Local property tax

In England and Wales, the term ‘local property tax’ (LPT) refers to either the council tax or business rates. Very broadly, domestic properties pay the council tax, whilst business properties pay business rates (sometimes referred to as non-domestic rates).

Where properties are partly for business use and partly for domestic use, such as a pub or shop, where the owner lives on the premises or in a flat above the business, it may be necessary to pay both taxes.

If an owner is using their home for minor business purposes, they are not normally expected to pay business rates, for example, if:

- They only use a small part of the home for business.

- They don’t use it to sell goods or services to visiting clients or members of the public.

- They don’t employ other people to work at the premises.

- They don’t make alterations that are not for domestic purposes.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.

The 2025 draft NPPF in brief with indicative responses

Local verses National and suitable verses sustainable: Consultation open for just over one week.

Increased vigilance on VAT Domestic Reverse Charge

HMRC bearing down with increasing force on construction consultant says.

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

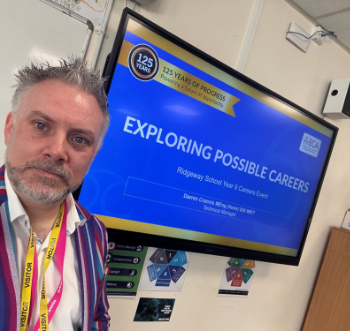

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.