Council tax

The council tax is a form of local property tax (LPT) collected by local councils. It was introduced in 1993 by the Local Government Finance Act 1992, when it replaced the unpopular Community Charge (Poll Tax).

Very broadly, domestic properties pay the council tax, whereas business properties pay business rates (sometimes referred to as non-domestic rates).

People generally have to pay the council tax if they are 18 years old or over and own or rent a home.

The amount charged is based on:

- The valuation band for the home (A-H), as valued by the Valuation Office Agency (VOA) on 1 April 1991.

- How much the local council charges for that band.

- Whether the occupant is eligible for a discount or exemption.

A dscount or exemption may be available if:

- The occupant is on a low income or benefits.

- They live on their own.

- No-one else in the home counts as an adult

- No-one living in the home counts as an adult.

- Everyone in the home is a full-time student.

- The home is condemned or unoccupied.

- It is a second home.

Appeals about valuations or other matters can be made to the Valuation Tribunal.

NB: Where properties are partly for business use and partly for domestic use, such as a pub or shop, where the owner lives on the premises or in a flat above the business, it may be necessary to pay both the council tax and business rates.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

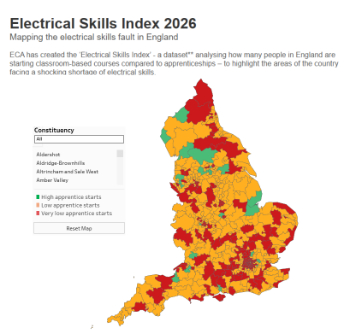

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.