Hourly rate

The term ‘hourly rate’ refers to the amount of remuneration a worker/employee receives for each hour that they work. Those who are paid at an hourly rate can be described as doing ‘time work’, unlike salaried workers who are paid a fixed salary regardless of the amount of time they work. Hourly rates tend to apply to part-time and manual labour, particularly in construction where tradespeople and site labourers are often paid by the hour.

Construction sites can sometimes be fitted with a clocking-in device that monitors the precise time that operatives arrive and depart, allowing them to be paid by the minute, or it can be rounded up or down to the nearest half hour. Weekends, Bank Holidays and evening work can be paid at a higher hourly rate as an employee incentive.

Workers in the UK who are paid on an hourly rate must be paid at least the National Minimum Wage, which is calculated over the month for which they are paid. The minimum hourly rate is determined by the age of the employee and whether or not they are an apprentice. In order to get the National Minimum Wage, they must be at least school leaving age (16) and they must be 25 or over to be entitled to the National Living Wage.

As of April 2018, the National Minimum Wage rates were as follows:

- 25 and over: £7.83

- 21 to 24: £7.38

- 18 to 20: £5.90

- Under 18: £4.20

- Apprentice: £3.70

Workers are legally entitled to the correct minimum wage from the above categories if they are one of the following:

- Part-time.

- Hired on a casual basis (e.g. for one day, week, etc.).

- Hired from an agency.

- Apprentice.

- Trainee employee or within their probation period.

- Disabled.

Those who are not legally entitled to either the National Minimum Wage or National Living Wage include:

- Self-employed (e.g. a family-run building firm).

- Director of a company.

- Voluntary workers.

- Workers younger than the school leaving age.

- Higher and further education students on a work placement of up to one year.

Apprentices are legally entitled to the apprentice hourly rate if they are aged under 19 or if they are 19 or over and undertaking the first apprenticeship year. If they are 19 or over and have already completed the first apprenticeship year, they are eligible for the minimum wage for their age category as listed above.

From the end of June 2018, the Building and Allied Trades Joint Industrial Council (BATJIC) 2018/19 wage rates come into effect, which is a one-year agreement negotiated between the Federation of Master Builders (FMB) and Unite the Union. The agreement is for a 3.1% pay increase across all various wage rates.

- Adult General Operatives’ rate increased by 29p per hr. to £9.52.

- Skilled wage rates, S/NVQ2 increased by 32p per hour to £10.72 and S/NVQ3 increased by 37p per hour to £12.45

- All other rates (including young adult operatives, apprentices and trainees, and all hourly skills rates) also rose by 3.1%.

[edit] Related articles on Designing Buildings Wiki

- Architect’s fees.

- BSRIA calls on industry to get involved with National Apprenticeship Week 2019.

- Building design and construction fees.

- Charge-out rate.

- Construction apprenticeships.

- Construction person year.

- Construction recruitment agency.

- Employee.

- Fees.

- Fees and resourcing on design and construction projects.

- Human resource management in construction.

- IR35.

- IR35: essential steps for compliance.

- National Minimum Wage and National Living Wage.

- New apprenticeship levy.

- Non-productive overtime.

- Payroll companies.

- Pay as you earn in construction PAYE.

- Structural engineers' fees

- Tax relief.

- Unit rates basis of payment.

- VAT.

Featured articles and news

Call for greater recognition of professional standards

Chartered bodies representing more than 1.5 million individuals have written to the UK Government.

Cutting carbon, cost and risk in estate management

Lessons from Cardiff Met’s “Halve the Half” initiative.

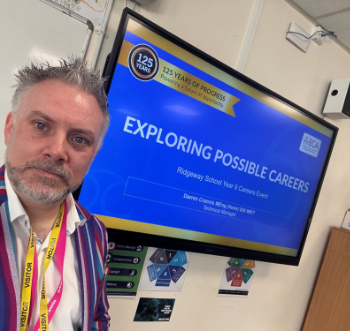

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.