Flood insurance

|

The twin effects of climate change and development on flood plains have become increasingly problematical for home owners and property insurers. Greater amounts of rainfall generally and more and more exceptional weather incidents have resulted in the insurance industry facing ever-rising flood-related insurance claims. In the UK, summer 2012 was the wettest for a century, in June alone flood claims were running at around £17 million per day, while in November 2019, floods in Yorkshire and Derbyshire caused widespread misery and damage to property.

All this means that properties in flood-prone areas are increasingly expensive to insure. Some are completely uninsurable.

Since 2000, in response to the increasing risk of flood damage to vulnerable properties, there has been an agreement in place between Government and the insurance industry (represented by the Association of British Insurers) whereby insurers would continue to offer insurance cover on vulnerable properties in return for guaranteed levels of public spending on flood defences.

However, this agreement ended in 2013 and was superceded by a new agreement which took effect in 2015, under which all homeowners, not just those affected by flooding, pay a fixed annual sum to help cover the cost of flood damage. This helps reduce insurance costs of those directly affected. In fact, homeowners have, for some time, been paying this amount, but the arrangement is now being formalised.

Insurers may continue to offer renewal terms on vulnerable properties, although the premiums will still be high when compared to low-risk properties. The premium differential for equivalent properties in high and low risk areas can be as much as four times.

If a property is in a high flood-risk area, there is no guarantee that insurance will either be available, or available at reasonable cost and the new agreement does not change these facts. Information on flood risk is available via the Environment Agency.

[edit] Related articles on Designing Buildings

- BREEAM Flood risk management.

- BS 851188.

- Environment Agency.

- Factors affecting property insurance premiums.

- Flood.

- Flood and Water Management Act.

- Flood Re.

- Flood risk.

- Flood risk management plan.

- Future Water, The Government’s water strategy for England.

- Insurance.

- Joint names policy.

- Planning for floods.

- Pitt review.

- Rainwater harvesting.

- River engineering.

- Sustainable urban drainage systems.

- Thames barrier.

- Water engineering.

[edit] External references

--Martinc

Featured articles and news

RTPI leader to become new CIOB Chief Executive Officer

Dr Victoria Hills MRTPI, FICE to take over after Caroline Gumble’s departure.

Social and affordable housing, a long term plan for delivery

The “Delivering a Decade of Renewal for Social and Affordable Housing” strategy sets out future path.

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

The proposed publicly owned and backed subsidiary of Homes England, to facilitate new homes.

How big is the problem and what can we do to mitigate the effects?

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

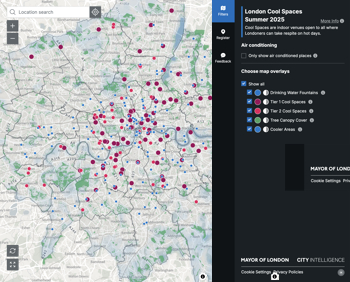

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).

Comments

To start a discussion about this article, click 'Add a comment' above and add your thoughts to this discussion page.