August 2020 construction PMI survey results

Contents |

[edit] Introduction

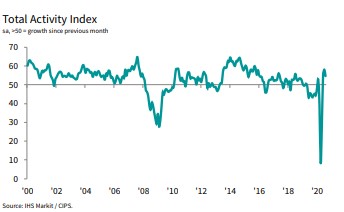

Construction sector growth slowed according to the IHS Markit/CIPS construction purchasing managers’ index (PMI) for August 2020. The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index registered 54.6 in August 2020, down from 58.1 in July 2020. Figures above 50.0 indicate growth of total construction output.

While higher levels of activity have been recorded in each of the past three months, the latest expansion was the weakest over this period.

These statistics suggest a setback for the recovery in UK construction output, as improvements continue to slow in relation to the near five-year high in July 2020. Some survey respondents indicate that a lack of new work to replace completed contracts has halted growth.

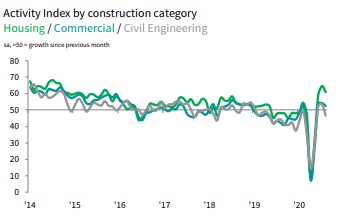

All three broad categories of construction - housing, commercial and civil engineering - registered declines in comparison to July 2020.

Source: IHS Markit/CIPS.

House building has registered the strongest rebound since work stoppages were triggered in March 2020. This trend continued in August 2020, with the seasonally adjusted Housing Activity Index at 60.7. The figure for commercial work was 52.5; civil engineering activity was 46.6 in August 2020.

[edit] Orders hold back output growth

Total new business volumes increased for the third month running during August 2020, but the rate of expansion slowed from July 2020. Construction companies noted that economic uncertainty, especially from clients, has made it more challenging to secure new work. However, survey responses were varied, mirroring the multi-speed recovery experienced across different sectors.

Supply chain disruption persisted across the sector, which led to a sharp downturn in vendor performance. Stock shortages and an imbalance of supply and demand contributed to higher purchasing costs. The overall rate of input price inflation was the highest since April 2019.

[edit] Business expectations boosted by potential infrastructure work

Despite reporting subdued new business intakes since the start of the pandemic, construction companies reported an improvement in their business expectations for 2021. More than twice as many survey respondents (43%) expect to see a rise in construction output over the next 12 months as those that anticipate a fall (19%).

This optimism was linked to anticipated involvement in major infrastructure and public sector construction projects. However, this did not stop a decrease in staffing numbers. The rate of job losses slowed slightly compared to July 2020 but overall continued at the fastest pace over the past decade.

[edit] Related articles on Designing Buildings

- Business and Planning Bill 2019-21.

- Construction market forecast 2015 to 2024.

- Construction Purchasing Managers Index (PMI) survey results: May 2020.

- Coronavirus and the construction industry.

- New deal for infrastructure 2020.

- Procurement route.

- The future of the coronavirus furlough.

[edit] External resources

- IHS Market/CIPS, Construction sector growth slows in August.

Featured articles and news

The Home Energy Model and its wrappers

From SAP to HEM, EPC for MEES and FHS assessment wrappers.

Future Homes Standard Essentials launched

Future Homes Hub launches new campaign to help the homebuilding sector prepare for the implementation of new building standards.

Building Safety recap February, 2026

Our regular run-down of key building safety related events of the month.

Planning reform: draft NPPF and industry responses.

Last chance to comment on proposed changes to the NPPF.

A Regency palace of colour and sensation. Book review.

Delayed, derailed and devalued

How the UK’s planning crisis is undermining British manufacturing.

How much does it cost to build a house?

A brief run down of key considerations from a London based practice.

The need for a National construction careers campaign

Highlighted by CIOB to cut unemployment, reduce skills gap and deliver on housing and infrastructure ambitions.

AI-Driven automation; reducing time, enhancing compliance

Sustainability; not just compliance but rethinking design, material selection, and the supply chains to support them.

Climate Resilience and Adaptation In the Built Environment

New CIOB Technical Information Sheet by Colin Booth, Professor of Smart and Sustainable Infrastructure.

Turning Enquiries into Profitable Construction Projects

Founder of Develop Coaching and author of Building Your Future; Greg Wilkes shares his insights.

IHBC Signpost: Poetry from concrete

Scotland’s fascinating historic concrete and brutalist architecture with the Engine Shed.

Demonstrating that apprenticeships work for business, people and Scotland’s economy.

Scottish parents prioritise construction and apprenticeships

CIOB data released for Scottish Apprenticeship Week shows construction as top potential career path.

From a Green to a White Paper and the proposal of a General Safety Requirement for construction products.

Creativity, conservation and craft at Barley Studio. Book review.

The challenge as PFI agreements come to an end

How construction deals with inherited assets built under long-term contracts.

Skills plan for engineering and building services

Comprehensive industry report highlights persistent skills challenges across the sector.

Choosing the right design team for a D&B Contract

An architect explains the nature and needs of working within this common procurement route.

Statement from the Interim Chief Construction Advisor

Thouria Istephan; Architect and inquiry panel member outlines ongoing work, priorities and next steps.