industry Association fully supports the ECA Blueprint as a timely, urgent call to action.

BSRIA Sentinel Clerk of Works Training Case Study

Strengthening expertise to enhance service delivery with integrated cutting-edge industry knowledge.

Impact report from the Supply Chain Sustainability School

Free sustainability skills, training and support delivered to thousands of UK companies to help cut carbon.

The Building Safety Forum at the Installershow 2025

With speakers confirmed for 24 June as part of Building Safety Week.

The UK’s largest air pollution campaign.

Future Homes Standard, now includes solar, but what else?

Will the new standard, due to in the Autumn, go far enough in terms of performance ?

BSRIA Briefing: Cleaner Air, Better tomorrow

A look back at issues relating to inside and outside air quality, discussed during the BSRIA briefing in 2023.

Restoring Abbotsford's hothouse

Bringing the writer Walter Scott's garden to life.

Reflections on the spending review with CIAT.

Retired firefighter cycles world to raise Grenfell funds

Leaving on 14 June 2025 Stephen will raise money for youth and schools through the Grenfell Foundation.

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

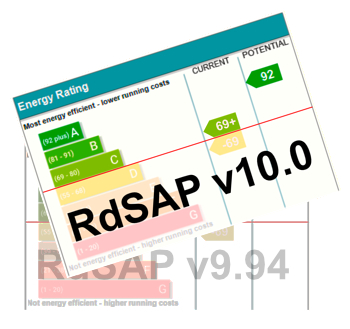

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.