Rating (Property in Common Occupation) and Council Tax (Empty Dwellings) Bill

[edit] Overview

In March 2018, new legislation was introduced to allow councils to charge double the rate of council tax on homes that have been left empty.

The Rating (Property in Common Occupation) and Council Tax (Empty Dwellings) Bill is intended to ensure that thousands of long-term empty properties across England are brought back into use by giving councils the power to levy additional charges on those left empty for two years or more. Councils will be able to use funds raised to help reduce standard council tax charges.

Although the government highlights the fact that the number of homes left empty for 6 months or longer (just over 200,000) is at its lowest level since records began in 2004, it is taking a range of measures to improve the country's housing market.

The New Homes Bonus scheme introduced in 2011, means that councils earn the same financial reward for bringing an empty home back into use as for building a new one. And since 2013, councils have been able to charge a 50% premium on the council tax for homes left empty for two years or more. 291 out of 326 councils applied an empty homes premium in 2017 to 2018.

However, in January 2018, the Liberal Democrats published research showing that just one in 13 councils were making use of Empty Dwelling Management Orders (EDMO), a local authority power for 'taking back' properties left empty for at least six months. For more information, see Vince Cable interview.

There are exemptions in place and discounts available for the new charge, covering:

- Homes that are empty due to the occupant living in armed forces accommodation.

- Annexes being used as part of a main property.

- Properties left empty for a specific purpose, such as when a person goes into care.

- Homes left empty due to special circumstances, such as hardship, fire or flooding.

Local Government Minister, Rishi Sunak, said:

"It is simply wrong that, while there are 200,000 long-term empty properties across the country, thousands of families are desperate for a secure place to call home. This new power will equip councils with the tools they need to encourage owners of long-term empty properties to bring them back into use – and at the same time tackle the harmful effect they have on communities through squatting, vandalism and anti-social behaviour."

[edit] Updates

In July 2018, during the third reading of the Bill, an amendment was introduced to increase the council tax premium charged on empty homes. According to the amendment, councils will be able to triple the council tax on homes left empty for 5-10 years, and quadruple it on homes left empty for more than a decade. Homes left empty for 2-5 years will still be subject to a doubling of council tax.

It is expected that councils will keep general council tax levels down by using the funds from this premium.

The new powers will be subject to revised guidance to be published at a later date, which will take into account issues relating to low-demand areas and complex regeneration schemes.

Secretary of State for Communities James Brokenshire MP said; "We’re determined to do everything we can to ensure our communities have the housing they need. That’s why we’re giving councils extra flexibility to increase bills and incentivise owners to bring long-standing empty homes back into use. By equipping councils with the right tools to get on with the job, we could potentially provide thousands more families with a place to call home."

NB The Liberal Democrat leader Sir Vince Cable, previously called for the imposition of "300% council tax or even more", in the documentary 'Empty Balconies facing the Sun'.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.

Skills England publishes Sector skills needs assessments

Priority areas relating to the built environment highlighted and described in brief.

BSRIA HVAC Market Watch - May 2025 Edition

Heat Pump Market Outlook: Policy, Performance & Refrigerant Trends for 2025–2028.

Committing to EDI in construction with CIOB

Built Environment professional bodies deepen commitment to EDI with two new signatories: CIAT and CICES.

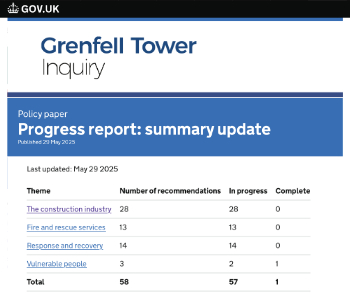

Government Grenfell progress report at a glance

Line by line recomendation overview, with links to more details.

An engaging and lively review of his professional life.

Sustainable heating for listed buildings

A problem that needs to be approached intelligently.

50th Golden anniversary ECA Edmundson apprentice award

Deadline for entries has been extended to Friday 27 June, so don't miss out!

CIAT at the London Festival of Architecture

Designing for Everyone: Breaking Barriers in Inclusive Architecture.

Mixed reactions to apprenticeship and skills reform 2025

A 'welcome shift' for some and a 'backwards step' for others.

Licensing construction in the UK

As the latest report and proposal to licence builders reaches Parliament.

Building Safety Alliance golden thread guidance

Extensive excel checklist of information with guidance document freely accessible.

Fair Payment Code and other payment initiatives

For fair and late payments, need to work together to add value.

Pre-planning delivery programmes and delay penalties

Proposed for housebuilders in government reform: Speeding Up Build Out.

High street health: converting a building for healthcare uses

The benefits of health centres acting as new anchor sites in the high street.