Essential Guide to Self Assessment Tax Returns for the Building and Construction Industry

Navigating the world of Self Assessment tax returns can be particularly challenging for those in the building and construction industry. With its unique income streams, varied expenses, and regulatory requirements, understanding how to properly handle your tax affairs is crucial. This guide provides a comprehensive overview of what you need to know to manage your Self Assessment tax returns effectively.

Understanding Self Assessment

Self Assessment is a system used by tax authorities, such as HM Revenue and Customs (HMRC) in the UK, to collect income tax from individuals and businesses who do not have tax automatically deducted from their earnings. For those in the building and construction industry, this typically includes self-employed contractors, subcontractors, and other professionals.

Who Needs to File?

If you’re a sole trader, partner in a business partnership, or a director of a company who also receives income from dividends or has other income not taxed at source, you are required to file a Self Assessment tax return. This applies to a wide range of roles within the construction sector, from builders and electricians to site managers and architects.

Key Components of the Tax Return

Income Reporting: You must report all sources of income, including:

- Payments received for construction work.

- Income from rental properties if applicable.

- Any additional earnings from freelance or consulting work.

Claiming Expenses: Accurate record-keeping is essential for claiming allowable expenses. Common deductions in the construction industry include:

- Tools and equipment costs.

- Materials purchased for specific projects.

- Travel expenses between sites.

- Professional fees, such as those for accountants or consultants.

- Safety equipment and uniforms.

Keep detailed records and receipts for all expenses to ensure they are substantiated and can be claimed.

Calculating Taxable Income: Deduct your allowable expenses from your total income to determine your taxable income. Apply the relevant tax rates to calculate the amount of tax you owe.

Key Considerations

- VAT: If your annual turnover exceeds the VAT threshold, you’ll need to register for VAT and submit VAT returns. Ensure you understand how VAT affects your income and expenses, as it can impact your overall tax liability.

- IR35 Regulations: For contractors working through intermediaries (e.g., limited companies), IR35 regulations may apply. This set of rules determines whether you are operating as a genuine contractor or if your arrangement resembles employment, affecting your tax status.

- Penalties for Late Filing: Missing deadlines for submitting your Self Assessment tax return or paying your tax can result in significant penalties and interest charges. Ensure you are aware of key dates and file your return promptly.

Helpful Tips

- Maintain Detailed Records: Accurate and comprehensive record-keeping is critical. Utilize accounting software or consult a professional to ensure you are capturing all necessary details.

- Seek Professional Advice: Tax regulations can be complex, and the building and construction industry has specific nuances. Engaging a tax advisor or accountant with experience in this sector can help you navigate your obligations and maximize your allowable deductions.

- Stay Informed: Tax rules and regulations can change. Keep up-to-date with any modifications that may affect your Self Assessment tax return by regularly checking HMRC updates or consulting with a tax professional.

Conclusion

Handling Self Assessment tax returns in the building and construction industry requires careful planning and attention to detail. By understanding your reporting requirements, accurately claiming expenses, and staying informed about relevant regulations, you can manage your tax responsibilities effectively and avoid common pitfalls. For many, working with a qualified accountant can be a valuable investment to ensure compliance and optimize tax outcomes.

Featured articles and news

Retired firefighter cycles world to raise Grenfell funds

Leaving on 14 June 2025 Stephen will raise money for youth and schools through the Grenfell Foundation.

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

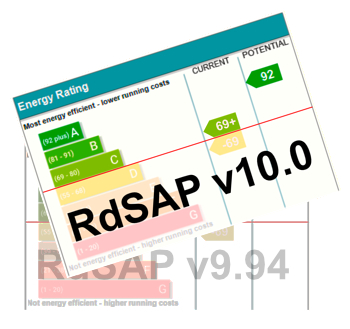

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.

Skills England publishes Sector skills needs assessments

Priority areas relating to the built environment highlighted and described in brief.

BSRIA HVAC Market Watch - May 2025 Edition

Heat Pump Market Outlook: Policy, Performance & Refrigerant Trends for 2025–2028.

Committing to EDI in construction with CIOB

Built Environment professional bodies deepen commitment to EDI with two new signatories: CIAT and CICES.

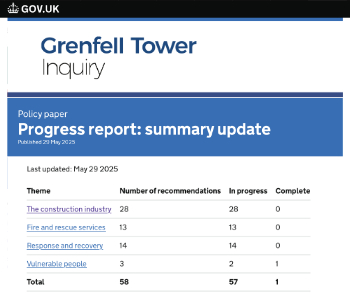

Government Grenfell progress report at a glance

Line by line recomendation overview, with links to more details.

An engaging and lively review of his professional life.

Sustainable heating for listed buildings

A problem that needs to be approached intelligently.

50th Golden anniversary ECA Edmundson apprentice award

Deadline for entries has been extended to Friday 27 June, so don't miss out!

CIAT at the London Festival of Architecture

Designing for Everyone: Breaking Barriers in Inclusive Architecture.

Mixed reactions to apprenticeship and skills reform 2025

A 'welcome shift' for some and a 'backwards step' for others.