Global water heating market shifts gear

|

| Article written by George Laganas |

[edit] Renewables Surge, Traditional Systems Sputter

The current energy crisis has added pressure on governments to accelerate their green initiatives in space and water heating technologies. It will therefore come as no surprise that our analysis of the global water heating markets found that heat pumps, electric storage, and instantaneous water heaters recorded the biggest growth in 2023 and the forecasted period.

2023 saw traditional water heating systems grow by 1.5% globally, whereas water heaters powered by renewable sources (i.e. heat pump water heaters) reported an impressive growth of 21.3% (vs 2022). Our analysis showed that end-users are increasingly replacing gas systems with electricity storage or instantaneous units, given the ever-growing spark gap in most economies. Oil-fuelled water heaters are declining, as they are banned from most markets, with some exceptions for remote areas off the gas grid. Nonetheless, there are certain countries that still permit oil water heaters, but they do so under the condition that a renewable source of heating works alongside them; hence ensuring partial sustainable output.

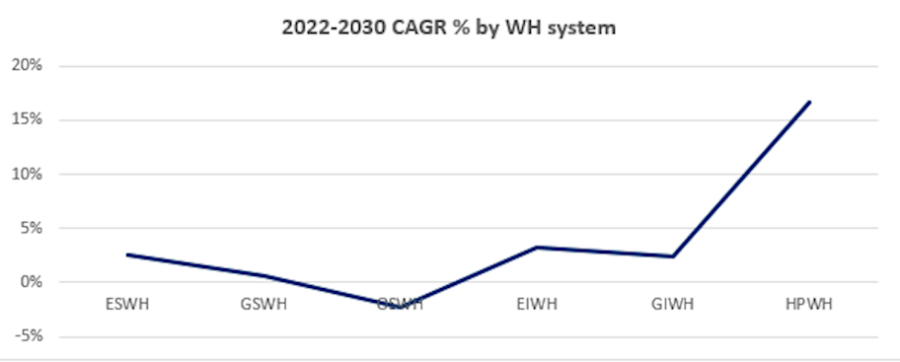

The above graph depicts the CAGR % for each water heating system from 2022 to 2030. Besides oil-fuelled systems that are in decline, gas storage water heaters note the lowest growth (below 1%). Middle East and Africa still rely on these types of systems, so slight growth is seen in this region. Electric storage water heaters also note a CAGR of 4.5%. However, in Europe gas storage systems are forecasted to decline by almost 5% by 2030 and electric storage water heaters note a marginal growth of 1.3%, for the same period.

Instantaneous water heating systems show a different global picture. In all researched regions, we found that electric instantaneous water heating systems are growing at a faster rate than gas instantaneous systems. The Americas show a 3.3% CAGR (2022-2030) for EIWH and 2.1% for GIWH. Europe’s CAGR for EIWH is marked at 2.7% yet GIWH are in decline with CAGR -2.9% for the same period.

Heat pump water heaters note the biggest potential globally, with almost 17% CAGR for the period 2022-2030. The Americas and Asia & Oceania hold the biggest participation in this market, with over 20% CAGR, whilst Europe notes a 12% CAGR, albeit representing the most advanced market worldwide when it comes to renewables and sustainable sources of energy. Middle East & Africa are not regions we find heat pumps established, as they still rely on traditional systems to heat space and water.

Solar-Thermal water heating saw a slight growth in 2023 versus 2022; however, the future outlook seems much more promising with an overall CAGR 2022-2030 at 3%. Middle East & Africa are the regions that invest the most in ST systems, benefitting from the local climate.

This article appears on the BSRIA news and blog site as 'Global Water Heating Market Shifts Gear: Renewables Surge, Traditional Systems Sputter' dated January 2024 and was written by George Laganas.

--BSRIA

[edit] Related articles on Designing Buildings

- Aaron Gillich, Professor of Building Decarbonisation and Director of the BSRIA LSBU Net Zero Building Centre.

- Building services.

- BSRIA seminar on knowledge to achieve a net zero future. March 2023

- BSRIA topic guide to thermal comfort TG22 / 2023. February 2023

- Combustion plant.

- Heat pump.

- Heat pumps and heat waves: How overheating complicates ending gas in the UK.

- Heating controls.

- Heating large spaces.

- Heating.

- Hot water.

- Hot water safety.

- HVAC.

- Low carbon heating and cooling.

- Net zero building centre with BSRIA and LSBU.

- Pipework.

- Radiant heating.

- Radiator.

- Rules of Thumb - Guidelines for building services.

- Thermostat.

- Types of heating system.

- US water heating market update 2021.

- Water heating.

Featured articles and news

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.