The world needs roads and bridges, but first it needs checks and balances

In the 2016 US presidential election, Hillary Clinton and Donald Trump agreed that the American economy was suffering from dilapidated infrastructure, and both called for greater investment in renovating and upgrading the country’s public capital stock.

The United States is not alone. In fact, infrastructure gaps are an even more urgent problem in the rest of the world. Other advanced economies also need to revive moribund investment, and emerging economies need to prepare for population growth, increased consumption, and higher demand for transportation spending.

Initiatives adopted in the aftermath of the 2008 global financial crisis are beginning to promote infrastructure investment. In the European Union, the Juncker Plan – which draws on EU funds to help finance riskier and more innovative projects – aims to generate more than $300 billion in investment between 2016 and 2018.

And there is an even greater push for infrastructure investment in emerging economies – especially China, which is pursuing projects both at home and abroad. In recent years, China has set up domestically funded institutions such as the Silk Road Fund and spurred the establishment of new international financial institutions such as the Asian Infrastructure Investment Bank.

When done well, infrastructure investment can revive flagging economies and pay for itself, by galvanizing private-sector activity and fostering economic growth. But when done poorly, public infrastructure spending can lead to corruption and waste, with taxpayers footing the bill for 'bridges to nowhere'. Properly executed infrastructure investment entails more than just financing; it also requires that all the myriad details of a project’s selection, design, and implementation be closely managed.

And here, the keys to success are not just professional skill and technocratic expertise. They are also transparency and a free press. Citizens should have accurate facts about a project, so that they can monitor its progress and pressure policymakers to protect the public interest.

In a book, Tomas Hellebrandt and Paolo Mauro project that consumer spending on transportation will quadruple by 2035 in Sub-Saharan Africa, India, China, and other emerging Asian countries.

People who earn $200 per year spend only 1% of their income on transportation, compared to 18% for people earning $20,000. In the next two decades, the number of people earning $6,000-20,000 will increase by more than one billion, and many of them will purchase their first car. Meanwhile, the number of people with annual incomes of $20,000+ will increase by almost 800 million, and many of them will begin to fly for leisure.

Transportation networks in emerging economies will have to expand vastly to keep up with this growing demand. And while advanced economies already have extensive transportation infrastructure and stable populations, their networks urgently need renovation and repair.

Emerging countries will be able to muster sufficient financing for infrastructure only if they expand the role of the private sector; pension funds and life insurance companies, in particular, could furnish vast resources. But to capitalise on this opportunity, prudential requirements for such investors must be loosened, so that they can hold diversified portfolios of infrastructure projects. And co-investment platforms with multilateral and regional development banks should be established, to boost the credibility of these investments.

To attract private investors, governments will need to maintain a stable regulatory environment that is free from arbitrary interference. At the same time, they will have to monitor and disclose fiscal obligations from projects that involve private participation, such as what Chile now does routinely. This will help to prevent government guarantees for public-private partnerships from imposing budgetary costs equivalent to one or more points of GDP, as has happened in Colombia, Indonesia, and Portugal.

Governments will need to foster a culture of transparency to ensure that financing is put to productive use – rather than illicitly syphoned off or directed to low-value-added projects for political purposes. Tenders and key contract features should be routinely published, and good record keeping and quality control must be maintained throughout the procurement process and contract performance.

To deter fraud, governments should reward whistleblowers, and protect them from retaliation. Many of the emerging countries where investment is most needed must urgently reform their institutional framework for selecting and implementing infrastructure projects. But corruption afflicts all countries to some extent, so advanced countries also need to protect infrastructure projects from undue private influence and arbitrary official interference.

Successfully boosting infrastructure investment in emerging economies is in everybody’s interest. And with emerging economies now at the forefront of the fight against climate change, the world will benefit even more if investments in these countries are steered toward green-infrastructure projects. Building new metro-railway networks, instead of roads, would help to reduce carbon dioxide emissions for decades to come.

Advanced countries can help in this effort by supporting green-technology research and development, and by providing financial incentives for climate-friendly infrastructure investment through export credit agencies and multilateral and regional development banks. With an open and transparent international procurement system, the most efficient technologies would then come out on top.

Infrastructure investment holds much promise, but to reap its benefits, policymakers in emerging economies will need to strengthen their institutional frameworks for procurement sooner rather than later. And policymakers in advanced economies should preserve and apply well-known checks and balances, to keep the project-selection playing field level, and to permit monitoring implementation from start to finish.

Written by Paolo Mauro, Assistant Director in the African Department at the International Monetary Fund.

This article is published in collaboration with Project Syndicate.

The views expressed in this article are those of the author alone and not the World Economic Forum.

This article was originally published on the Future of Construction Knowledge Sharing Platform and the WEF Agenda Blog

--Future of Construction 14:38, 20 Jun 2017 (BST)

[edit] Related articles on Designing Buildings Wiki

- India needs to build more infrastructure fast. Here's how.

- Jeffrey D. Sachs: Why we need to invest for sustainable development.

- Project controls in a post-BIM world.

- Scoping project approach in the developing world.

- Sustainable development.

- These giant infrastructure projects are set to reshape Africa.

- Two steps towards a more resilient world.

Featured articles and news

A change to adoptive architecture

Effects of global weather warming on architectural detailing, material choice and human interaction.

How big is the problem and what can we do to mitigate the effects?

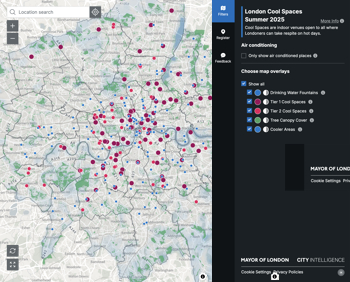

Overheating guidance and tools for building designers

A number of cool guides to help with the heat.

The UK's Modern Industrial Strategy: A 10 year plan

Previous consultation criticism, current key elements and general support with some persisting reservations.

Building Safety Regulator reforms

New roles, new staff and a new fast track service pave the way for a single construction regulator.

Architectural Technologist CPDs and Communications

CIAT CPD… and how you can do it!

Cooling centres and cool spaces

Managing extreme heat in cities by directing the public to places for heat stress relief and water sources.

Winter gardens: A brief history and warm variations

Extending the season with glass in different forms and terms.

Restoring Great Yarmouth's Winter Gardens

Transforming one of the least sustainable constructions imaginable.

Construction Skills Mission Board launch sector drive

Newly formed government and industry collaboration set strategy for recruiting an additional 100,000 construction workers a year.

New Architects Code comes into effect in September 2025

ARB Architects Code of Conduct and Practice available with ongoing consultation regarding guidance.

Welsh Skills Body (Medr) launches ambitious plan

The new skills body brings together funding and regulation of tertiary education and research for the devolved nation.

Paul Gandy FCIOB announced as next CIOB President

Former Tilbury Douglas CEO takes helm.

UK Infrastructure: A 10 Year Strategy. In brief with reactions

With the National Infrastructure and Service Transformation Authority (NISTA).

Ebenezer Howard: inventor of the garden city. Book review.

Airtightness Topic Guide BSRIA TG 27/2025

Explaining the basics of airtightness, what it is, why it's important, when it's required and how it's carried out.