Project bank account

Project bank accounts (PBA) have emerged as a means of enabling faster payments through the construction supply chain, with payments being made as soon as 5 days from the due date. This is intended to reduce cash flow problems that can lead to supply chain members becoming insolvent, which is potentially catastrophic for projects, both in terms of money and time.

The government suggests that, ‘Historically, it is has not been unusual for lower tier supply chain members to have to wait for up to 100 days to receive payment, which damages their cash flow and can harm their business.’ Ref Cabinet Office, Project Bank Accounts – Briefing document.

In September 2009 the Government Construction Board proposed that government projects should begin to adopt project bank accounts unless there were compelling reasons not to do so. In 2011, the Government Construction Strategy set a target for £4bn of contracts to be awarded using project bank accounts by the end of 2013 to 2014.

In 2014, Francis Maude, Minister for the Cabinet Office, announced that £5.2bn worth of government construction projects were being paid through project bank accounts, including projects such as Crossrail. Maude stated, “To win the global race, we must support the smaller suppliers which are the lifeblood of our economy.” Ref Construction Enquirer, Project bank accounts in use on half government jobs.

Project bank accounts are ring-fenced accounts from which payments are made directly and simultaneously by the client to all parties in the supply chain. Funds in the account can only be paid to beneficiaries, that is, members of the supply chain named in the account (the lead contractor and supply chain members).

As a consequence, supply chain members do not have to wait for higher-tier contractors to process payments, they receive them directly. This ensures:

- Certainty of payment.

- Security of payment.

- Speed of payment.

- Transparency.

- A reduction in the need for borrowing or financing credit.

- A reduction in the need to chase payments.

- A reduction in disputes.

This does not affect procedures for valuing and certifying payments, and does not remove the lead contractor’s responsibility for selecting and managing the supply chain.

A number of banks offer project bank accounts for construction projects, including Lloyds, Santander and Bank of Scotland Group/NatWest. Contracts such as NEC3, the Project Partnering Agreement (PPC2000) and the JCT contracts also provide for project bank accounts.

Project bank accounts are best suited to projects with complex supply chains, irrespective of the size of the project. They can be ‘dual authority’ or ‘single authority’ accounts depending on whether both the client and lead contractor instruct payments, or only the lead contractor. The account is held in the names of trustees (the client and lead contractor for dual authority accounts or just the lead contractor for single authority accounts). This trustee status means that in the case of insolvency amounts payable to the supply chain are secure and can only be paid to them.

Project bank accounts should extend down to at least tier 3 contractors and 80% of the value of sub-contract payments. Suppliers should only not participate if; the value of the contract is too low, or they are paid more frequently than a monthly cycle, or if they are not vulnerable suppliers and do not wish to participate.

The government estimates that project bank accounts can save approximately 1% of the cost of construction.

In September 2016, the Scottish government announced that project bank accounts would be used on all of its building projects with a value of more than £4m from 31 October 2016. Stirling-based Robertson Group warned that main contractors would have to rebalance margins as a result of the move. Chairman Bill Robertson said, "... if the intended project bank account process promoted by the public sector is pursued across the industry, the additional profit element required to operate such a scheme will require a rebalancing of margins within the industry.”

In December 2017, the Welsh government announced that it would use project bank accounts on all building projects over £2m procured by government bodies from 1st January 2018. A guidance note was issued to accompany the announcement. Ref http://prp.gov.wales/toolkit/?lang=en

In January 2019, Debbie Abrahams, MP for Oldham East and Saddleworth, brought forward a ten minute rule bill to require public authorities to pay suppliers using project bank accounts. It was agreed that the bill would be read a second time on 1 March. Ref http://www.constructionmanagermagazine.com/news/second-reading-project-bank-accounts-bill/

In February 2019, the Scottish Government announced that from 19 March, its thresholds would be reduced so that public bodies would have to include project bank accounts in tender documents for building contracts worth £2m or more and civil engineering projects worth £5m or more.

In March 2020, Costain announced it was is seeking a £100m equity injection from shareholders, partly as a result of the introduction of project bank accounts, saying: ‘There has been an increase in the use of joint operation delivery structures and project bank accounts, as clients and partners respond to the impact of the well-documented failure of certain contractors in the sector by requiring increased direct control over their financial risk profiles – this has resulted in an increase in the level of Costain’s balance sheet cash being held in such joint operation structures and project bank accounts, rather than being freely available for the Group to use for general working capital purposes; and… The introduction of the Prompt Payment Code whereby contractors are required to pay their suppliers earlier has also resulted in higher working capital requirements.’ Ref https://www.costain.com/media/598947/c-users-sopeel-desktop-equity-raise-announcement-final-10032020.pdf

In May 2021, it was revealed that the government was not monitoring the use of project bank accounts. Ref https://www.theconstructionindex.co.uk/news/view/project-bank-account-usage-not-being-monitored-by-government

In June 2023, the Government blocked an amendment to the Procurement Bill proposed by Debbie Abrahams MP that would have made project bank accounts mandatory for all jobs valued at over £2m. Cabinet Office minister Alex Burghart said; "...it is not the Government’s position that PBAs should be mandated across all contracting authorities, as they are not always suitable or cost-effective, particularly where the subcontractor is very small or is paid more frequently than monthly, or where the supply chain is short."

The 2025 updated directory of PBA providers can be found here - UK Project Bank Account Providers

[edit] Related articles on Designing Buildings

- Cash flow.

- Construction supply chain payment charter.

- Escrow.

- Fair payment practices.

- Government Construction Board.

- Government construction strategy.

- Housing Grants Construction and Regeneration Act.

- Integrated supply chain.

- Interim payment.

- Payment notice.

- Project bank accounts hep tackle payment abuse.

- Prompt payment code.

- Remedies for late payment.

- Scheme for construction contracts.

- Supply chain.

[edit] External references

- The B1M, What are Project Bank Accounts? (short animation). 15 June 2016.

- Construction Enquirer, Project bank accounts in use on half government jobs. 4 July 2014.

- Cabinet office, Project Bank Accounts – Briefing document. 10th February 2012.

- Cabinet office, A Guide to the implementation of Project Bank Accounts (PBAs) in construction for government clients, 03 July 2012.

Featured articles and news

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description from the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

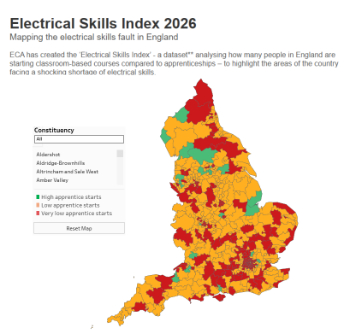

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Comments

Love it! This is the way to go. The industry as a whole needs to protect the supply chain. Too many medium to large contractors have no concern for the smaller contractors and or subcontractors. They seem to be void of a moral compass.