Cement market in Saudi Arabia

Cement is a one of the key binding materials used in the construction industry. Cement acts as a binding agent for mortar, concrete, non-specialty grouts, and stucco, etc. Physical and chemical properties of cement such as high durability, high dependability, cost-effectiveness, and versatility are favorable for construction applications. It is manufactured from raw materials such as limestone, sand, and clay, which are widely available in Saudi Arabia. In addition, cheap and widely available petroleum fuel has allowed cost-effective manufacturing of cement in the region.

The Saudi Arabia region demand for cement was valued at USD 3.90 billion in 2014 and is expected to reach USD 5.27 billion in 2020, growing at a CAGR of slightly above 5.1%. In terms of volume, the cement market in the Saudi Arabia stood at 61,000-kilo tons in 2014.

The key factor driving the demand for cement in Saudi Arabia is increasing construction activity in sectors such as commercial, residential, industrial and infrastructure. The rapidly growing population has resulted in growing demand for residential and commercial buildings as well as infrastructure. The residential market for cement in Saudi Arabia is expected to witness strong growth during the forecast period. Infrastructure is one of the largest segments, which accounted for around a 50% share of the total market in 2014. The increasing number of airports and road construction projects is expected to boost the cement market in Saudi Arabia further. Commercial applications were the second largest segment of the market in 2014.

The cement market was dominated by the Central region of Saudi Arabia, which accounted for more than 32% of the market in 2014. Saudi Arabia was followed by the Western, Eastern, Southern and Northern regions respectively. The cement market in the central region is expected to witness rapid growth compared to other regions. Over the past few years, there has been an increase in construction activities in the Saudi Arabia, especially in the eastern and central provinces. Various cities in the Kingdom have started infrastructure projects, fuelling demand for cement. Strong economic growth in Saudi Arabia is expected to fuel further growth.

Manufacturers have a significant impact on the value chain through a higher degree of vertical integration. These companies manufacture raw materials as well as the final product. Some of the key players operating in the Saudi Arabia cement market include; Saudi Cement Company, Riyadh Cement Company, Yamama Cement Company, and Najran Cement Company.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Aggregate.

- Alkali-aggregate reaction (AAR).

- Applications, performance characteristics and environmental benefits of alkali-activated binder concretes.

- Cellular concrete.

- Cement.

- Cement in Saudi Arabia.

- Coal ash.

- Concrete.

- Concrete vs. steel.

- Concreting plant.

- Efflorescence.

- Ferro-cement.

- Fibre cement.

- Formwork.

- High alumina cement.

- Lime mortar.

- Material Flow Analysis: A tool for sustainable aggregate sourcing.

- Mortar.

- Portland cement.

- Power float.

- Rendering.

- Research on novel cements to reduce CO2 emissions.

- Screed.

- Stucco.

Featured articles and news

Guidance notes to prepare for April ERA changes

From the Electrical Contractors' Association Employee Relations team.

Significant changes to be seen from the new ERA in 2026 and 2027, starting on 6 April 2026.

First aid in the modern workplace with St John Ambulance.

Ireland's National Residential Retrofit Plan

Staged initiatives introduced step by step.

Solar panels, pitched roofs and risk of fire spread

60% increase in solar panel fires prompts tests and installation warnings.

Modernising heat networks with Heat interface unit

Why HIUs hold the key to efficiency upgrades.

Reflecting on the work of the CIOB Academy

Looking back on 2025 and where it's going next.

Procurement in construction: Knowledge hub

Brief, overview, key articles and over 1000 more covering procurement.

Sir John Betjeman’s love of Victorian church architecture.

Exchange for Change for UK deposit return scheme

The UK Deposit Management Organisation established to deliver Deposit Return Scheme unveils trading name.

A guide to integrating heat pumps

As the Future Homes Standard approaches Future Homes Hub publishes hints and tips for Architects and Architectural Technologists.

BSR as a standalone body; statements, key roles, context

Statements from key figures in key and changing roles.

ECA launches Welsh Election Manifesto

ECA calls on political parties at 100 day milestone to the Senedd elections.

Resident engagement as the key to successful retrofits

Retrofit is about people, not just buildings, from early starts to beyond handover.

Plastic, recycling and its symbol

Student competition winning, M.C.Esher inspired Möbius strip design symbolising continuity within a finite entity.

Do you take the lead in a circular construction economy?

Help us develop and expand this wiki as a resource for academia and industry alike.

Warm Homes Plan Workforce Taskforce

Risks of undermining UK’s energy transition due to lack of electrotechnical industry representation, says ECA.

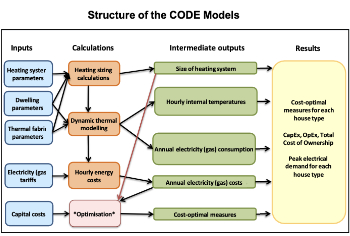

Cost Optimal Domestic Electrification CODE

Modelling retrofits only on costs that directly impact the consumer: upfront cost of equipment, energy costs and maintenance costs.