Polymer foam market

Polymer foam is mainly developed from chemical resins such as polyurethane, polystyrene, phenolic and polyvinyl chloride. It possesses useful chemical properties such as flexibility, low density, and heat transfer capacity. It is extensively used in industries such as; food and beverages, packaging, construction, furniture and amongst others.

The global polymer foam market is primarily driven by heavy demand from the automotive industry across the globe. It has multitude uses in the automotive industry for components such as headlights, cables, gaskets and cushioning.

Stringent environmental rules and regulations imposed by governments are likely to drive demand for polymer foam in future years and demand from building and construction is likely to open new doors for major manufacturers. However, the volatile prices of feedstock are likely to hold growth back,

The global polymer foam market was valued at USD 101.50 billion in 2015 and is expected to reach USD 161.0 billion in 2021, growing at a CAGR of 8.0%.

Based on the types of foam, the global polymer foam market is segmented into; polystyrene foam, phenolic foam, melamine foam, PVC foam, polyurethane foam and polyolefin foam and others.

Polyurethane foam was leading segment in 2015 and is also predicted to maintain its dominance in coming years. It is manufactured in two distinct forms; flexible and rigid. Whereas, rigid polyurethane foam is employed for thermal insulation, flexible polyurethane foam is used for cushioning.

Polyolefin foam is expected to experience the good growth in the near future due to mounting demand from building and construction industry.

In terms of applications, the market is categorised into; building & construction, packaging, automotive, furniture & bedding, and other applications. Building and construction were the largest application segment in 2015, accounting for more than 30.0% of total volume, and it is predicted to continue this trend in coming years. Packaging was the second largest application. Automotive and furniture & bedding are projected to have significant growth within the forecast period.

In terms of regions, Asia Pacific held a dominant position in the market in 2015 and is expected to remain dominant during the years to come owing to the rising demand from the construction industry. Countries such as China, India, Malaysia and Indonesia are expected to contribute towards the strong demand for polymer foam due to emerging automotive and construction industries. Europe was the second largest market in 2015. North America and Latin America will witness exponential growth in near future.

Some of the key players of global polymer foam include BASF, SE, the DOW Chemical Company, Armacell International S.A., Stepan Company, JSP Corp, INEOS Group, Adeplast S.A., Woodbridge Foam Partner and amongst others.

[edit] Find out more

[edit] Related articles on Designing Buildings Wiki

- Aerogel insulation for buildings.

- Cavity wall insulation

- Celotex RS5000 PIR insulation.

- Designing out unintended consequences when applying solid wall insulation FB 79.

- Insulation.

- Insulation for ground floors.

- Phase change materials.

- Polyurethane spray foam in structurally insulated panels and composite structures.

- Solid wall insulation.

- Sound insulation.

- Transparent insulation.

- Types of insulation.

Featured articles and news

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.

Skills England publishes Sector skills needs assessments

Priority areas relating to the built environment highlighted and described in brief.

BSRIA HVAC Market Watch - May 2025 Edition

Heat Pump Market Outlook: Policy, Performance & Refrigerant Trends for 2025–2028.

Committing to EDI in construction with CIOB

Built Environment professional bodies deepen commitment to EDI with two new signatories: CIAT and CICES.

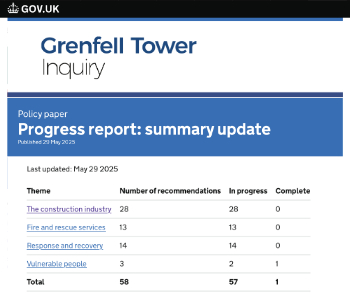

Government Grenfell progress report at a glance

Line by line recomendation overview, with links to more details.

An engaging and lively review of his professional life.

Sustainable heating for listed buildings

A problem that needs to be approached intelligently.

50th Golden anniversary ECA Edmundson apprentice award

Deadline for entries has been extended to Friday 27 June, so don't miss out!

CIAT at the London Festival of Architecture

Designing for Everyone: Breaking Barriers in Inclusive Architecture.

Mixed reactions to apprenticeship and skills reform 2025

A 'welcome shift' for some and a 'backwards step' for others.