Local property tax

In England and Wales, the term ‘local property tax’ (LPT) refers to either the council tax or business rates. Very broadly, domestic properties pay the council tax, whilst business properties pay business rates (sometimes referred to as non-domestic rates).

Where properties are partly for business use and partly for domestic use, such as a pub or shop, where the owner lives on the premises or in a flat above the business, it may be necessary to pay both taxes.

If an owner is using their home for minor business purposes, they are not normally expected to pay business rates, for example, if:

- They only use a small part of the home for business.

- They don’t use it to sell goods or services to visiting clients or members of the public.

- They don’t employ other people to work at the premises.

- They don’t make alterations that are not for domestic purposes.

[edit] Related articles on Designing Buildings Wiki

Featured articles and news

The Building Safety Forum at the Installershow 2025

With speakers confirmed for 24 June as part of Building Safety Week.

The UK’s largest air pollution campaign.

Future Homes Standard, now includes solar, but what else?

Will the new standard, due to in the Autumn, go far enough in terms of performance ?

BSRIA Briefing: Cleaner Air, Better tomorrow

A look back at issues relating to inside and outside air quality, discussed during the BSRIA briefing in 2023.

Restoring Abbotsford's hothouse

Bringing the writer Walter Scott's garden to life.

Reflections on the spending review with CIAT.

Retired firefighter cycles world to raise Grenfell funds

Leaving on 14 June 2025 Stephen will raise money for youth and schools through the Grenfell Foundation.

Key points for construction at a glance with industry reactions.

Functionality, visibility and sustainability

The simpler approach to specification.

Architects, architecture, buildings, and inspiration in film

The close ties between makers and the movies, with our long list of suggested viewing.

SELECT three-point plan for action issued to MSPs

Call for Scottish regulation, green skills and recognition of electrotechnical industry as part of a manifesto for Scottish Parliamentary elections.

UCEM becomes the University of the Built Environment

Major milestone in its 106-year history, follows recent merger with London School of Architecture (LSE).

Professional practical experience for Architects in training

The long process to transform the nature of education and professional practical experience in the Architecture profession following recent reports.

A people-first approach to retrofit

Moving away from the destructive paradigm of fabric-first.

International Electrician Day, 10 June 2025

Celebrating the role of electrical engineers from André-Marie Amperè, today and for the future.

New guide for clients launched at Houses of Parliament

'There has never been a more important time for clients to step up and ...ask the right questions'

The impact of recycled slate tiles

Innovation across the decades.

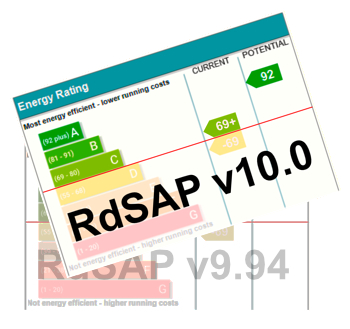

EPC changes for existing buildings

Changes and their context as the new RdSAP methodology comes into use from 15 June.